NGI The Weekly Gas Market Report | Infrastructure | NGI All News Access

Kinder Morgan Finding Strong Interest in Moving Permian Gas to Texas Gulf Coast

Kinder Morgan Inc. (KMI) is in advanced talks with shippers for its Gulf Coast Express (GCX) expansion targeting associated gas from the Permian Basin, and the Houston-based midstreamer could make a final investment decision on the project during the fourth quarter, management said Wednesday.

Earlier this month, Targa Resources Corp. joined KMI and DCP Midstream LP as a third partner developing GCX, a 1.92 Bcf/d pipeline that would connect Permian gas to KMI’s Texas Intrastate pipelines. During a conference call Wednesday to discuss 3Q2017 results, KMI CEO Steve Kean said contracting talks are moving quickly for GCX, which would carry volumes produced by Pioneer Natural Resources Co. through its joint ownership in Targa’s WestTX Permian Basin gas system.

“We are in advanced stages on firm transport agreements with core shippers,” Kean said. “We’ve made substantial progress on this since our last earnings call, but we have not yet placed the project in the backlog. We will when we finalize the shipper agreements, which we’re targeting for this quarter.”

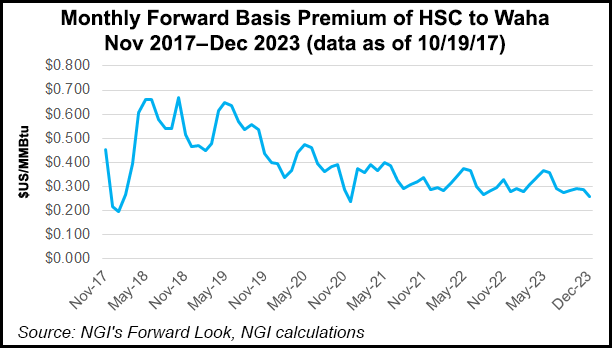

Given negative basis differentials at the Waha Hub in the Permian, combined with slow progress on the demand-side for Permian-to-Mexico pipes in West Texas, producer interest in moving gas east to the Texas Gulf Coast appears strong, Kean said.

“I think people are realizing that perhaps there’s another way that they need to get out of Waha, that the volumes going to Mexico are not materializing as quickly as the pipeline capacity to move to Mexico has materialized. And so now with the Texas Gulf Coast becoming more of a premium market, shippers are definitely looking to get there,” Kean said.

“…They obviously observe the basis differential between the Permian today and what it is in the Houston Ship Channel. When they go through our system they can access Mexico through our connections with Mexico, including a pipeline that serves Monterey. They can also access the emerging” liquefied natural gas (LNG) “liquefaction capacity that is coming online on the Gulf Coast plus the petchems plus the Houston area utility power demand in the industrial market,” the CEO continued.

“Not speaking for the shippers, but I think it gives producers the option to exploit a large number of different and varied markets and not depend solely on what the prospects for power demand growth in Mexico are.”

As KMI expects to receive FERC approval by the end of the year for Natural Gas Pipeline of America LLC’s (NGPL) 460,000 Dth/d Gulf Coast Southbound Expansion, gas looking to reach the Texas Gulf Coast markets could drive additional expansion of southbound flows on the NGPL system, management said.

Asked about additional reversal capacity on NGPL as more gas moves into the Midwest from Appalachia and Canada, Executive Chairman Richard Kinder estimated that there could be another 250-400 MMcf/d available moving forward. “And that’s probably another couple years out…but those discussions are ongoing with Gulf Coast customers, as well as even Canadian producers to some extent and producers” on the Rockies Express Pipeline, he said.

Added Kean, “We do think that there’s going to be Canadian gas that wants to find its way to another market further south, and we think that there will be additional westbound supplies coming into NGPL that also want to get south to Mexico, to LNG, etc.”

Natural gas transport volumes grew 3% year/year to 28,879 billion Btu/d for the third quarter; volumes were boosted by higher throughput on the Texas Intrastates from growth in exports to Mexico and higher throughput on El Paso Natural Gas driven by additional Permian capacity sales and an expansion on that system, management said. Incremental capacity sales on the Tennessee Gas Pipeline and an expansion leading to higher throughput on the Elba Express pipeline also positively affected gas throughput for the quarter.

“The increases were partially offset by lower throughput on TransColorado, due to lower Rockies production, on Cheyenne Plains due to mild weather and fuel switching to coal, and on Citrus, also due to mild weather,” management said.

KMI pipelines saw natural gas deliveries to Mexico increase 3% year/year, with deliveries to the Sabine Pass LNG terminal increasing 37% year/year despite reductions due to Hurricane Harvey.

Natural gas gathering volumes for the quarter declined 14% to 2,523 billion Btu/d versus 2,935 billion Btu/d in 3Q2016, mainly due to impacts from Harvey and lower volumes from the Eagle Ford Shale and the KinderHawk system.

Management also revealed Wednesday that Kinder Morgan Canada Limited’s (KML) planned C$7.4 billion expansion of the oilsands export Trans Mountain pipeline could see a nine-month delay amid ongoing political and regulatory hurdles.

“Construction preparation activity is off to a slower start than planned in the project schedule due primarily to the time required to file for, process and obtain all necessary permits and regulatory approvals,” management said. “KML is assessing construction mitigation plans that maintain the current” year-end 2019 target in-service date. This “will rely upon continued progress towards schedule-critical regulatory approvals and will assess the acceleration of construction activities that are behind schedule. Absent this mitigation, project completion could be delayed by up to nine months.”

KMI reported net income of $334 million for the quarter (15 cents/share) versus a net loss of $227 million (minus 10 cents/share) in the year-ago quarter.

Third quarter distributable cash flow was $1.055 billion (47 cents/share) versus $1.081 billion (48 cents/share) in the year-ago period.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |