NGI The Weekly Gas Market Report | Infrastructure | M&A | NGI All News Access

American Midstream, Southcross Merger to Create Gulf Coast Powerhouse for Onshore, GOM

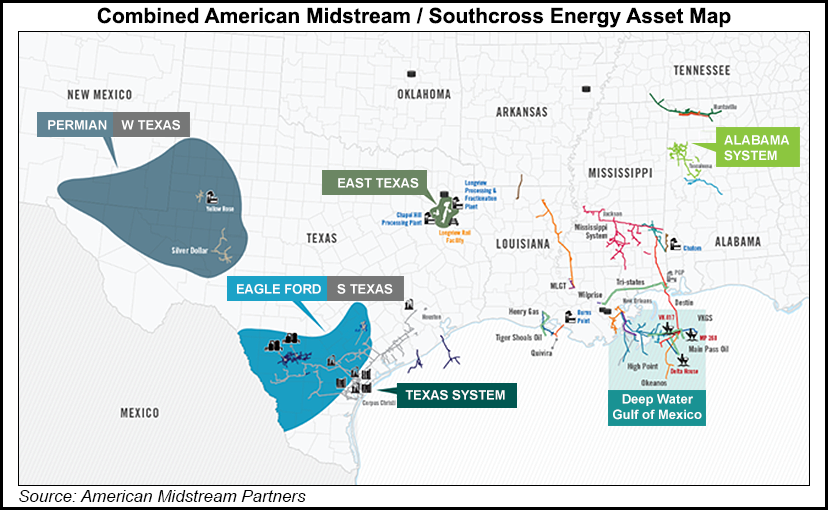

American Midstream Partners LP (AMID) on Wednesday announced an estimated $3 billion merger with Southcross Holdings LP entities, a transformational tie-up that when completed would create an enterprise with 8,000 miles of onshore and offshore natural gas, crude and liquids pipelines, and substantial gas and liquids processing.

Once merged, AMID would control 2.5 Bcf/d of transmission capacity, 10 processing plants with 1 Bcf/d-plus, six fractionation facilities with 111,500 b/d and 6.7 million bbl of aboveground liquids storage. The deal also includes a 35.7% stake in the Delta House floating production facility in the deepwater Gulf of Mexico (GOM).

Earlier this week AMID agreed to take over more interest in the Destin Pipeline gas system, which carries natural gas from the deepwater GOM, from financial sponsor ArcLight Capital Partners LLC.

The Southcross merger “accelerates our transformation into a fully integrated gathering, processing and transmission company focused in select core areas,” said CEO Lynn L. Bourdon III. “The transaction also furthers our strategy of redeploying capital into higher growth businesses along with divesting noncore assets at attractive multiples.”

AMID owns or has stakes in about 4,000 miles of interstate and intrastate pipelines, gas processing plants, fractionation facilities, an offshore semisubmersible floating production system and terminal sites with close to 6.7 million bbl of storage capacity. Its combined interests in the Destin and High Point pipelines cover more than 10,000 square miles of active production in the GOM, while an onshore segment of Destin provides gas transmission into the Southeast market.

Dallas-based Southcross Holdings, which filed for Chapter 11 bankruptcy protection in 2016, indirectly owns all of the equity in the general partner of Southcross Energy Partners LP (SXE), a midstream and natural gas liquids (NGL) fractionation and transportation provider. SXE also sources, purchases, transports and sells gas and liquids from its Eagle Ford Shale assets in South Texas and from Mississippi and Alabama assets. SXE has two gas processing plants, one fractionation plant and an estimated 3,100 miles of pipeline.

The Southcross portfolio, said Bourdon, would add heft to AMID’s strategy to provide services to an expanding Gulf Coast demand area that has new and expanded petrochemical facilities coming online in the coming years, along with liquefied natural gas and Mexico gas export projects.

“Given the compelling rationale for the acquisition, we anticipate that our combined unitholders should benefit from the partnership’s increased scale, greater financial flexibility, and operational density. The integration and commercialization of the acquired assets will contribute to our growth and help establish solid distribution growth over time,” Bourdon said.

Southcross general partner CEO Bruce A. Williamson said the combination would allow the affiliates’ private and public equity holders “to participate in a more diverse, sustainably capitalized company.”

Under terms of the merger, AMID agreed to acquire equity interests in Southcross Holdings subsidiaries that directly or indirectly own 100% of the stakes in SXE and 55% of SXE common units. AMID also agreed to repay $139 million of the entities’ net debt.

As part of the transaction, ArcLight agreed to transfer ownership of 15% of AMID’s general partner and incentive distribution rights to Southcross Holdings. AMID still plans to sell $400-500 million of noncore assets, primarily related to its terminaling services segment.

The SXE merger is subject to unitholder approval, and the transaction with Southcross Holdings and SXE also needs regulatory approvals. The deal is set to be completed in 2Q2018.

The Southcross deal follows AMID’s announcement earlier this week to buy from ArcLight another 17% stake in Destin, which post-closing would give it a two-thirds interest in the 255-mile, 1.2 Bcf/d system, considered one of the largest gas pipelines in the GOM.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |