NGI The Weekly Gas Market Report | Markets | NGI All News Access

California to Closely Monitor NatGas Supplies, Pipelines Through Winter Season

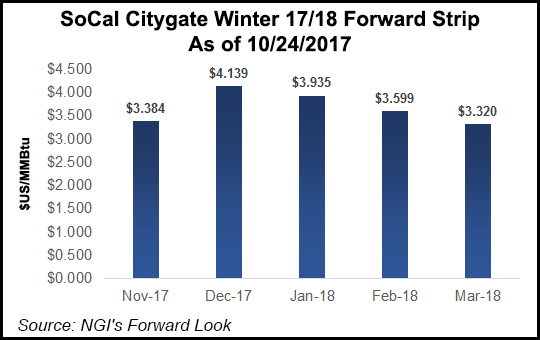

Although the forecast for the coming winter is for above-normal temperatures and average participation, California’s grid operator is concerned about potential constraints in natural gas infrastructure, as well as limits imposed by identified power transmission maintenance and enhancement work.

In its winter 2017-2018 outlook, the California Independent System Operator (CAISO) said it plans to closely monitor gas infrastructure, including the depleted operations at the state’s largest underground gas storage facility at Aliso Canyon, according to Executive Director Nancy Traweek, who handles system operations.

CAISO has increased coordination with gas pipeline operators and gas-fired generators, and its planning activities now include assessing pipeline capabilities. The grid operator has requested rule changes at FERC to allow for responses to stressed gas market conditions if they develop, Traweek said. She spoke at a panel discussion last week at the Federal Energy Regulatory Commission’s regular meeting.

Earlier this month CAISO asked FERC to approve two tariff changes effective Nov. 1, designed to overcome the loss of gas availability caused by the limited operations at the Aliso Canyon. Since a massive gas leak has been contained, the facility, which had operated with 86 Bcf of capacity, has reopened but is limited to using 29 Bcf. Injection and withdrawal rates also have been cut.

CAISO has requested authority to extend temporary market measures that enable suppliers to reflect more volatile costs as a result of limited access to the Southern California Gas Co. (SoCalGas) storage facility, she said.

One set of the tariff revisions sought by CAISO would extend indefinitely three existing temporary measures — day-ahead market gas index, adjustments to commitment cost caps and default energy bids, and after-the-fact fuel cost recovery measures.

The second set of proposed changes would be made permanent and apply western-wide: maximum gas constraint, employing market power mitigation tools in constrained areas, virtual bidding, and pre-pay day-ahead information.

On an ongoing basis, gas cost estimates would be increased to calculate the CAISO real-time market commitment costs bid cap and default energy bids for generators on the SoCalGas and San Diego Gas and Electric Co. gas systems.

Because of possible constraints on power transmission capacity between segments of its system, CAISO will be coordinating closely with the western energy imbalance market, increasing its “situational awareness and market flexibility,” Traweek said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |