NGI Weekly Gas Price Index | Markets | NGI All News Access

SoCal, AGT Citygate Lead Weekly NatGas Cash Down as Market Awaits Winter Weather

The wait for winter weather is on, and it showed in NGI’s weekly natural gas spot prices, as the vast majority of points in the Lower 48 ended the week in the red. The NGI National Spot Gas Average for the week fell 28 cents to $2.42/MMBtu.

Among the biggest moves down, SoCal Citygate fell back to earth after a price blowout the week before, while New England prices caved under downward pressure from moderate weather coinciding with additional pipeline capacity reentering the market on Algonquin Gas Transmission’s system.

SoCal Citygate, after reaching $12/MMBtu late last month, gave up $3.24 this week to finish at an average of $3.10. SoCal prices began to fall early in the week as Southern California temperatures moderated from the triple-digit levels that had helped send prices skyrocketing.

The constrictions entering the Southern California market had resulted in an uptick in imports along the border at Otay Mesa. Genscape Inc. said Friday that the net decline in exports to Mexico caused by the Otay Mesa imports was showing signs of easing off.

“Our estimate of exports to Mexico has shown a slight uptick in recent days led primarily by our proprietary observations of flows on the NET Mexico Pipeline,” Genscape said. “We have exports today and yesterday back above 4.4 Bcf/d for the first time since last week…The interstate sample of exports for the past three days has actually been running lower than the last seven days of October, primarily due to lower volumes flowing into Baja via the North Baja system combined with exports from Baja into Southern California at Otay Mesa.

“…When Otay Mesa volume began flowing in earnest last week, we saw Gasoducto Rosarito report an uptick in receipts from the Costa Azul LNG terminal in Baja, a facility that has more or less been idled for the past several years. These moves have been supported by the heightened volatility in SoCal in the wake of record heat followed by the current cold snap lifting demand there.”

The reintroduction of capacity at the Stony Point compressor station is the likely culprit for the declines observed at New England price points this week, Genscape analyst Molly Rosenstein told NGI Friday.

“Nov. 1 marked the first day since Winter 16-17 where the Stony Point, and other mainline compressors, were able to flow without restriction,” Rosenstein said. “Even further, 40 MMcf/d additional incremental capacity was added with the Atlantic Bridge Expansion that came online the same day. That day, the compressor was nominated fully to its new 1.85 Bcf/d capacity (which has since been revised down), and led to a 89 cent decline day/day.

“Between Oct. 31 and Nov. 1, Stony Point flows increased 797 MMcf/d, and operational capacity increased from 698 MMcf/d to 1,851 MMcf/d. Additionally, deliveries to Iroquois Brookfield are maxed at nearly 400 MMcf/d, and deliveries into New England at TGP Mendon have not declined since the introduction of the new Stony Point capacity. Iroquois is not sending much of the gas to Canada via Waddington either, which is exacerbating price declines in the area.”

While most regional averages tracked by NGI fell a dime or more week/week, Canada bucked the trend, driven by strength at NOVA/AECO C, which added C$1.29/GJ to finish the week with an average of $2.46.

On Wednesday Union Gas announced the start of service of C$622.5 million ($498 million) in additions to the Dawn Hub in southern Ontario. The facilities raised capacity by 400 MMcf/d, completing a 1.2 Bcf/d package of pipe and compressor facilities built for C$1.5 billion ($1.2 billion) since 2015. The expansions got a boost from TransCanada Corp.’s deep cross-country pipeline toll cut.

TransCanada reported cross-country deliveries of Alberta and British Columbia gas began on schedule Wednesday using the new bargain toll, Dawn Long-term Fixed Price (LTFP).

The deal grants a 46% discount for 10 years, down to C 77 cents/gigajoule (65 cents/MMBtu), to 23 producers that bought shipping contracts for 1.4 Bcf/d.

Futures traders, meanwhile, spent the week waiting for some fundamental sign that would send the market breaking either bullish or bearish. The December contract ended the week on a strong note, gaining Thursday and Friday before settling at $2.984, a whopping 1.8 cents higher than Monday’s settlement of $2.966.

Elaine Levin, president of Powerhouse, an energy risk management firm based out of Washington, DC, said traders are stuck in “wait-and-see mode” until winter arrives. The potential bullish risks created by growing demand for exports is helping to keep a bottom on the range at the moment, she said.

“With natural gas, the test will be when we get into the throes of winter weather, and to see how exports impact marginal demand. But we need that weather, and I think that’s why we’re in a holding pattern,” Levin told NGI. “Nobody’s wanting to go into this winter short. I think that’s why $2.75 holds. Traders are just not anxious” to go long, “nor are they anxious to go short.”

She added, “I just think you have people waiting for this to break out of the range, and there’s been no fundamental news to make that happen yet. So I think we remain here for a little bit longer.”

Natural gas for weekend and Monday delivery reflected the ambivalence in the current weather outlook, as traders continue to guess which way temperatures will go with the start of winter only a few weeks away.

Big downswings in Appalachia and the Northeast overshadowed modest gains of a penny to a nickel most everywhere else, and the NGI National Spot Gas Average fell 5 cents to $2.39/MMBtu.

Futures crept higher Friday, with forecasters noting some cooler risks in the medium-term outlook, albeit nothing to get excited about. The December contract finished higher for the second consecutive day, up 4.9 cents to settle at $2.984; January climbed 4.6 cents to $3.097. December crude oil gained a healthy $1.10 to settle at $55.64/bbl.

Amid rising production and moderate temperatures in the region, Northeast and Appalachian price points were awash in red ink heading into the weekend, giving up a good chunk of the previous day’s gains as market conditions offered little incentive to buy.

Boston’s Friday high of 73 degrees was expected to fall to 52 Saturday before climbing to 58 Sunday, while New York was also enjoying highs of 73 Friday, with peak temperatures only expected to fall to 55 Saturday before climbing to 64 Sunday, according to forecaster Weather Underground.

Transco Zone 6 New York fell 50 cents on Friday for weekend and Monday delivery to average $1.49. Further north, Iroquois Zone 2 dropped 88 cents to $1.46, while Iroquois Waddington shed 62 cents to $1.75.

Algonquin Citygate posted a 23 cent loss on the day, falling to $1.05 and trading as low as 85 cents. That’s the lowest average price recorded at Algonquin since December 2015, when prices averaged 97 cents.

Meanwhile, PointLogic Energy’s production models show Northeast dry gas production continuing to climb as the calendar flips to November, with production exceeding 25.7 Bcf/d Friday, up around 1 Bcf/d month/month.

The Northeast production increases come as Marcellus and Utica shale producers prepare to fill a wave of incremental pipeline capacity coming online in the region, including the Rayne XPress, Access South and Adair Southwest projects, which all received authorization to enter service this week.

But those new Northeast pipes are unlikely to offer price relief at Dominion South, at least not in the short-term, BTU Analytics senior energy analyst Matthew Hoza said in a recent webinar.

Dominion South fell 8 cents Friday to 83 cents, while Tetco M-3 Delivery gave up 34 cents to finish at 83 cents.

Elsewhere, prices posted modest gains. Henry Hub added a nickel to finish at $2.74. Chicago Citygate gained 6 cents to $2.83, while Transco Zone 4 rose 4 cents to $2.73.

Out west, Kern River added 2 cents to $2.63, while SoCal Citygate continued to moderate after recent spikes, falling 29 cents to $2.93.

Forecasters continue to see mixed signs in the weather outlook, leading to a futures market that remains range-bound.

“Our sentiment into the weekend remains mostly neutral with a slight skew towards bullish risks, as we would not be surprised to see decent weekend gas-weighted degree day additions with the cold shot moving across the country next week,” said Bespoke Weather Services in an afternoon update to clients.

“But we do not yet expect long-range forecasts to trend significantly cooler. The result is that the market could continue to grind higher towards at least $3.02, but we do not yet see a catalyst for a significant break higher that would move us above strong $3.10 resistance (or potentially even lead us to test it).”

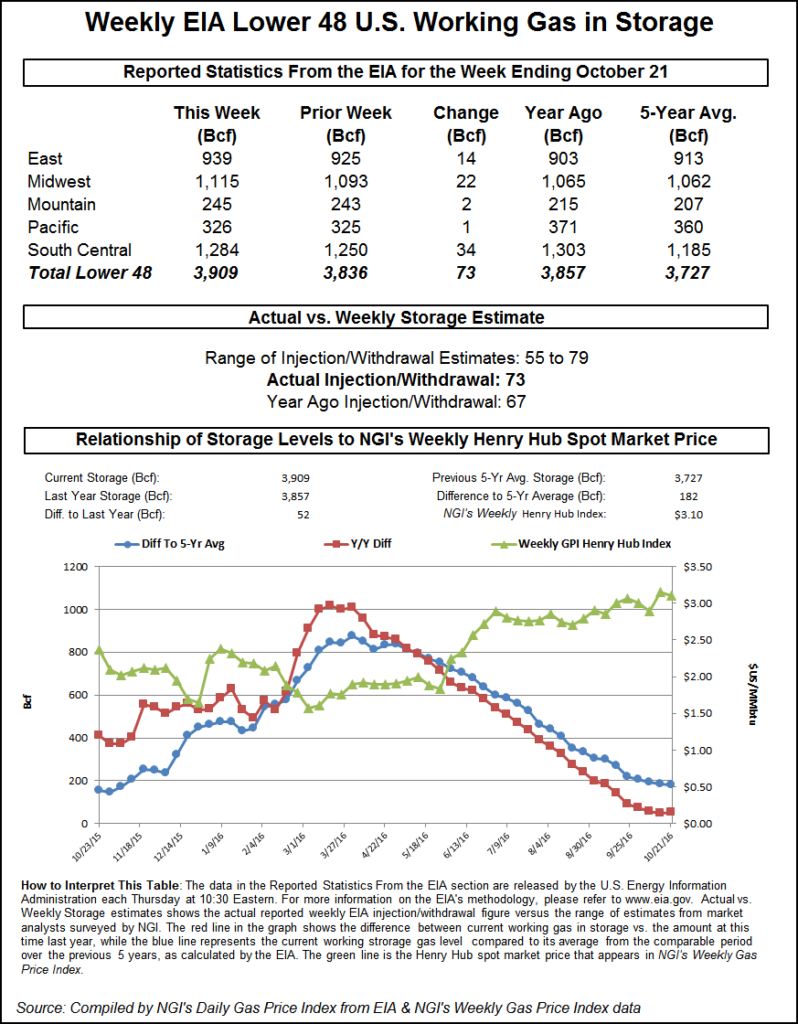

Futures have seemed destined to show a counterintuitive response to Energy Information Administration (EIA) storage data and Thursday was no exception. The EIA reported a storage injection of 65 Bcf for the week ending Oct. 27, about 3 Bcf greater than expectations, yet prices rose. At the close on Thursday December was higher by 4.2 cents to $2.935 and January had gained 3.4 cents to $3.051. December crude oil rose 24 cents to $54.54/bbl.

Just before report time the market was hovering around $2.926 and following the release of the number December futures barely moved, failing to take out the day’s high or low. By 10:45 a.m. December was trading at $2.938, up 4.3 cents from Wednesday’s settlement.

Prior to the release of the data traders were looking for a storage build slightly less than the actual figures. Last year 56 Bcf was injected and the five-year average stands at 60 Bcf. Citi Futures was looking for a 52 Bcf injection and Raymond James calculated a 70 Bcf build. A Reuters survey of 26 traders and analysts showed an average 62 Bcf with a range of +45 Bcf to +71 Bcf.

“I thought the number was a little bearish, so we should have been lower,” said a New York floor trader. “There was no reaction to the number when it was released, and it wasn’t until about 10 minutes after the number came out that it made a new high.

“Somebody came out and said, ‘Hey why not run this market up to $2.947, we haven’t got anything better to do,'” the trader mused.

“It seems that every time we close one month and trade the next month, if that month is trading above $3 then we seem to be able to get it under $3. $3 is proving to be one impenetrable barrier.”

Analysts called the report neutral. “This week’s injection was 11 Bcf above last year’s reported figure of 54 Bcf and 5 Bcf above the five-year average of 60 Bcf,” said the Wells Fargo analytical team. “We now forecast end of injection season storage at approximately 3.83 Tcf, 50 Bcf below the five-year average and 217 Bcf below comparable 2016 levels.”

Inventories now stand at 3,775 Bcf and are 180 Bcf less than last year and 41 Bcf less than the five-year average. In the East Region 11 Bcf were injected, and the Midwest Region saw inventories rise by 25 Bcf. Stocks in the Mountain Region and the Pacific Region rose by 2 Bcf. The South Central Region added 25 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |