NGI Weekly Gas Price Index | Markets | NGI All News Access | NGI Data

Weekly NatGas Cash Bounces Back, But Futures Post Greater Gains

In spite of a continued loss of seasonal heating load in key eastern markets, weekly natural gas prices managed nearly a dime gain overall. Breaking a string of two consecutive weekly setbacks, the NGI Weekly Spot Gas Average added 8 cents to $2.57. Gains were not great, typically a nickel to a dime, and all regions advanced.

The market point showing the week’s greatest gain was Emerson, with a rise of 77 cents to $2.61, and the week’s greatest losses were endured by Kingsgate, losing 69 cents to $1.58.

Regionally, the greatest gain was seen in Appalachia, where quotes rose 16 cents to $1.25. The Rockies added the least, 2 cents to $2.43.

Texas, Louisiana, and the Midcontinent were up 6 to 8 cents, anywhere from $2.59 in the Midcontinent to $2.87 in South Texas.

The Midwest added 10 cents to $2.74 and the Southeast and Northeast were both higher by 9 cents to $2.88 and $2.57, respectively

November futures rose a stout 13.7 cents to $3.000.

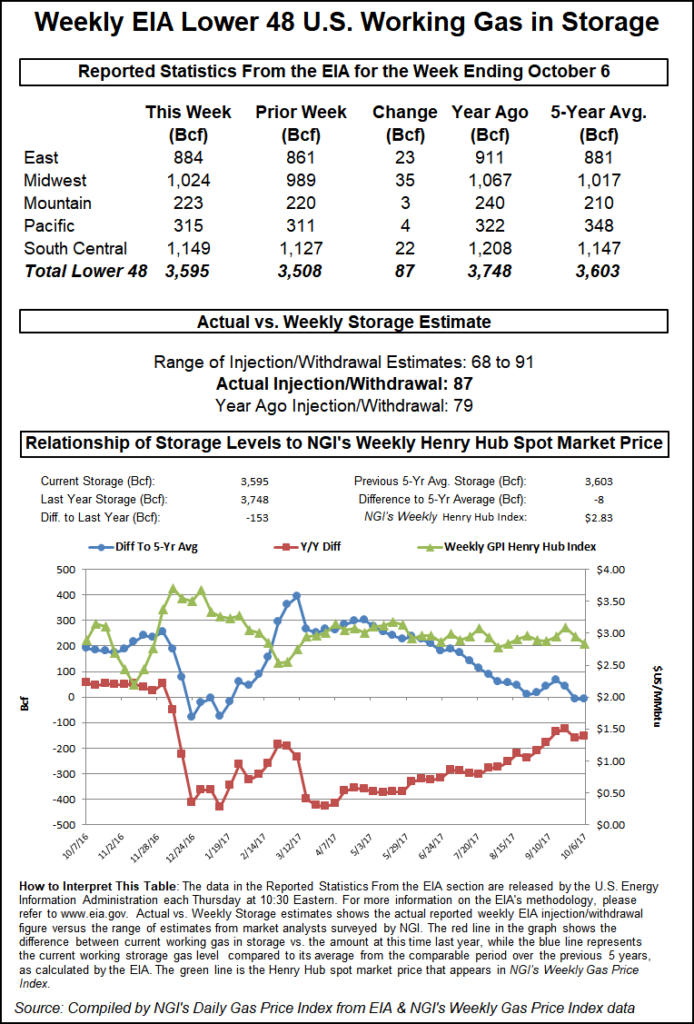

Thursday saw the Energy Information Administration (EIA) report a storage build of 87 Bcf, about 5 Bcf more than the market was expecting, and prices made a counterintuitive advance. Just before the EIA figures went live at 10:30 a.m. EDT the market was hovering around $2.955 and following the release November futures dropped to $2.931. By 10:50 a.m. November was trading at $2.974, up 8.5 cents from Wednesday’s settlement. At the close, November had added 10.0 cents to $2.989 and December was up 7.8 cents to $3.144.

Before the release of the data traders were looking for a lesser storage build, but about in line with historical norms. Last year 79 Bcf was injected and the five-year average stands at 87 Bcf. Citi Futures Perspective calculated a 77 Bcf injection and Stephen Smith Energy Associates was looking for an 87 Bcf build. A Reuters survey of 24 traders and analysts showed an average 82 Bcf with a range of +68 Bcf to +91 Bcf.

“We took a little dive once the number came out, but did not take out the low from overnight trading,” said a New York floor trader. “The market fell down to $2.93 and then rallied back up.”

“Interesting scenario, interesting results, but we are still stuck in a range so it is not as if anything has changed.”

That the two previous storage reports were bullish and traders sold, while Thursday’s bearish report prompted buying, did not surprise many traders.

“I think we are overwhelmingly in a trading range, probably from $2.85 up to the $3.15 to $3.20 area,” said Tom Saal, vice president at FCStone Latin America in Miami.

“I’m saying it’s not a big deal that we got a rally off a negative number. It’s still in a trading range. If we were at $3.20 and the market had broken out of its trading range that would be interesting. Now when the number came out the market was below $3; the sellers aren’t likely to be so aggressive selling under $3,” he said.

“They may think there is more upside than downside.”

Inventories now stand at 3,595 Bcf and are 153 Bcf less than last year and 8 Bcf less than the five-year average. In the East Region 23 Bcf were injected, and the Midwest Region saw inventories rise by 35 Bcf. Stocks in the Mountain Region were 3 Bcf greater and the Pacific Region grew by 4 Bcf. The South Central Region added 22 Bcf.

In Friday’s trading natural gas for weekend and Monday delivery rose, with gains across a broad front, including New England, the Midwest, Midcontinent, Rockies and California, just able to offset weakness in the Mid-Atlantic. The NGI National Spot Gas Average gained a penny to $2.56.

Futures traders returned to their old habits as prices were confined to a 5 cent range and unable to post any significant move higher or lower. At the close November had risen 1.1 cents to $3.000 and December was seen 1.6 cents higher at $3.160. November crude oil gained 85 cents to $51.45/bbl.

Weekend and Monday gas at New England points got a boost from higher Monday on-peak power. Intercontinental Exchange reported on-peak Monday power at the ISO New England’s Massachusetts Hub rose a stout $11.31 to $44.38/MWh. On-peak Monday power at the PJM West terminal was quoted at $30.23, up $1.03/MWh.

Gas at the Algonquin Citygate rose 25 cents to $3.16 and deliveries to Tennessee Zone 6 200 L changed hands 12 cents higher at $2.99.

The Mid-Atlantic saw continued diminished heating load, and Monday prices sank. AccuWeather.com forecast that New York City’s Friday high of a pleasant 65 would reach 71 Saturday before easing back down to 64 on Monday, the seasonal average.

For the month of October New York City has accumulated just 20 heating degree days (HDD), well short of its normal 268 HDD, according to AccuWeather.com.

Philadelphia was expected to see its Friday high of 67 degrees climb to 75 Saturday before dropping to 65 Monday, 2 degrees below normal. Heating load in Philadelphia currently stands at 16 HDD for the month of October, far below its normal 253 HDD.

The National Weather Service in New York City said, “A surface trough shifts into the area tonight and remains nearby through Saturday night. Abnormally mild and summer-like on Sunday ahead of a cold front that will cross the region Sunday night. High pressure then dominates for the work week with dry weather and near seasonable temperatures, though with gradual warming by late in the week.”

Deliveries to Tetco M-3 fell 7 cents to 53 cents and gas headed for New York City on Transco Zone 6 tumbled 90 cents to $1.30.

Gas at the Chicago Citygate was up two cents to $2.78 and deliveries to the Henry Hub jumped 10 cents to $3.01. Gas priced on El Paso Permian dropped a penny to $2.47 and gas at NGPL Midcontinent rose 4 cents to $2.67.

Kern River added a penny to $2.60 and Kern Delivery was seen 2 cents higher at $2.72. Gas at Malin gained 4 cents to $2.68 and gas at the SoCal Citygate was seen 11 cents lower at $3.01.

Technical analysts are turning to Japanese Candlestick patterns to aid in their market projections. “With another shooting star top pattern forming on the daily candlestick chart some consolidation, even a pull back, is possible to start the week,” said Brian LaRose, market technician at United ICAP. “Based on the technical picture, I am inclined to treat any sideways to lower price action as corrective at this time.”

In order for LaRose to turn bearish he said he would have to see a shift in the technical picture such as a resumption of the market downtrend.

Market technicians note that from a technical standpoint the bullish case for natural gas is displayed in a chart of the April futures picturing a bullish rising wedge pattern from late 2016. The market made successive highs near $3 in early 2017, April and May 2017 and September 2017 with a succession of rising bottoms in November 2016, February 2017, and July 2017. The common interpretation is that the series of successive rising bottoms ultimately results in prices breaking to the upside, in this case the April contract breaching $3.

Medium term weather forecasts maintained their theme of pervasive warmth. “Forecast changes were small in this period, with any cooler adjustments associated with a round of low pressure through the Midwest late as well as in Southeast under high pressure,” said MDA Weather Services in its morning six- to 10-day report to clients. “Otherwise, the period remains a warm dominated one nationally, with this being a result of Pacific flow downstream of a Gulf of Alaska low.

“With this comes a round of near strong aboves into the Midwest around mid-period as well as several rounds of wet weather into the Pacific Northwest. The Northwest is the one region on the cool side of normal, and still cooler risks exist here through mid-period.

Thursday’s advance off the Energy Information Administration storage number might be the market’s last hurrah for a while.

Jim Ritterbusch of Ritterbusch and Associates said, “The temperature factor continues to tilt bearish with unusually mild temps that are broad-based with limited CDD or HDD usage expected. But with mid-October approaching, focus on HDDs will become the much more critical weather item and until some cold begins to show up within the 1-2 week outlooks, this market could struggle in pushing back to above the $3 mark. As a result, we are maintaining a cautious near-term bullish stance as we suggest holding any long positions established at around current levels for accounts willing to risk to below the $2.79 level on a close only basis.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |