Shale Daily | E&P | Haynesville Shale | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Permian Leads Declines As Rig Pullback Continues; U.S. Drops 15

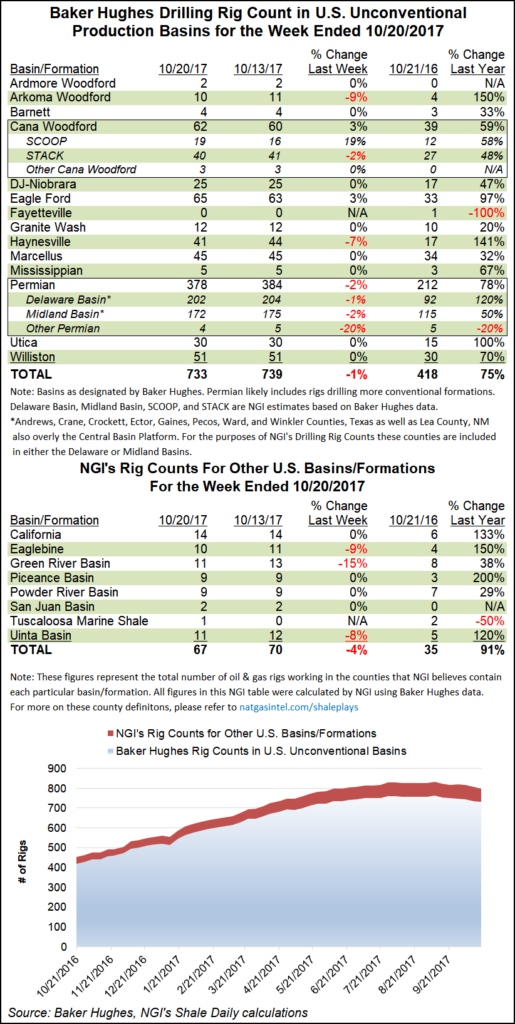

Driven by declines in the Permian Basin and Haynesville Shale, the U.S. rig count fell by 15 for the week ended Friday, nearly doubling the already steep eight-rig loss from the week before, according to data from Baker Hughes Inc. (BHI).

The sizeable week/week drop shows a continued pullback in U.S. onshore drilling activity even as a return to oil prices above $50/bbl may have renewed optimism in the exploration and production (E&P) sector.

The U.S. declines for the week included seven oil-directed rigs and eight natural gas-directed. Fifteen horizontal units left the patch, while one directional unit was added to offset the loss of one vertical unit. The domestic rig count now stands at 913, an improvement over 553 rigs running a year ago but well below the recent high of 958 rigs active for the week ended July 28, the BHI figures show.

Canada also saw sharp declines for the week, dropping by 10, half gas and half oil, to finish at 202 versus 143 a year ago.

That left the combined North American rig count at 1,115 for the week, versus 696 rigs running in the year-ago period.

Among plays, the Permian, which runs through West Texas and southeastern New Mexico, saw the largest week/week drop at six. The Permian, by far the most active of the major U.S. onshore plays, ended the week at 378 rigs versus 212 rigs a year ago.

As the industry enters the 3Q2017 earnings season, some analysts have pointed to a pullback in the venerable Permian.

“The future ain’t what it used to be,” BMO Capital Markets analysts Phillip Jungwirth and Dan McSpirit said recently. “Many producers, mostly of the Permian variety and a first for some, have pre-announced 3Q2017 production slippage on downtime connected to Hurricane Harvey and greater cycle times owing to less experienced fracture crews, as well as general delays in non-operating activity (always a crowd pleaser).”

Meanwhile, the Haynesville, in North Louisiana and parts of East Texas, may have lost some of its recent momentum after dropping three rigs for the week to end at 41. That’s still well above its year-ago tally of 17, and permit activity in the play remains strong, according to data collected by Evercore ISI. The Haynesville now sits four rigs behind the Marcellus Shale, the current leader among gas-focused plays at 45 rigs.

Gainers for the week among plays included the Cana Woodford, which added two rigs to end at 62 (39 a year ago), and the Eagle Ford Shale, up two to 65 rigs (33 a year ago).

Among states, Texas saw the largest week/week decline, giving up eight rigs to end at 436. Alaska and Wyoming dropped two rigs each, while Utah and New Mexico each saw one rig pack up shop, according to BHI.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |