Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

West Coast NatGas Generation Declining as Renewables, Hydro Rise

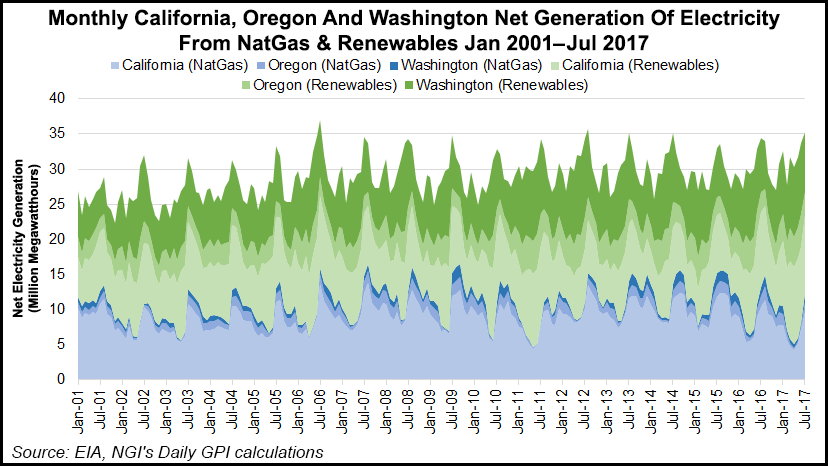

Renewables have grown as a source of electric generation along the West Coast, with natural gas-fired power generation taking a hit, falling an estimated 16% year/year from April through July, according to RBN Energy LLC.

RBN, in its “Here Comes the Sun” report, said renewable and hydroelectric generation “has chomped away” at the gas market share of total power generation in Washington, Oregon and California, citing data from the U.S. Energy Information Administration (EIA).

Reduced gas-fired generation demand and reduced gas storage capacity in the West continues to displace gas from the region and disrupt gas flow patterns, RBN’s Sheetal Nasta said. “These shifts provide a glimpse of what gas flows and pricing dynamics could look like as more renewable capacity is added.”

Nasta said it had been “a banner year for renewable energy in the West.” Renewables were only modestly higher, but hydro supplies have been substantial, while gas-fired generation and storage has been down.

“What these developments boil down to is that the West Coast has needed less gas this year, which raises a whole host of questions about how much gas is being displaced, where it is going, and how that will affect upstream markets.”

Data from Genscape Inc. indicated a drop off in gas supply during the first six months of 2017, mostly from the Rockies through the Ruby Pipeline, while flows from the Southwest were higher. From April through July, Southwest flows were down by 200 MMcf/d from year-ago levels, according to RBN. West Coast supplies continue to come from three principal areas, Western Canada, the U.S. Rockies and Southwest/Permian Basin.

“These shifts in increments of 100 MMcf/d aren’t exactly seismic by any means, but they provide a glimpse of what the market could look like as these generation and flow trends deepen,” Nasta said.

California’s hydroelectric supplies doubled in 2016 from above-normal storms and snowpack, while precipitation increased significantly in the first half of the year, according to the California Energy Commission (CEC).

“As hydroelectric generation increased, natural gas-fired generation decreased,” the CEC noted. “At the same time, there was significant double-digit growth in both solar photovoltaic (PV) and wind generation with total in-state solar generation increasing nearly 32% and wind increasing nearly 11% from 2015.”

Based on the CEC’s comparison of 2016 and 2015 electric generation data, renewables were 27.9% of in-state generation and 25.4% of the overall power mix last year, versus 2015 when renewables were slightly less than 25% of the in-state generation and almost 22% of the power mix.

Meanwhile, gas dropped last year to under 50% of in-state generation and 36.4% of the statewide power mix from 2015 levels of nearly 60% of the in-state generation and 44% of the overall power mix.

Nuclear, large hydro and renewables “accounted for 50% of the total in-state generation in 2016, compared to 40% in 2015,” a CEC spokesperson said. Efficiency gains and greater volumes of self-generation solar PV have combined to reduce the total energy delivered from traditional utility-scale power plants, most of which are gas-fired.

“The combined total gas-hydro in California in 2016 was down by 2.8% (3,674 GWh) to 127,808 GWh from 131,482 GWh in 2015,” according to the CEC.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |