Utica Shale | E&P | Marcellus | NGI All News Access | NGI The Weekly Gas Market Report

Antero Claims Crown as Largest U.S. NGL Producer

Antero Resources Corp. became the nation’s largest natural gas liquids (NGL) producer in the third quarter, according to company calculations, after years of amassing a wetter position and focusing on the richer portions of the Marcellus and Utica shales.

The company has long dumped capital into liquids-rich wells, even as other operators have increasingly found better economics in the Appalachian Basin’s dry gas windows. Antero produced 105,609 b/d of NGLs in the third quarter, up 37% from the year-ago period and enough to vault the company to the No. 1 position. Antero based its calculation on public company disclosures, but that could not immediately be verified on Thursday.

“We built our business around the liquids-rich areas of Appalachia,” CFO Glen Warren told financial analysts during an earnings call. “The rising liquids price environment plays a major part in cash flow growth and value creation at Antero, and we plan to continue building on that progress.”

Indeed, NGLs improved with a strengthening of the benchmark Mont Belvieu prices during the quarter, primarily lifted by an increase in export volumes. Before hedges, Antero’s average realized NGL price was $28.92/bbl, or 60% of the average West Texas Intermediate (WTI) oil price on the New York Mercantile Exchange (NYMEX). Pre-hedge liquids prices were up 65% from the year-ago period. Antero forecasts that its NGL price realizations will increase to 70-75% of the average WTI price this quarter.

“We’ve positioned the company strategically for this, being very much focused on liquids-rich [assets],” Warren said. “We’ve done a lot of work on that over time — just understanding where are the remaining locations and what companies hold them. We’re highly confident in our position.”

Liquids revenue of $251 million accounted for a record 38% of the company’s total pre-hedged product revenues. Antero reaffirmed on Thursday that it would continue targeting liquids-rich acreage in the basin, where management said the company controls 44% of all future liquids-rich drilling areas in the Marcellus and Utica. Antero has continuously bolted on properties over the years, amassing a sizable contiguous acreage position that has allowed it to capture wetter targets through longer laterals.

“Antero has done an extensive technical analysis on acreage configurations, well results and the geology underlying our competitors in the core of the Marcellus and Utica. Based on an extensive analysis, Antero holds over 30% of the long lateral inventory beyond 10,000 feet, outpacing close peers by a wide margin,” CEO Paul Rady said. “In fact, 24% of our undrilled inventory is made up of laterals longer than 10,000 feet.”

Longer laterals, increased estimated ultimate recoveries and lower well costs also find Antero cutting out 200 wells and $1.5 billion from its plans through 2020. In a three-year forecast that has yet to be approved by the company’s board, the company said it would still target annual production growth of 20% between 2017 and 2020. The capital efficiencies management expects to achieve in that time should also help the company transition from one that has historically overspent on its drilling program to one funded entirely within upstream cash flow.

Drilling and completion costs are expected to stay flat year/year in 2018 at $1.3 billion, before increasing to $1.5 billion in 2019 and 2020. The company plans to run six or seven rigs next year and then eight or nine in 2019 and 2020.

The third quarter wasn’t without challenges. Two contractual disputes over the company’s natural gas sales cost it millions. WGL Midstream Inc. allegedly failed to take delivery of a portion of Antero’s volumes at a point in Braxton, WV, in violation of the contract terms. That forced Antero to sell 380,000 MMBtu/d at lower pricing points, resulting in a $40 million loss during the third quarter. The companies have fought in court over the contract before. Antero has charged WGL for its losses, which have not yet been paid.

Another dispute, with South Jersey Gas Co. (SJGC), which started in 2014, cost Antero $7 million during the quarter. According to Antero, SJGC has been short paying it based on different unidentified price indices and not the one it uses from S&P Global Platts. Antero filed a lawsuit in the U.S. District Court in Colorado and won a favorable verdict. But Antero alleges that SJGC continues to short pay during an appeal. The dispute has cost Antero $47 million since 2015.

Management said, however, that it does not expect any balance sheet impact next year, as more takeaway capacity comes online and Appalachian basis is forecast to narrow. Its contract with SJGC expires in April 2019, while different tranches of the WGL contract are scheduled to phase out over the next 20 years.

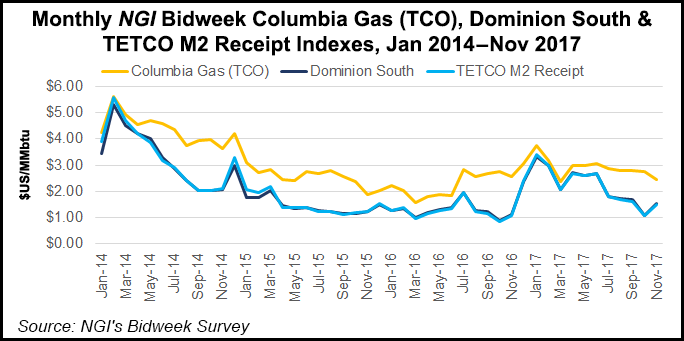

Antero’s realized natural gas price before hedges for the third quarter was $2.71/Mcf, a 29-cent differential to the average NYMEX price, including a 26-cent impact stemming from the contractual disputes.

Antero produced more than 2.3 Bcfe/d in the third quarter, up from about 1.9 Bcfe/d in 3Q2016 and 2.2 Bcfe/d in 2Q2017.

Higher volumes helped lift third quarter revenue to $1.1 billion from $647.9 million in the year-ago period. Antero reported a net loss of $135 million (minus 43 cents/share), compared to net income of $238 million (78 cents) in 3Q2016.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |