NGI Data | Markets | NGI All News Access

NatGas Cash, Futures Part Company As Bulls Embrace Plump EIA Storage Data

Natural gas for next-day delivery fell slightly in trading Thursday as an unplanned outage in the Midwest caused backups and stranded gas. Losses in Appalachia and soft pricing in the Midwest and Midcontinent were nearly matched by gains in the Northeast and Louisiana.

The NGI National Spot Gas Average slipped 1 cent to $2.55.

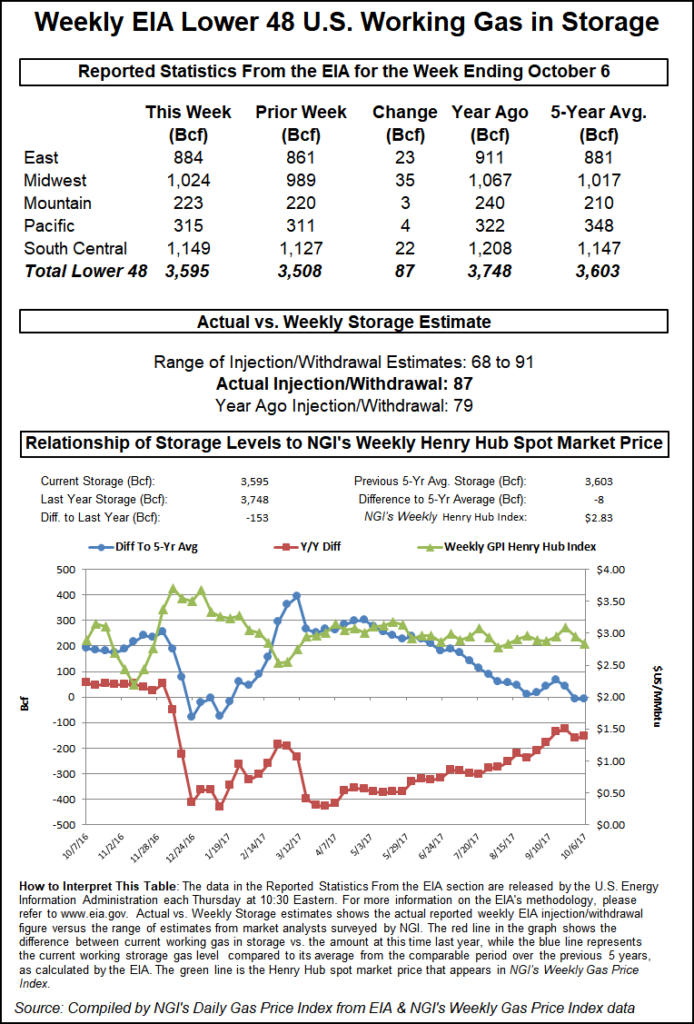

The Energy Information Administration (EIA) reported a storage build of 87 Bcf Thursday, about 5 Bcf more than the market was expecting, and prices made a counterintuitive advance. Just before the EIA figures went live at 10:30 a.m. EDT the market was hovering around $2.955 and following the release November futures dropped to $2.931. By 10:50 a.m. November was trading at $2.974, up 8.5 cents from Wednesday’s settlement. At the close, November had added 10.0 cents to $2.989 and December was up 7.8 cents to $3.144. November crude oil fell 70 cents to $50.60/bbl.

Before the release of the data traders were looking for a lesser storage build, but about in line with historical norms. Last year 79 Bcf was injected and the five-year average stands at 87 Bcf. Citi Futures Perspective calculated a 77 Bcf injection and Stephen Smith Energy Associates was looking for an 87 Bcf build. A Reuters survey of 24 traders and analysts showed an average 82 Bcf with a range of +68 Bcf to +91 Bcf.

“We took a little dive once the number came out, but did not take out the low from overnight trading,” said a New York floor trader. “The market fell down to $2.93 and then rallied back up.”

“Interesting scenario, interesting results, but we are still stuck in a range so it is not as if anything has changed.”

That the two previous storage reports were bullish and traders sold, while Thursday’s bearish report prompted buying, did not surprise many traders.

“I think we are overwhelmingly in a trading range, probably from $2.85 up to the $3.15 to $3.20 area,” said Tom Saal, vice president at FCStone Latin America in Miami.

“I’m saying it’s not a big deal that we got a rally off a negative number. It’s still in a trading range. If we were at $3.20 and the market had broken out of its trading range that would be interesting. Now when the number came out the market was below $3; the sellers aren’t likely to be so aggressive selling under $3,” he said.

“They may think there is more upside than downside.”

Inventories now stand at 3,595 Bcf and are 153 Bcf less than last year and 8 Bcf less than the five-year average. In the East Region 23 Bcf were injected, and the Midwest Region saw inventories rise by 35 Bcf. Stocks in the Mountain Region were 3 Bcf greater and the Pacific Region grew by 4 Bcf. The South Central Region added 22 Bcf.

In the physical market traders trying to move gas on Texas Eastern had to contend with a Force Majeure that has dropped southbound flows from 2.402 Bcf/d to 489 MMcf/d in two days, according to industry consultant Genscape. The Force Majeure is due to an unplanned outage at the Berne Compressor Station in Berne, OH, and severely impacted gas out of Appalachia.

Gas on Dominion South fell 60 cents to 32 cents, the lowest in over a year, and gas on Tetco M-3 Delivery shed 45 cents to 60 cents. Gas priced on Tennessee Zone 4 Marcellus fell 34 cents to 46 cents and gas on Transco Leidy plunged 42 cents to 48 cents.

Outside of Appalachia changes were muted. Gas at the Chicago Citygate fell 3 cents to $2.76 and gas at the Henry Hub dropped 2 cents to $2.91. Gas on El Paso Permian rose a penny to $2.48 and deliveries to Panhandle Eastern were quoted down 3 cents to $2.50.

Gas at Opal changed hands a penny higher at $2.59 and deliveries to Malin came in 2 cents higher at $2.64. Gas at the SoCal Citygate shed 2 cents to $3.12 and packages priced at the SoCal Border Average added a penny to $2.69.

Weather forecasts hinted at cooler changes deep into the forecast period. “For the third day in a row, we see significant pattern adjustments in the latter half of the 11-15 day range that are slowly rolling forward,” said Matt Rogers, president of Commodity Weather Group in a morning report to clients. “Before that point, we have very small changes in the one-to-five day with some slightly warmer West shifts and a bit cooler Ohio Valley.

“The six-to-10 day runs with mostly warmer changes while the East, South, and West are closer to unchanged category-wise from yesterday. The 11-15 day is still net warmer nationally mainly due to warmer changes for the Midwest to East early in the period, but we start to show some gradual Midcontinent cooling for Days 14-15.”

Longer term traders are trying to get their heads around what type of weather might prevail this winter. Often traders will look at the El Nino Southern Oscillation pattern to see if an El Nino or its counter, a La Nina will be in play. La Nina is now more likely to form this winter, though it remains unclear whether U.S. temperatures frigid enough to boost natural gas prices will follow.

There is a 67% chance for a weak La Nina some time from December to February, up from 61% last month, the U.S. Climate Prediction Center said Thursday. The center is maintaining a watch for La Nina, a cooling of Pacific Ocean surface temperatures that can trigger weather changes the world over.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |