Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Midcontinent Energy Firms Report Slowing Growth, Modest Price Expectations

Energy activity within the Federal Reserve Bank’s Tenth District, which includes Colorado, Oklahoma and Wyoming, slowed during the third quarter, but operators said they are more optimistic about the future.

The Tenth District covers activity trends in western Missouri, Nebraska, Kansas, Oklahoma, Wyoming, Colorado and northern New Mexico. Energy firms in the region were surveyed between Sept. 15-29.

“Third quarter energy survey results revealed only slight growth in Tenth District energy firm activity,” said Oklahoma City Branch Executive Chad Wilkerson. “The future activity outlook remained positive.”

The Eleventh District survey by the Dallas office, issued in late September, also reported slower activity during 3Q2017.

Oil and gas price expectations by respondents to the Tenth District survey modestly improved, with more respondents expecting prices to nudge higher over the next six months.

Asked what prices were needed for oil and gas drilling to be profitable in the areas in which they were active, respondents said the average natural gas price needed was $3.05/MMBtu, with responses ranging from $2.00-4.00. That’s down from an expectation of $3.38/MMBtu in the first quarter.

For oil, those surveyed said they needed an average price of $51/bbl, with a range of $40 to $75, which is flat from the 1Q2017 survey.

Energy firms also were asked what they expected prices to be in six months, one year, two years, and five years. Expectations have increased modestly since the 2Q2017 survey.

The average expected Henry Hub natural gas price in six months was $3.01/MMBtu, with an average of $3.11 in one year’s time, $3.30 in two years and $3.73 in five years.

“There is ample supply in the U.S. and abroad to keep natural gas prices in the $3.00 to $4.00/MMBtu range for years ahead,” said one respondent of gas price expectations.

Average West Texas Intermediate oil prices are expected to average $52/bbl in the next six months, $55 in one year, $58 in two years and $65 in five years.

“We are moving ahead with the expectation that commodity prices may not materially improve for years. We can grow and be profitable at these levels as long as we watch our cost structure carefully,” said one respondent.

Hurricane Harvey, which came ashore in South Texas on Aug. 25, had a “low-to-medium negative impact on the oil and gas industry, with refineries being affected the longest, for an estimated average of nine weeks,” Wilkerson said.

Most of the survey indexes fell but remained positive.

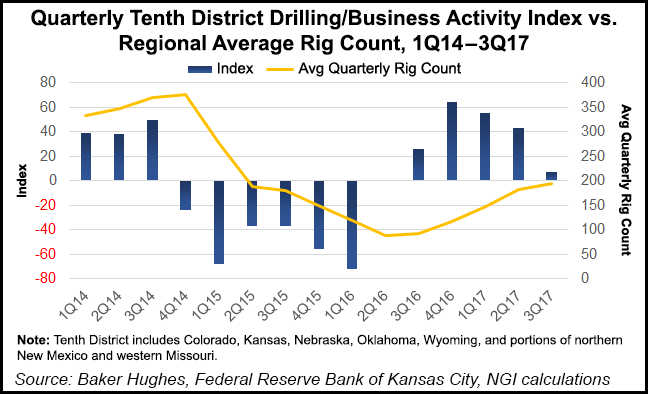

The drilling and business activity index declined to 7 from 43. The indexes for employment, employee hours and wages and benefits were moderately lower, while the supplier delivery time index fell into negative territory.

“However, access to credit climbed back into positive territory, and the revenues index inched higher,” researchers noted. The total profits index increased to 21 from 3.

Most year/year indexes in the third quarter declined but remained above zero, with drilling and business activity, revenues, and profits indexes falling “considerably.”

Capital expenditures and employment eased somewhat, and the supplier delivery time index dropped to minus 14 from 11.

“On the other hand, access to credit increased to its highest level since the third quarter of 2014, and wages and benefits increased for the third consecutive quarter,” researchers said.

Expectations about future conditions across the industry are mixed.

Future wages and benefits, revenues, profits and capital expenditures indexes “increased moderately,” with future drilling and business activity and access to credit indexes edging higher. The energy sector’s future employment index mostly was unchanged, while employee hours eased slightly. However, the supplier delivery time index turned negative for the first time since 4Q2016.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |