Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Rising DUC Backlog Escalating Fracture Demand, Says Raymond James

The U.S. onshore rig count will decline modestly through the rest of the year, but a large backlog of wells awaiting completion indicates pressure pumping demand will continue to move higher over the coming months, Raymond James & Associates Inc. said Monday.

More important, Raymond James’ bullish oil price assumptions for 2018 of $65/bbl should provide exploration and production (E&P) companies with sufficient cash flow and budgets “to put an average of 1,100 rigs back to work in 2018,” said analysts J. Marshall Adkins and Praveen Narra.

Hydraulic fracture (frack) limitations exist today, causing challenges to finish drilled but uncompleted wells, or DUCs. No. 1 pressure pumper Halliburton Co. said as much about completions intensity during its 3Q2017 conference call on Monday.

Because of the frack shortage, “we think it will be challenging for well completions to keep pace with 1,100 active rigs by the end of 2018, much less average 1,100 for the full year,” said the Raymond James analysts.

“Put another way, if the U.S. rig count continues to rise to an average of 1,100 next year (versus 920 currently), we do not think the U.S. frack fleet can keep pace and frack pricing is likely to surge meaningfully higher next year. Furthermore, we anticipate 1,200 active U.S. rigs in 2019 rising to 1,250 in 2020.”

The U.S. pressure pumping industry “is likely to remain very tight for at least the next three years,” Adkins and Narra said. “Frack intensity,” like completions intensity, means proppant demand and lateral length, and that likely will continue increasing in 2018, but at a slower pace.

Meanwhile, the horsepower demand per rig should continue to rise, while the growing DUCs begin to stabilize as crews begin to catch up to drilling.

Decreasing crew, equipment and efficiencies also should factor into the mix, but possibly only have a modest effect on overall frack demand per active rig.

“As we have witnessed for the past five years, the completions side of the business and particularly the pressure pumping side should continue to capture a greater piece of the U.S. spending pie over the next several years,” the analysts said.

The Raymond James assumption is for well completions to grow by around 25% in 2018, leading to sharp demand for U.S. horsepower.

“By our estimates horsepower demand has the potential to reach 15-16 million hp by the end of 2018, though we would expect bottlenecks in manufacturing and labor to hold back that number. Still, with that sufficient of an undersupply, we expect frack pricing to continue increasing sharply through 2018.”

What about the declining rig count? Raymond James expects about 100 rigs to fall overall through the last half of this year. “Concerns are warranted” about the pace of continued pricing growth, but pressure pumping demand “should be more resilient than the general trend of the rig count for several reasons.”

Halliburton and other leading pressure pumpers have indicated their frack calendars are booked into 2018, and the market for crews is tight.

“That means that E&P operators will typically be more hesitant to lay down frack crews fearing that they won’t be able to pick them back up in a tight market,” said Adkins and Narra.

The pent-up demand for crews only is exacerbated by the DUC inventory.

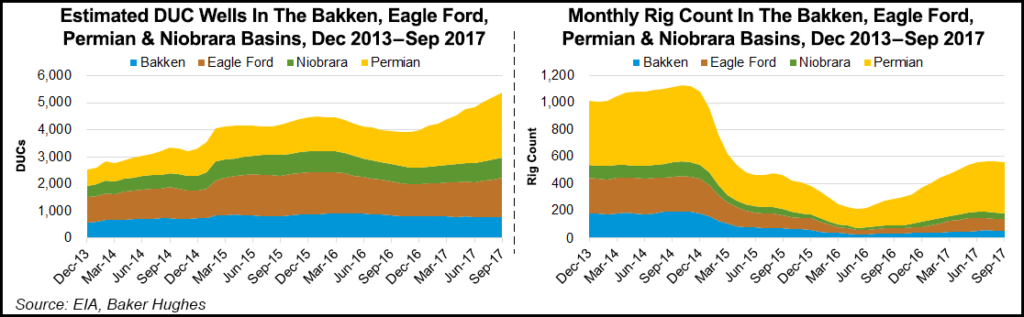

“On paper, operators have amassed a whopping 5,050 DUCs through July 2017 in just four major modeled oil plays,” the Permian Basin, Eagle Ford and Bakken shales and the Niobrara formation.

Around 70% of the DUCs are in the Permian and Eagle Ford, and overall, the number roughly equals seven months’ of completions within the four basins.

“Assuming four months of well backlog is now the new normal level of DUCs, this would imply an ”abnormal’ level of DUCs amounting to around 2,200 wells,” analysts said. “Put simply, even though we are concerned that relatively low oil prices from earlier in 2017 will likely continue pushing drilling activity lower over the next few months, we believe pressure pumping activity is likely to hold up much better…

“More importantly, under our bullish oil price assumptions, we expect the U.S. rig count to resume growth in 2018 averaging about 250 rigs higher than 2017.”

Demand for pressure pumping services, said the analyst team, should outpace the surge in drilling activity as DUCs slowly are drawn down.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |