NGI Weekly Gas Price Index | Markets | NGI All News Access | NGI Data

California Weekly NatGas Soars While Appalachian Basin Quotes Languish

Although on balance weekly natural gas prices were unchanged for the week of Oct. 20, try telling that to traders working the SoCal Citygate or constricted Appalachian basins.

The NGI Weekly National Spot Gas Average was flat at $2.57, and of the actively traded points extreme heat in the LA Basin, meteoric power prices, and a pipeline outage all conspired to lift weekly prices at the SoCal Citygate a stout $1.24 to $4.31, the week’s strongest market point. At the other end of the spectrum was Tennessee Zone 4 313 Pool losing 31 cents to $1.84.

Regionally, California was the strongest posting an advance of 31 cents to $3.10 and the Southeast proved to be the week’s weakest, falling 11 cents to $2.77.

Appalachia, the Rockies and the Northeast rounded out regions in the plus column with gains of 3, 4 and 5 cents to $1.28, $2.47 and $2.62, respectively.

Losses of 2-9 cents were confined to Texas, Louisiana, the Midcontinent, and Midwest.

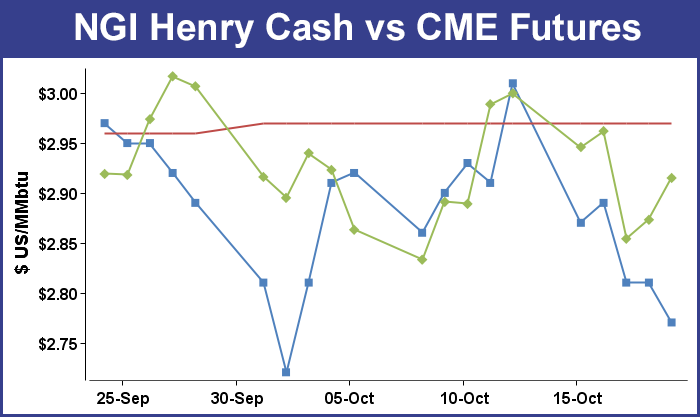

November futures retreated 8.5 cents to $2.915.

Traders Thursday had a double-whammy of data to contend with. At first traders had to deal with a new report from the U.S. Climate Prediction Center calling for warmer-than-normal temperatures across much of the Lower 48 this winter. The market tested the bottom of the prompt month’s recent trading range before thinking better of it, and after probing as low as $2.773, the November contract settled at $2.873, up 1.9 cents on the day, with December climbing a modest 2.1 cents to settle at $3.086.

The Energy Information Administration (EIA) also released its weekly storage figures and the market continued its trend of counter intuitive market responses as a roller-coaster-dip in the futures Thursday morning followed the release of a supportive weekly storage injection figure. EIA reported a 51-Bcf build for the week ended Oct. 13, about 4 Bcf less than consensus estimates.

Just before the 10:30 a.m. EDT release the market was hovering around $2.840 and following the EIA release November futures dropped to $2.806. By 10:45 a.m., November was trading at $2.815, down 3.9 cents from Wednesday’s regular session close.

Traders had been looking for a storage build that was somewhat larger, but less than historical norms. Last year 77 Bcf was injected and the five-year average stands at 78 Bcf. Citi Futures Perspective calculated a 63 Bcf injection and ION Energy was looking for a 78 Bcf build. A Reuters survey of 26 traders and analysts showed an average 55 Bcf injection with a range of +44 Bcf to +80 Bcf.

“We were hearing an increase of about 55 Bcf so the market is a real head-scratcher,” said a New York floor trader. “In the natty world there are a lot of puzzling days.”

The trader estimated that there may be resting stop loss orders “just below” $2.75, and “if we trade under $2.75 for a couple of days, this market may go south in a hurry, but we have been at these levels before and it has come back.”

He offered the caveat that “guys don’t put stops in the market anymore. They find that once they put a stop [loss order] in the market, it takes them out and goes right back to where it was. They will just pick a spot they want to get out and if the market trades down to that level or within a tick or two they just get out.

“It’s like the algorithms look for these stops and they literally take them out within one or two ticks and rally right back. It’s not worth even putting your stop in,” he said..

The analytical team at Wells Fargo called the report neutral. “The focus remains on weather forecasts for the remainder of shoulder season and current projections from the NOAA [National Oceanic and Atmospheric Administration] forecast warmer than normal temperatures across most of the northeastern U.S. for the next two weeks.

“As we move into late October/November, warmer temperatures become bearish for demand as Heating Degree Days (HDDs) are lost. Therefore, if warmer weather persists into November we could see storage creep back up to levels in-line with or above the five-year average.”

Adding to any concerns bulls may have about warm weather heading into the cooling season, the U.S. Climate Prediction Center (CPC) released its updated Winter Outlook Thursday calling for warmer-than-normal conditions across the southern two-thirds of the continental United States and the East Coast in the December to February timeframe. The CPC report also calls for below-average temperatures along the Northern Tier of the country from Minnesota to the Pacific Northwest over the same period.

Right now, the market is focused on where storage will end up heading into the heating season, Tom Saal, broker with FCStone Latin America, told NGI.

“That story is pretty much told and already over. We’re going to be close to the five-year average, but that’s lower than last year. That’s a little on the friendly side.” But the CPC’s Winter Outlook came in on the bearish side and likely sent futures “searching for the bottom of the range” Thursday, Saal said.

“Natural gas this time of year, with anticipation of winter, you’ve got a forecast that says we’re not going to have one, that’s bearish. There’s going to be a market reaction to that,” Saal said, adding, “The speculators might have traded a little bit on the forecast, but it’s still a forecast. We’ve got a lot of winter left.”

Saal noted that even during last year’s unusually warm winter, the January contract still traded near $4/MMBtu in December.

Meanwhile, near-term weather conditions were showing little threat of unexpected shoulder season demand Thursday, and cash market prices languished.

“The current weather conditions across the U.S. are quite possibly exhibiting some of the most bearish temperatures for natural gas demand of the entire shoulder season,” PointLogic Energy Senior Markets Analyst Alan Lammey said. “This is because unseasonably warm weather across the northern half of the nation is coming up against equally mild and cool temperatures across the south.

“These ‘demand neutral’ conditions suppress both early-season heating demand in the north and late-season cooling demand in the south,” he said. “However, it does appear that a large bout of notably chilly (Canadian-sourced) air will dominate a majority of the eastern-half of the nation, including Texas” during the six- to 10-day period.

Natural gas buyers Friday were in no mood to commit to three-day deals given a well supplied market and expected moderate weekend weather conditions.

Steady prices in Texas along with some modest strength in the Midcontinent and California were no match for the double-digit declines in New England, Appalachia and weak pricing in Louisiana. The NGI National Spot gas average fell 5 cents to $2.43.

Futures prices remained handcuffed in a near-term trading range between $2.75 and $3.10. At the close November had risen 4.2 cents to $2.915 and December had risen 2.7 cents to $3.113.

Eastern prices plunged as forecasts called for weekend temperatures in major markets 10 to 12 degrees above normal. AccuWeather.com forecast that New York City’s Friday high of 73 would rise to 75 by Saturday and reach 74 by Monday, 12 degrees ahead of its seasonal norm. Philadelphia’s Friday high of 73 was expected to give way to a Saturday high of 76 before easing slightly Monday to 75, 10 degrees above normal.

Gas priced at Tetco M-3 Delivery tumbled $1.16 to 85 cents and gas headed for New York City on Transco Zone 6 dropped 81 cents to $1.66. Gas on Algonquin Citygate was quoted at $2.50, down 22 cents and gas on Dominion South plunged to 41 cents, down 24 cents.

Whether mild, ten-degree temperature variations repeat themselves throughout the upcoming winter remains to be seen, but longer term weather patterns are definitely on the minds of traders.

Right now, the market is focused on where storage will end up heading into the heating season, Tom Saal, broker with FCStone Latin America, told NGI.

“That story is pretty much told and already over. We’re going to be close to the five-year average, but that’s lower than last year. That’s a little on the friendly side.” But the CPC’s Winter Outlook came in on the bearish side and likely sent futures “searching for the bottom of the range” Thursday, Saal said.

“Natural gas this time of year, with anticipation of winter, you’ve got a forecast that says we’re not going to have one, that’s bearish. There’s going to be a market reaction to that,” Saal said, adding, “The speculators might have traded a little bit on the forecast, but it’s still a forecast. We’ve got a lot of winter left.”

Elsewhere prices were mixed. Gas at the Chicago Citygate fell 8 cents to $2.64 and the Henry Hub came in at $2.77, down 4 cents. Deliveries to El Paso Permian were seen a penny lower at $2.41 and packages priced at NGPL Midcontinent added 2 cents to $2.55.

At Opal weekend and Monday deliveries shed 2 cents to $2.55 and gas on El Paso S Mainline added 3 cents to $2.70. Gas at the SoCal Citygate was quoted at $3.57, down 10 cents and gas priced at the SoCal Border Average rose 2 cents to $2.69.

Recent market swings have traders licking their wounds.

“While yesterday’s fresh price lows followed by a higher close and this morning’s upside follow through might be viewed as a bullish technical consideration, we feel that the money managers are simply accepting profits as the market fell in the face of a seemingly bullish storage figure that could reemerge as a bullish factor once temperature forecasts begin to shift to the cold side,” said Jim Ritterbusch of Ritterbusch and Associates Friday.

“The EIA’s reported 51 Bcf injection was about 4 Bcf smaller than the average street idea and roughly 12 Bcf less than our forecast. But the fact that the supply deficit stretched more than expected to about 35 Bcf didn’t appear to be a significant concern in [Thursday’s] trade. Daily updates to the short term temperature views are still driving pricing and the outlooks continue to favor unusually mild trends that are now extending into early November.

“With the market apparently pricing in a disappearance of the small supply shortfall within the next few weeks, lifting back up could prove arduous. While we believe that nearby futures will be returning north of the $3 mark, we also feel that lack of significant chart support until the $2.75 level favors one more round of fresh lows. We are sidelined for now after accepting a small loss on a long position. We will caution against following this market lower given a developing oversold technical condition. But at the same time, the exceptionally wide carrying charges into about next spring are suggesting caution against entry into the long side.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |