NGI Data | Markets | NGI All News Access

Midwest NatGas Gains On Forecast Cooler Temps; Futures Rise Post Plump Storage Build

Physical markets rebounded from Wednesday’s drubbing and natural gas for Friday delivery sported double-digit gains at most locations. Strength was seen across the board from Texas, Louisiana, the Midcontinent, Midwest, Rockies and California.

Hefty gains approaching a half-dollar were seen in the Northeast and Appalachia, and only two points followed by NGI failed to trade in positive territory. The NGI National Spot Gas Average jumped 11 cents to $2.44.

Futures have seemed destined to show a counterintuitive response to Energy Information Administration (EIA) storage data and Thursday was no exception. The EIA reported a storage injection of 65 Bcf, about 3 Bcf greater than expectations, yet prices rose. At the close December was higher by 4.2 cents to $2.935 and January had gained 3.4 cents to $3.051. December crude oil rose 24 cents to $54.54/bbl.

Just before report time the market was hovering around $2.926 and following the release of the number December futures barely moved, failing to take out the day’s high or low. By 10:45 a.m. December was trading at $2.938, up 4.3 cents from Wednesday’s settlement.

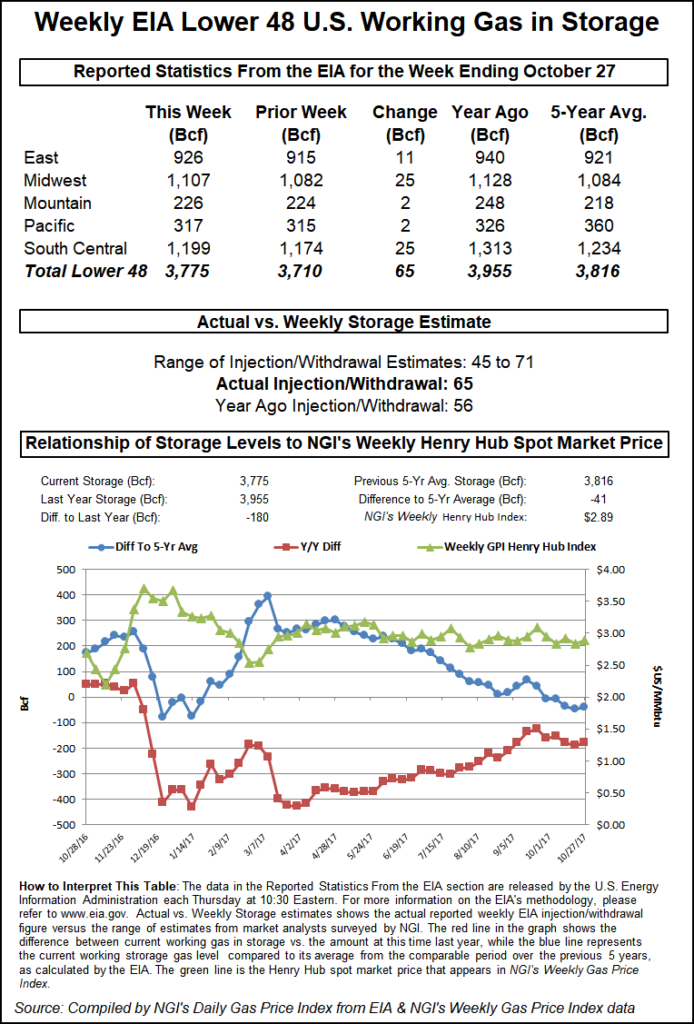

Prior to the release of the data traders were looking for a storage build slightly less than the actual figures. Last year 56 Bcf was injected and the five-year average stands at 60 Bcf. Citi Futures was looking for a 52 Bcf injection and Raymond James calculated a 70 Bcf build. A Reuters survey of 26 traders and analysts showed an average 62 Bcf with a range of +45 Bcf to +71 Bcf.

“I thought the number was a little bearish, so we should have been lower,” said a New York floor trader. “There was no reaction to the number when it was released, and it wasn’t until about 10 minutes after the number came out that it made a new high.

“Somebody came out and said, ‘Hey why not run this market up to $2.947, we haven’t got anything better to do,'” the trader mused.

“It seems that every time we close one month and trade the next month, if that month is trading above $3 then we seem to be able to get it under $3. $3 is proving to be one impenetrable barrier.”

Analysts called the report neutral. “This week’s injection was 11 Bcf above last year’s reported figure of 54 Bcf and 5 Bcf above the five-year average of 60 Bcf,” said the Wells Fargo analytical team. “We now forecast end of injection season storage at approximately 3.83 Tcf, 50 Bcf below the five-year average and 217 Bcf below comparable 2016 levels.”

Inventories now stand at 3,775 Bcf and are 180 Bcf less than last year and 41 Bcf less than the five-year average. In the East Region 11 Bcf were injected, and the Midwest Region saw inventories rise by 25 Bcf. Stocks in the Mountain Region and the Pacific Region rose by 2 Bcf. The South Central Region added 25 Bcf.

In the physical market prices at Midwest points rose as temperatures were forecast below seasonal norms. Wunderground.com predicted the high in Chicago Thursday of 50 would slide to 48 Friday before inching back up to 49 Saturday, 6 degrees below normal. Detroit’s 59 high Thursday was forecast to drop to 50 Friday before making it back to 52 on Saturday, 4 degrees less than its seasonal norm.

Gas at the Chicago Citygate rose 10 cents to $2.77 and gas at the Henry Hub rose 5 cents to $2.69. Deliveries to Northern Natural Demarcation added 8 cents to $2.74. Gas priced at Transco Zone 4 gained 5 cents to $2.69.

The National Weather Service in Chicago said, “High pressure will pass across northern Wisconsin Friday, which will lead to a dry day with a bit more sunshine, though we will call it partly sunny to partly cloudy as some clouds will roll in off the lake in the morning/early afternoon, and with active westerly flow aloft ahead of several weekend systems, additional higher clouds will spread in also. Temperatures will be slightly below seasonal levels.”

Gas at eastern points recovered smartly from the $1-plus pounding they took Wednesday. Next day deliveries to the Algonquin Citygate rose 10 cents to $1.28 and parcels on Dominion South came in 24 cents higher at 91 cents. Gas on Tetco M-3 Delivery posted a 30 cent gain to $1.17 and gas bound for New York City on Transco Zone 6 jumped 65 cents to $1.99.

Out west Kern Receipts were quoted at $2.61, up 10 cents and Kern Delivery changed hands a dime higher as well to $2.73. Gas at the SoCal Citygate was down a penny at $3.22 and gas at Malin rose 12 cents to $2.68.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |