Shale Daily | Bakken Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

WPX Sticking with Bakken, Permian Development in 2018

Tulsa-based WPX Energy Inc., which has turned its focus to the Permian Basin in the past couple of years, remains committed to the Bakken Shale, executives said Thursday during a conference call to discuss quarterly earnings.

Operations in the Williston Basin of North Dakota “have worked a small miracle” in the past two years, driving down costs and accelerating efficiencies, said COO Clay Gaspar. “I think we’re still a bit earlier in the process of driving the costs down in the Permian, where water disposal and water transportation are still big [cost] items.”

CEO Rick Moncrief added that after 2018, the Permian’s Delaware sub-basin will become a “much bigger percentage” of production.

Analysts queried the team about the relative advantages to operating in both the Bakken and Permian.

“Many investors ask if we shouldn’t be a purely Delaware Basin operator, and I think that is a very valid question that we as an organization and our board continue to pressure test,” Moncrief said. “But in times like we just went through, having optionality from a basin perspective really paid off for us,” he said, referring in part to Hurricane Harvey impacts, which reached into Permian takeaway and processing.

“Our impacts from the hurricane were relatively minimal, with a little bit of impact on the gas and NGL [natural gas liquids] side, but from the oil side it was almost nonexistent,” said the CEO. “And that was the case primarily, not so much because we’re in multiple basins, but because of the kind of acreage we’re involved with in each of the basins. That is a differentiator.”

WPX also works in the San Juan Basin, and Moncrief said its stakes there are only about half of what it holds in the Bakken. In turn, Bakken acreage is only about 10% of the Permian inventory. Increasingly, the company plans to put more capital into the Permian.

“Nevertheless, at the end of the day it comes down to returns, and our Bakken acreage is not like anyone else’s,” Moncrief said. “Very few people have the quality of the acreage we have and the immaturity [in development] we have, so I don’t see a change in our Bakken holdings.”

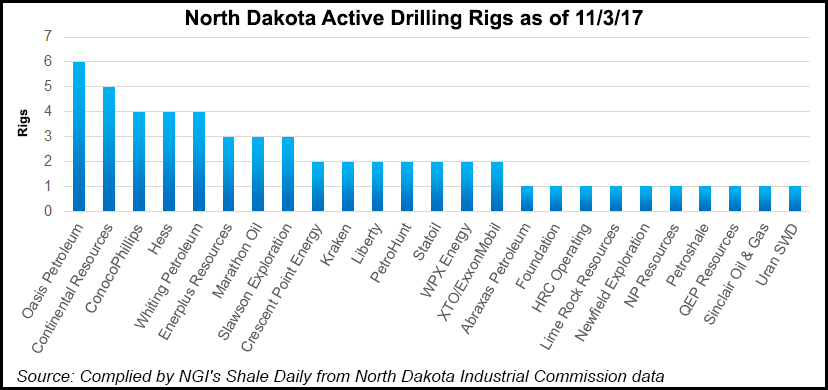

For 2018, WPX has set a capital budget at $1.1-1.2 billion, supporting an average of 9.5 rigs during the year and eight to 11 rigs operating at any given time, management said. This would include six to seven rigs in the Permian’s Delaware, two to three in the Williston, and potentially one in the San Juan.

WPX is not interested in “growth for growth’s sake,” he reiterated. Rather, it is focused on the overall debt load and raising the margins on a per-barrel basis.

“With a signed agreement for the sale of our San Juan dry gas assets, our story continues to get simpler and stronger,” said Moncrief. The company closed a strategic partnership with Howard Energy Partners to develop oil gathering and gas processing infrastructure in the Delaware.

WPX needs to stay focused on its strategic plan, which anticipates $50/bbl oil and $3.00/Mcf gas in 2018, and a flat rig count, Moncrief said.

Beyond 2018, “the key is optionality and the path in front of us is as clear as it has ever been.”

Gaspar said the company plans to use 20% longer laterals of 1.5-2 miles for all of its wells.

WPX reported a net loss of $149 million (minus 39 cents/share) in 3Q2017, compared with a year-ago loss of $245 million (minus 72 cents).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |