Markets | NGI All News Access | NGI Data

NatGas Cash, Futures Rise Ahead Of Expected Lean Storage Figures; November Gains 4 Cents

Physical natural gas prices managed to recover smartly from drubbings in the previous four sessions as all points followed by NGI except for one managed to score gains of a nickel to a dime or more. Greatest strength was noted in West Texas and Appalachia, and the NGI National Spot Gas Average rose 13 cents to $2.54.

Futures managed a gain as traders focused on warm temperatures in key eastern markets along with expectations of a storage build Thursday far less than historical averages. At the close November had risen 4.5 cents to $2.940 and December had added 3.7 cents to $3.122. November crude oil shed 44 cents to $49.98/bbl.

Higher day-on-day forecasts of energy demand throughout the East laid a firm foundation for higher next-day gas prices. ISO New England forecast that peak load Wednesday of 15,350 MW would climb to 15,850 MW Thursday before easing to 14,700 MW Friday. The New York ISO predicted peak load Wednesday of 18,562 MW would reach 19,276 MW Thursday and then ease to 18,428 MW Friday. The PJM Interconnection said max load Wednesday of 32,466 MW would advance to 35,326 MW Thursday before rising further Friday to 35,546 MW.

Gas at the Algonquin Citygate added 15 cents to $2.78 and deliveries to Transco Zone 6 New York gained 34 cents to $2.78. Gas on Tetco M-3 Delivery jumped 71 cents to $1.63 and deliveries to Dominion South were quoted 32 cents higher at 84 cents.

Chicago Citygate added 16 cents to $2.71 and gas at the Henry Hub changed hands 9 cents higher at $2.81. Packages on El Paso Permian rose 26 cents to $2.35 and gas priced on Panhandle Eastern came in 17 cents higher at $2.49.

Next-day gas at the PG&E Citygate rose 8 cents to $3.15 and parcels at Malin gained 11 cents to $2.51. Gas priced at the SoCal Border Average added 11 cents to $2.56.

The only U.S. point followed by NGI that declined was SoCal Citygate, losing 16 cents to $3.12.

A pipeline explosion in the western Mojave Desert has led SoCal to declare a force majeure and has cut over 600 MMcf/d of flowing supply, according to industry consultant Genscape.

To accommodate for the proximate 600 MMcf/d loss SoCal has primarily increased storage withdrawals. In addition SoCal has increased receipts from Kramer Junction by 357 MMcf/d and from El Paso Ehrenberg by 137 MMcf/d, according to Genscape.

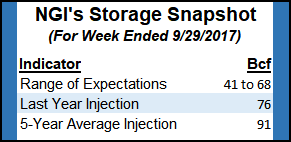

Thursday’s storage report is likely to re-instate reductions to the long-term storage surplus. Last year 76 Bcf was injected and the five-year pace is a plump 91 Bcf. Tradition Energy is looking for a 47 Bcf addition and Citi Futures calculates a 61 Bcf increase. A Reuters survey of 22 traders and analysts showed an average 51 Bcf with a range on the survey of plus 42 Bcf to plus 68 Bcf.

Weather forecasts turned warmer and more humid in the pivotal Mid-Atlantic.

“The short range one- to five-day shifts warmer for the Midwest to Northeast with near flat changes for the South and West,” said Matt Rogers, president of Commodity Weather Group in its morning report to clients. “While the East Coast peak warmth for high temperatures hits tomorrow into the weekend, the muggiest weather is actually more toward Sunday and Monday as a slug of tropical moisture advances up through the East (very warm low temperatures near 70F Monday morning for the Middle Atlantic).

“We made warmer changes to the Midwest, East, and South in the six- to 10-day with some cooler interior West adjustments. Those changes added some cooling demand to the forecast, while slightly cooler changes to the upper Midwest and East Coast in the 11-15 day added some very modest heating degree days as well.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |