NGI Data | Markets | NGI All News Access

NatGas Futures Stress Over Winter Outlook; Cash In Shoulder Season Lull

A perfect storm of demand-neutral shoulder season temperatures had day-ahead natural gas prices in the red at most points across the country Thursday, and the NGI National Spot Gas Average fell 11 cents to $2.48/MMBtu, approaching the recent low of $2.41/MMBtu set at the beginning of the month.

Futures traders, perhaps alarmed by a new report from the U.S. Climate Prediction Center calling for warmer-than-normal temperatures across much of the Lower 48 this winter, tested the bottom of the prompt month’s recent trading range before thinking better of it. After probing as low as $2.773 Thursday, the November contract settled at $2.873, up 1.9 cents on the day, with December climbing a modest 2.1 cents to settle at $3.086.

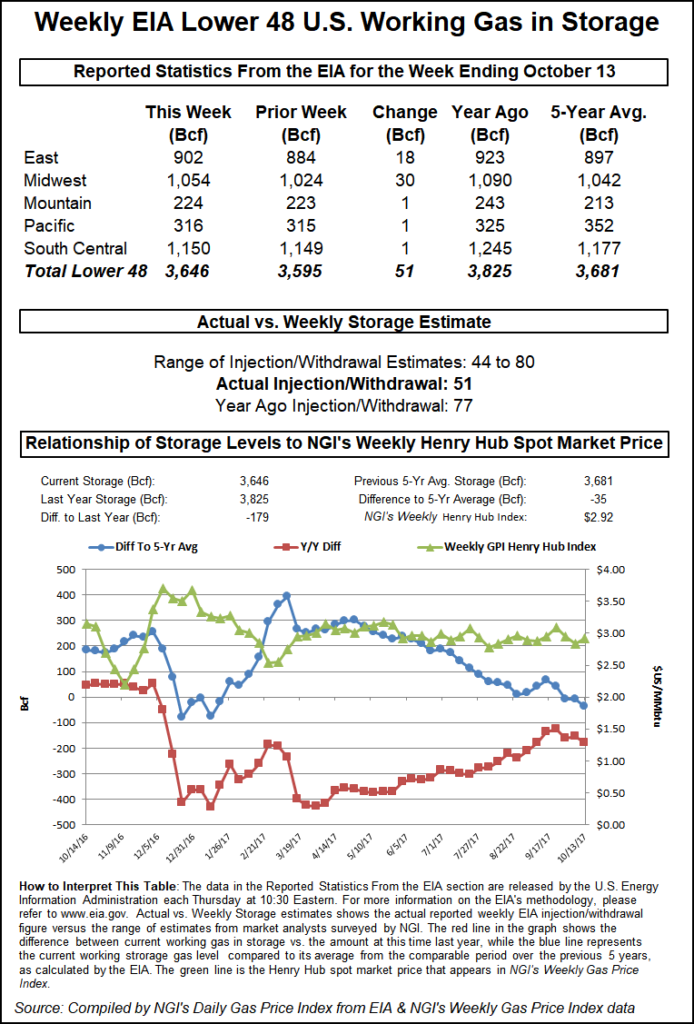

The roller-coaster-dip in the futures Thursday morning unintuitively followed the release of a supportive weekly storage injection figure from the Energy Information Administration (EIA). EIA reported a 51 Bcf build for the week ended Oct. 13, about 4 Bcf less than consensus estimates.

Just before the 10:30 a.m. EDT release the market was hovering around $2.840 and following the release of the number November futures dropped to $2.806. By 10:45 a.m., November was trading at $2.815 down 3.9 cents from Wednesday’s regular session close.

Traders had been looking for a storage build that was somewhat larger, but less than historical norms. Last year 77 Bcf was injected and the five-year average stands at 78 Bcf. Citi Futures Perspective calculated a 63 Bcf injection and ION Energy was looking for a 78 Bcf build. A Reuters survey of 26 traders and analysts showed an average 55 Bcf injection with a range of +44 Bcf to +80 Bcf.

“We were hearing an increase of about 55 Bcf so the market is a real head-scratcher,” said a New York floor trader. “In the natty world there are a lot of puzzling days.”

The trader estimated that there may be resting stop loss orders “just below” $2.75, and “if we trade under $2.75 for a couple of days, this market may go south in a hurry, but we have been at these levels before and it has come back.”

He offered the caveat that “guys don’t put stops in the market anymore. They find that once they put a stop [loss order] in the market, it takes them out and goes right back to where it was. They will just pick a spot they want to get out and if the market trades down to that level or within a tick or two they just get out.

“It’s like the algorithms look for these stops and they literally take them out within one or two ticks and rally right back. It’s not worth even putting your stop in,” he said..

The analytical team at Wells Fargo called the report neutral. “The focus remains on weather forecasts for the remainder of shoulder season and current projections from the NOAA (National Oceanic and Atmospheric Administration) forecast warmer than normal temperatures across most of the northeastern U.S. for the next two weeks.

“As we move into late October/November, warmer temperatures become bearish for demand as Heating Degree Days (HDDs) are lost. Therefore, if warmer weather persists into November we could see storage creep back up to levels in-line with or above the five-year average.”

Adding to any concerns bulls may have about warm weather heading into the cooling season, the U.S. Climate Prediction Center (CPC) released its updated Winter Outlook Thursday calling for warmer-than-normal conditions across the southern two-thirds of the continental United States and the East Coast in the December to February timeframe. The CPC report also calls for below-average temperatures along the Northern Tier of the country from Minnesota to the Pacific Northwest over the same period.

Right now, the market is focused on where storage will end up heading into the heating season, Tom Saal, broker with FCStone Latin America, told NGI.

“That story is pretty much told and already over. We’re going to be close to the five-year average, but that’s lower than last year. That’s a little on the friendly side.” But the CPC’s Winter Outlook came in on the bearish side and likely sent futures “searching for the bottom of the range” Thursday, Saal said.

“Natural gas this time of year, with anticipation of winter, you’ve got a forecast that says we’re not going to have one, that’s bearish. There’s going to be a market reaction to that,” Saal said, adding, “The speculators might have traded a little bit on the forecast, but it’s still a forecast. We’ve got a lot of winter left.”

Saal noted that even during last year’s unusually warm winter, the January contract still traded near $4/MMBtu in December.

Meanwhile, near-term weather conditions were showing little threat of unexpected shoulder season demand Thursday, and cash market prices languished.

“The current weather conditions across the U.S. are quite possibly exhibiting some of the most bearish temperatures for natural gas demand of the entire shoulder season,” PointLogic Energy Senior Markets Analyst Alan Lammey said. “This is because unseasonably warm weather across the northern half of the nation is coming up against equally mild and cool temperatures across the south.

“These ‘demand neutral’ conditions suppress both early-season heating demand in the north and late-season cooling demand in the south,” he said. “However, it does appear that a large bout of notably chilly (Canadian-sourced) air will dominate a majority of the eastern-half of the nation, including Texas” during the six- to 10-day period.

Prices in Appalachia and the Northeast were hit the hardest by the moderate temps, with regional averages falling by 26 cents and 18 cents respectively.

Algonquin Citygate fell 18 cents to $2.72, while Transco Zone 6 New York tumbled 32 cents to $2.47.

Dominion South gave up 36 cents on the day to end at $0.65. TETCO M3 Delivery broke from the trend, gaining 7 cents to $2.01 Thursday.

TETCO has been undergoing maintenance at its Chambersburg Compressor Station, cutting M2 gathering and M3 flows, according to Genscape Inc. The maintenance began this week and is expected to end Saturday, the analytics firm said.

“With the maintenance now underway, flows through Bedford, Chambersburg and Heidlersburg have dropped an average of 192 MMcf/d since Monday, with Chambersburg showing the biggest cut of 200 MMcf/d,” Genscape said in a Thursday note to clients. “M2 gathering systems are down 143 MMcf/d, from 2.947 Bcf/d on Tuesday to 2.804 Bcf/d on Wednesday.”

In California, prices at SoCal Citygate continued to moderate Thursday after jumping by more than $2/MMBtu earlier in the week on a combination of heat-related demand and infrastructure constraints. SoCal Citygate dropped 33 cents to $3.67, while the SoCal Border Average dropped 9 cents to $2.67.

According to EIA, inventories now stand at 3,646 Bcf and are 179 Bcf less than last year and 35 Bcf less than the five-year average. In the East Region 18 Bcf were injected, and the Midwest Region saw inventories rise by 30 Bcf. Stocks in the Mountain Region were 1 Bcf greater and the Pacific Region grew by 1 Bcf as well. The South Central Region added a Bcf also.

Salt storage fell by 8 Bcf to 302 Bcf and non-salt storage increased 9 Bcf to 847 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |