Natural Gas Futures Slide Following On-Target Storage Figures

November natural gas futures fell Thursday following a report by the Energy Information Administration (EIA) showing a storage build that was right on target with what traders were expecting.

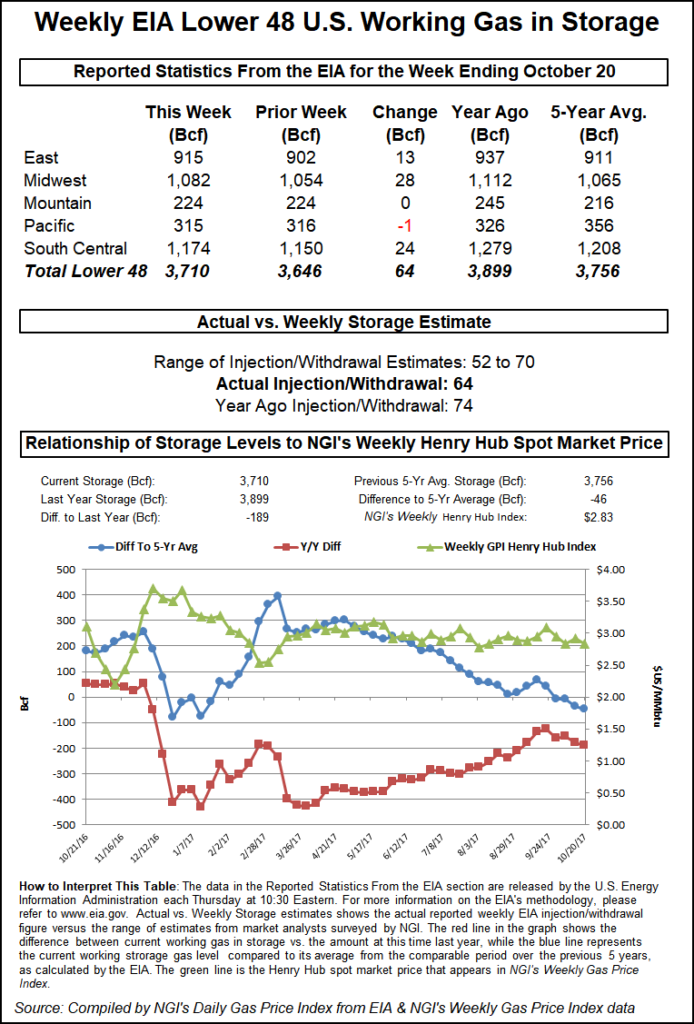

The EIA reported a storage injection of 64 Bcf for the week ended October 20, about 1 Bcf less than consensus estimates. Just before the 10:30 a.m. EDT the market was hovering around $2.894 and following the release of the number November futures dropped to $2.883. By 10:45 a.m. November was trading at $2.886 down 3.3 cents from Wednesday’s settlement.

Prior to the release of the data traders were looking for a storage build about equal to the actual figures. Last year 74 Bcf was injected and the five-year average stands at 75 Bcf. ION Energy’s Kyle Cooper calculated a 63 Bcf injection and Gelber and Associates was looking for a 68 Bcf build. A Reuters survey of 24 traders and analysts showed an average 65 Bcf build with a range of +60 Bcf to +70 Bcf.

“The high and low on the day remained the same after the number came out. It was trading about $2.89 before the figures were released, and we were hearing a 65 Bcf build. It was not a big deal,” said a New York floor trader.

Harrison NY-based Bespoke Weather Services said, “The print is rather tight still as it indicates that last week’s even tighter print was not entirely because of Nate, and we see this as helping to provide a bit of support for the market, though it will be relatively meaningless without any sustained cold weather.”

The analytical team at Wells Fargo saw the report as neutral. “The focus remains on weather forecasts for the remainder of shoulder season and recent projections from the NOAA (National Oceanic and Atmospheric Administration) have flipped, with cooler than normal temperatures now forecasted across much of the U.S. for the next one to two weeks.

“As we move into late October/November, cooler temperatures become bullish for demand and we forecast a cumulative build of just 83 Bcf for the next two weeks, well below the five-year average of 111 Bcf and last year’s cumulative build of 108 Bcf. Additionally, we now forecast end of injection season storage at approximately 3.81 Tcf, 70 Bcf below the five-year average and 237 Bcf below comparable 2016 levels.”

Inventories now stand at 3,710 Bcf and are 189 Bcf less than last year and 46 Bcf less than the five-year average. In the East Region 13 Bcf were injected, and the Midwest Region saw inventories rise by 28 Bcf. Stocks in the Mountain Region were unchanged and the Pacific Region fell by 1 Bcf. The South Central Region added 24 Bcf.

Salt storage rose by 11 Bcf to 313 Bcf and non-salt storage increased 14 Bcf to 861 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |