NGI The Weekly Gas Market Report | E&P | Infrastructure | NGI All News Access

U.S. Drops Two NatGas, Five Oil Rigs As Count Reaches Lowest Point Since June 9

Drilling permit activity is on the upswing, which could mean a rebound in the U.S. rig count is on the way — just not for the week ended Friday.

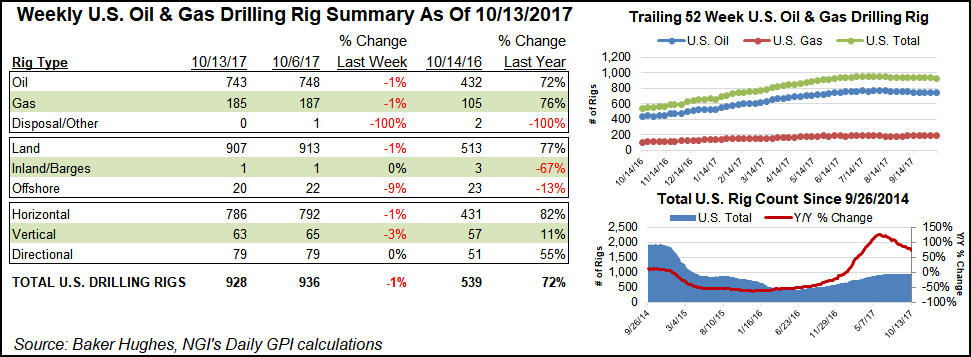

The domestic rig count fell by eight to 928, including two natural gas-directed and five oil-directed units, according to Baker Hughes Inc.’s weekly tally. The U.S. count is still well above its year-ago tally of 539, but falling oil prices earlier in the year have led to some retrenchment since a recent high of 958 rigs in late July.

Six horizontal units packed up shop for the week, as did two vertical. The Gulf of Mexico saw two rigs go home, and it now stands at 20 active units, according to BHI.

The Canadian rig count increased by three, all gas-directed, and ended the week at 212 rigs versus 165 in the year-ago period.

The combined North American rig count stood at 1,140 on Friday, down by five week/week and up by 436 year/year.

Among plays, the Eagle Ford Shale in South Texas dropped six rigs for the week, falling to 63 versus 31 in the year-ago period. Meanwhile, the gas-focused Barnett dropped four rigs to halve its total and end at four versus three rigs running a year ago.

The Denver Julesburg-Niobrara dropped one rig to end at 25, as did the Granite Wash formation, which ended the week at 12, while the Mississippian Lime, Permian Basin and Williston Basin each added one rig for the week.

Among states, Texas (down four), Oklahoma (down three) and California (down two) saw the largest declines, with Louisiana and West Virginia also each giving up one rig for the week, BHI said.

Alaska and Pennsylvania added one rig each. And as of the latest count, a lone rig is now operating in Kansas.

Whether it’s a darkest-before-the-dawn situation, the combined U.S. oil/gas rig count has now reached its lowest point since June 9, according to NGI calculations, noted NGI‘s Markets Analyst Nate Harrison.

“The loss of seven rigs makes this the second largest week/week decline in the combined oil/gas rig count this year,” Harrison said.

Evercore ISI’s latest tally of U.S. drilling permit activity suggests the rig count could be due for a rebound. The firm said the trailing four-week average in the United States is now approaching pre-downturn levels, exceeding the 1,000-plus mark for the first time since it began aggregating weekly data in January 2015. The firm said the increase in permitting activity is supported by oil prices, which have moved above $50/bbl after sinking into the low $40s over the summer.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |