Shale Daily | E&P | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Halliburton Sees Strong North American Gains, No Slowdown in ‘Completions Intensity’

Houston-based Halliburton Co., the largest pressure pumping operator in North America, was “hitting on all cylinders” during the third quarter, and market conditions appear to be strengthening, CEO Jeff Miller said Monday.

North American sales, the largest business segment for the No. 3 global oilfield services (OFS) operator, nearly doubled year/year and climbed 14% sequentially to $3.2 billion and significantly outpacing the average sequential U.S. land rig count growth of 6%.

The improvement was driven primarily by increased utilization and pricing throughout the United States land sector in most of the product service lines, primarily pressure pumping, as well as higher well completion and pressure pumping activity in Canada.

“Our North American business is hitting on all cylinders and our international business proved resilient in a challenging environment,” Miller said in his first conference call at the helm after taking over for Dave Lesar.

Miller’s optimistic comments contrasted those by No. 1 Schlumberger Ltd. and No. 2 Baker Hughes, a GE company, whose CEOs last week each cited deceleration in North America’s onshore. Halliburton’s revenues underperformed Schlumberger’s 18% sequential increase but exceeded a 6% gain in the onshore rig count.

Halliburton had sold out all of its pressure pumping fleet going into the third quarter, while Schlumberger continues to deploy idle capacity, which means Halliburton may have an edge in passing through supply cost increases through the second half of the year.

Halliburton in the third quarter also completed its takeover of Tulsa-based Summit ESP, an electric submersible pump (ESP) specialist in North America. The deal made Halliburton the No. 2 provider and is expected to help build out production-oriented business lines, Miller said.

However, there were operational issues in the quarter related to Hurricane Harvey, he said.

“As a result of the weather, we had a few customers temporarily suspend activity in both the Gulf of Mexico and the Eagle Ford. We also experienced increased costs because diesel fuel was temporarily unavailable and reduced efficiency due to sand supply chain disruptions, both of which negatively affected our margins for the quarter.

“In spite of these disruptions, the sophistication and hard work of our supply chain organization allowed us to quickly adapt to these challenges and continue to execute and deliver superior service quality.”

Rig Count Plateau Expected

Miller reminded the analyst/investor audience listening to the conference call that Halliburton in July had predicted the North American rig count would plateau in the third quarter “and that’s exactly what it did. We said our North America sequential revenue would significantly outperform average U.S. land rig count growth and it did.

“We told you that our completion and production margins would continue to expand and they did. We said operators were beginning to optimize as opposed to maximize the use of sand and turn to technology to increase production. This trend held true, as we saw average sand per well remain flat sequentially. And finally, we said we would have the highest returns in the industry and we do as we continue to outgrow our peers and take market share.”

The U.S. land rig count “effectively flattened as customers reacted to shareholder input and their own view of market conditions for the balance of the year,” Miller said. “However, our revenue increased, and we saw improved activity in our completions-related product lines due to the natural lag between drilling and completing wells.

“Today, the industry is drilling approximately the same footage as in 2014 with half the rigs, while completions intensity significantly increased.” Customers are focused on “efficiencies, optimization and making more barrels,” he said.

Halliburton’s North American fracture fleet also remains sold out into 2018. The completions market “remains tight,” which has allowed the operator to push pricing across its portfolio.

“Demand for our completions equipment and service quality remains strong. The improving oil price outlook provides a runway for us to increase our portfolio pricing as we go forward. So let me be clear, we still have the ability to push price.”

Pressure Pumping Undersupplied

Total sand volumes improved during the quarter, but the average sand per well remained sequentially flat.

“Data points from the last two quarters, and my discussions with customers, indicate customers are focused on cost-effective production,” said Miller. “They hear a lot of conflicting anecdotes about sand use today because they’re based on individual operators and individual basins.

“But the facts are for Halliburton, sand per well was down in the Bakken, Rockies and Northeast, and it was up in the Permian Basin. This happened because customers that know the production characteristics of the reservoirs have streamlined their operations to focus on cost per boe and are optimizing sand utilization.”

However, customers still drilling across their entire acreage or exploring production boundaries of their reservoirs continue to pump jobs with higher sand loads, said the CEO.

The pressure pumping equipment market is undersupplied today, he said. “At the same time, equipment is being used harder and maintenance costs are higher. As a result, there will be a greater call for new equipment just to replace the active equipment that’s being worn out more quickly. Meaning, the day when supply and demand come into balance is further out than people think.”

OFS operators that are not making money today may struggle to add newbuilds beyond their current fleet take-or-pay commitments as they work within constrained budgets and struggle to obtain funding, he said.

“You see many announcements of new fleet deployments but no announcements of fleet retirements, but I can tell you they are happening,” Miller said.

Because completions intensity hasn’t slowed down, Halliburton is pumping more sand with less equipment. As a result, maintenance costs associated with advanced completion designs are increasing.

“I believe deferred maintenance is happening throughout the industry,” Miller said. “A proxy for deferred maintenance and the simplest place to see it is in the industry horsepower and creeping crew size. And while Halliburton continues to operate with an average fleet size of 36,000 hp per crew and have for the last several years, the rest of the industry is now averaging closer to 45,000 hp per crew. Deferred maintenance is creating this equipment redundancy on location.”

Newbuilds Still Unlikely

Halliburton still has no plans to build more equipment.

“We will only bring out newbuild equipment under certain conditions. And those conditions are: No. 1, it’s backed by customer commitments; No. 2, it captures leading-edge pricing, which is accretive to our margins; and finally, No. 3, it generates an acceptable return on investment.”

Income from continuing operations totaled $365 million (42 cents/share) in 3Q2017, versus $6 million (1 cent) a year earlier and $28 million (3 cents) sequentially. Wall Street on average had expected Halliburton to earn 37 cents/share in 3Q2017.

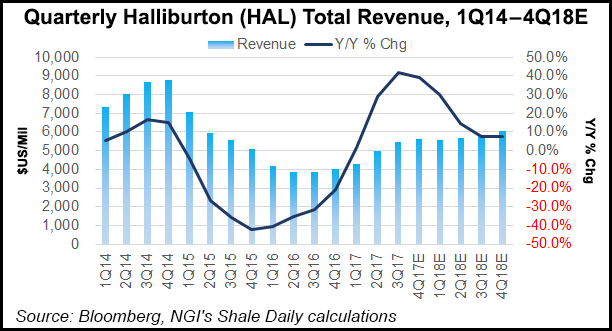

Revenue climbed 10% sequentially to $5.4 billion, beating Wall Street estimates.

Total operating income surpassed $630 million, “primarily driven by continued strengthening of market conditions in North America and improved profitability in our drilling and evaluation product lines,” Miller said.

Drilling and evaluation revenue increased 4%, while operating margins expanded by 260 basis points (bps) to about 9%. Completion and production revenue increased by 13%, while operating margins improved by 215 bps, despite a 50 bps negative impact from Hurricane Harvey.

“This was driven by improved activity and pricing throughout North America land in our pressure pumping, completion tools and cementing product service lines,” Miller said. “Our North American revenue increased by 14%, significantly outperforming the average sequential U.S. land rig count growth of 6%.”

Halliburton made progress between July and September “toward our goal of normalized margins in North America, demonstrating that our strategy is working,” the CEO said.

Beyond North America, “our conservative outlook for the last several quarters is proving accurate. Our international organization has shown impressive control over their costs and their commitment to making the toughest of markets sustainable.”

International revenue rose 4% from the second quarter to $2.3 billion, primarily from increased activity across multiple product services lines in Latin America, and increased pressure pumping services and drilling activity in the Eastern Hemisphere.

Latin America revenue was $530 million, a 4% increase sequentially, driven by rising activity in Argentina, higher production group activity in Brazil and increased drilling activity in Mexico. Results were partially offset by reduced well completion activity in Venezuela.

“Latin America saw a slight rig count growth in the third quarter driven by increased activity in Argentina, Mexico, and Brazil,” Miller said. “While activity is improving, the pricing pressures across the region make it increasingly important to be efficient as we execute.

“This quarter in Mexico, we designed and ran a specialty drillbit to help tackle a particularly difficult reservoir. This design reduced the necessary runs and hole, resulting in a three-day reduction in rig count. This example shows that even in a tough pricing environment, there’s an appetite for new technology especially if it will reduce cost.”

In recent days, commodity prices have modestly rebounded, with a tightening macro supply/demand picture.

“However, I still believe that the oil and gas industry will largely remain in a range-bound commodity price environment in the near to medium term,” Miller said. “In this environment, we are focused on returns and capital discipline.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |