Thin Storage Build Draws Only Passing Interest to Bulls

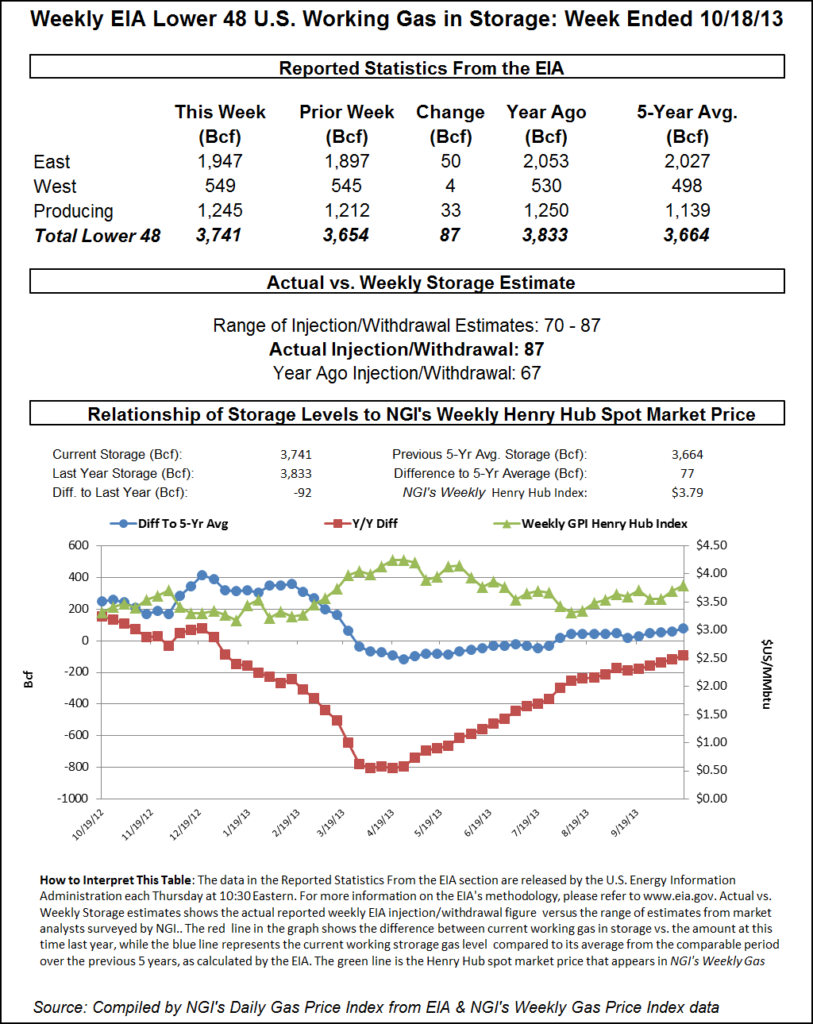

November futures worked higher Thursday following a report by the Energy Information Administration (EIA) showing a storage injection that was far less than what traders were expecting.

The storage injection was 42 Bcf for the week, about 9 Bcf lower than consensus estimates. Just before the report was released, the market was hovering around $2.970. Following the release, November futures rose to a high of $2.995. By 10:45 a.m., November was trading at $2.962, up 2.2 cents from Wednesday’s settlement.

Before the storage report, traders were looking for a build significantly higher, but less than historical norms.

Last year 76 Bcf was injected and the five-year average stands at 91 Bcf. Tradition Energy calculated a 47 Bcf injection, and Citi Futures was looking for a 61 Bcf build. A Reuters survey of 22 traders and analysts showed an average 51 Bcf with a range of +42 Bcf to +68 Bcf.

“We had heard 51 Bcf and the number made its high right after the number came out,” a New York floor trader told NGI. “The market held $3, and I think some shorts jumped on that. We are not seeing any great momentum to the upside and we are still stuck in the trading ranges.”

Wells Fargo Securities LLC analysts called the report “slightly bullish” and noted that since the end of April (22 weeks) “the surplus versus the five-year average has fallen by 310 Bcf, indicating the market continues to be 2 Bcf/d undersupplied.

“Our cumulative injection forecast for the next two weeks is 153 Bcf, 3 Bcf below last year’s cumulative injection of 156 Bcf and 12 Bcf below the five-year average of 165 Bcf.”

Inventories now stand at 3,508 Bcf and are 161 Bcf less than last year and 8 Bcf more than the five-year average.

In the East Region 13 Bcf were injected, and the Midwest Region saw inventories rise by 25 Bcf. Stocks in the Mountain Region were 3 Bcf higher and the Pacific Region grew by 4 Bcf. The South Central Region shed 3 Bcf.

Salt storage fell by 5 Bcf to 300 Bcf, and nonsalt storage increased 2 Bcf to 827 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |