10 Bidders Approved for Pemex E&P Farmout Auctions Next Week

Mexico’s National Hydrocarbons Commission (CNH) has approved the final list of participants in three farmout auctions scheduled for next week.

At the 10th ordinary session of the year, commissioners on Monday authorized 10 exploration and production (E&P) operators to compete in auctions on Oct. 4 to jointly explore the Ayin-Batsil, Cardenas-Mora and Ogarrio areas with national oil company Petroleos Mexicanos (Pemex).

A total of 16 companies had prequalified earlier in September to participate in the three auctions, which are being held in conjunction. The participants approved Monday include six individual bidders and four consortiums.

The individual bidders are Egypt’s Cheiron Holdings Ltd., China National Offshore Oil Corp. (CNOOC), Germany’s DEA Deutsche Erdoel AG, Ecopetrol SA of Colombia, Canada-based explorer Gran Tierra and Ogarrio E&P of Chile.

The four consortiums approved include Gran Tierra in partnership with Mexican independent Sierra Oil & Gas as Sierra Blanca. Sierra Oil & Gas, as Sierra Nevada, also is partnering with Murphy Oil Corp. in another consortium, while California Resources Corp. is partnered with Mexico’s PetroBAL, and Argentina’s Tecpetrol is participating with Galem Energy of Mexico.

“To ensure that we have a competitive process, we are not detailing how many bidders are targeting each farmout,” CNH President Juan Carlos Zepeda said during a webcast of the session.

In total, 12 different companies are competing in the October farmouts. Six of the participants — CNOOC, DEA, Ecopetrol, Sierra, Murphy and PetroBAL — have signed E&P contracts with CNH in previous licensing rounds.

In July, Sierra Oil struck oil at the Zama-1 exploration well with partners Talos Energy LLC and Premier Oil plc. Meanwhile, Gran Tierra has bid in previous auctions held by CNH, but it has yet to win any licenses. And Tecpetrol and Cheiron each signed services contracts with Pemex before Mexico’s energy reforms began in 2013.

Bidders in the Oct. 4 auction are to compete for a 50% operating interest in each of the three Pemex projects. The operators participating in multiple bidding groups — Gran Tierra and Sierra — may not issue more than one offer for each contractual area.

The shallow water Ayin-Batsil area is estimated to hold 297 million boe of proved, probable and possible, or 3P, reserves, and 832 million boe of prospective resources, according to CNH. Cardenas-Mora and Ogarrio, both onshore mature fields, contain 93 million boe and 54 million boe, respectively. In a presentation earlier this year, Pemex reported slightly different 3P figures for Ayin-Batsil (359 million boe) and Ogarrio (41 million boe).

According to the bidding terms, the Ayin-Batsil farmout offers a production sharing contract with a carry of $250 million. Ogarrio and Cardenas-Mora are each for license contracts entailing upfront payments to Pemex of $190 million and $125 million, respectively.

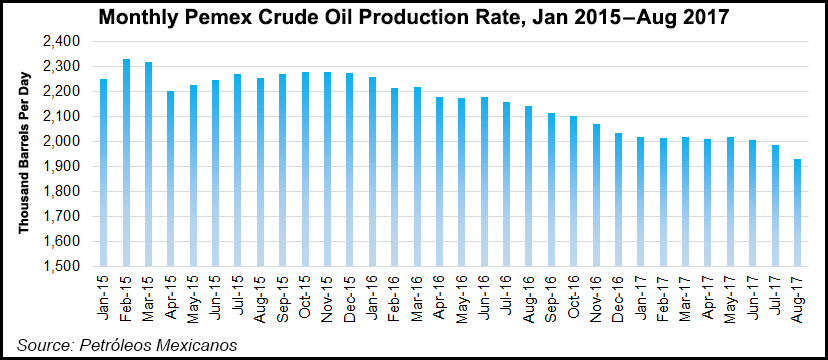

Pemex is courting private partners to help develop its E&P assets and replace oil production lost at the aging supergiant Cantarell and expected declines at the Ku-Maloob-Zaap (KMZ) field. The Cantarell field is Mexico’s leading producer of natural gas, at 1.278 Bcf/d, but the gas is heavily polluted with nitrogen that was used for injection in a bid to to reach a crude production peak of 2.38 million b/d in 1994, which made it the most productive offshore field of its time.

Pemex has launched five farmout tenders since the energy reforms allowed it to form partnerships with private and foreign players.

Last December, Pemex awarded its first ever farmout deal to Australia’s BHP Billiton Ltd. for the deepwater Trion discovery in the Gulf of Mexico’s Perdido Fold Belt. Earlier this month CNH launched an auction for the Nobilis-Maximino deepwater farmout, also in the Perdido. Bids are to be opened Jan. 31.

The Nobilis-Maximino auction is to coincide with the opening of bids for licensing round 2.4, which is to offer 30 E&P blocks in the Perdido and other deepwater areas.

CNH commissioners on Monday also were updated on the upcoming round, which is in the prequalification phase.

“Access to the data room expires on Nov. 3, 2017,” said CNH’s Martin Alvarez Magaña, head of the legal unit. “To date six companies have expressed interest in the auction, and four of them have accessed the data room.”

Total SA and BHP Billiton have already begun the prequalification process for round 2.4, Alvarez added. ExxonMobil Corp. and Chevron Corp. have also accessed the data room.

CNH also Monday held the signing ceremony for the 10 shallow water contracts awarded at round 2.1 in June. The commission is reviewing information provided by the winning bidders from rounds 2.2 and 2.3, each held on July 12, and expects to sign contracts by Dec. 8 at the latest, according to Alvarez.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9966 |