Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Gutted Canadian NatGas Spot Sales to Get Reprieve as NGTL Facilities Completed

The end is in sight to traffic interruptions for new facilities construction that gutted spot sales off TransCanada Corp.’s supply collection network in Alberta and British Columbia, Nova Gas Transmission Ltd. (NGTL).

TransCanada reported four of eight parts are completed in the C$1.3 billion ($1 billion) work program that at its August height cut NGTL delivery capacity by about 2 Bcf/d, or 20%, down to 7.5 Bcf/d.

The September edition of a monthly NGTL outage forecast for shippers shows service returning to about 10 Bcf/d as of the November start of the 2017-2018 gas contract year, and rising through December as the facilities underway are finished.

Construction disruptions by the perennial capital program for 2017 were exceptionally severe because NGTL focused on a northwestern region it calls the Upstream of James River Area, a hotbed of growing Montney Shale gas development.

New installations are also being made in the northeastern Alberta oilsands region, where thermal bitumen extraction operations producing about 2.8 million b/d are still growing as Canada’s biggest industrial gas user.

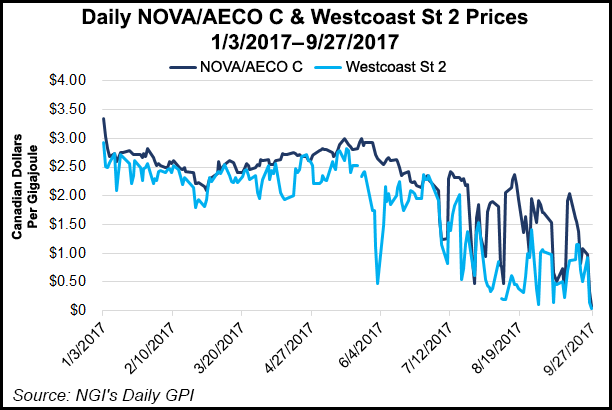

The construction congestion aroused private grumbling but few public complaints among gas producers, although patience was strained among traders and financial analysts that rivet attention on daily sales volumes and prices. NGI’s NOVA/AECO C index traded Tuesday for Wednesday’s flows highlighted the situation as prices ranged from negative C29 cents/gigajoule (GJ) to positive C55 cents, averaging just C8 cents/GJ.

EnergyGPS principal Jeff Richter told NGI Tuesday there were “all kinds of constraints going on,” with “bottlenecks all over the place” that was stranding Canadian gas. “That market point will have to send a price signal, and three weeks ago C47 cents/GJ didn’t do it so you had to go to C25 cents. If C25 cents doesn’t do it you have to go to C5 cents, and if that doesn’t do it, you have to go to negative because everything is getting pushed back there from maintenance.”

Negative pricing is a first. “NGI began offering NOVA/AECO C pricing in March 2002,” said NGI market analyst Nate Harrison. “In the more than 15 years since, NOVA/AECO has never before traded in the negatives.”

Rather than results of breakdowns or repairs, the temporary disruptions are the price of fulfilling contracts for new service requested by Alberta and BC producers. Following regulatory approval of the 2017 additions, NGTL customers since last December repeatedly were notified and briefed with increasingly detailed program information.

The program is adding about 230 kilometers (140 miles) of jumbo pipe 36 inches and 42 inches in diameter plus two compressors, for an initial overall gain of 443 MMcf/d in NGTL capacity scheduled to go into service Nov. 1.

At a summer industry briefing NGTL confirmed that the first and main casualty of the construction traffic interruptions would be daily spot sales using interruptible service on spare system capacity. Firm transportation contracts were given top priority.

The work program at times virtually shut off spot market activity at affected NGTL locations. Gas changes hands at multiple points using standardized procedures known as NIT, short for Nova Inventory Transfer. The system makes the entire network operate as a giant Western Canadian gas trade hub.

During the construction period supplier scrambles to stay online by undercutting rivals for spot sales have driven daily average NIT prices for all trading points down to as low as C$1.15/GJ, or 97 cents/MMBtu.

The disruptions have been a setback to an otherwise strong recovery year for Alberta and BC on the crowded North American gas market, said industry analysts.

A key benchmark, the Alberta Reference Price for sales to all destinations that the provincial treasury compiles monthly for royalty calculation purposes, averaged C$2.35/GJ ($1.97/MMBtu) during June through July before the construction program started — a 59% improvement on C$1.48/GJ ($1.24/MMBtu) during the comparable period of hard times in 2016.

TransCanada’s latest progress report suggests the worst of the setback will soon be over: “The 2017 NGTL Expansion Project is almost complete and many sections are already finished construction and/or in-service.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |