E&P | Eagle Ford Shale | NGI All News Access | Permian Basin

Noble Energy Raises Third Quarter Oil, NatGas Guidance by 3%

Houston-based Noble Energy Inc. said Monday sales volumes for the third quarter have been raised to 352,000-358,000 boe/d, about 10,000 boe/d at the midpoint, or 3%.

Total oil volumes were increased to 126,000-130,000 bb/d, up more than 4% from prior estimates. Gas volumes are anticipated higher at 965-990 MMcf/d, while natural gas liquids (NGL) are expected to be 63,000-65,000 b/d.

Capital expenditures were maintained from original estimates at $625 to 725 million.

“Total U.S. onshore equivalent volumes are trending slightly above the high end of the company’s original guidance range, with both oil and natural gas volumes above the high end and NGLs slightly below the original range of expectation,” management said.

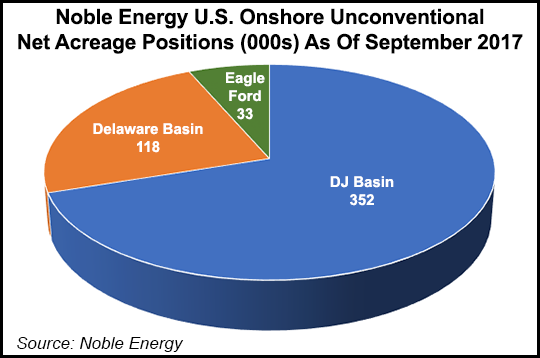

The revised onshore outlook primarily reflects better than expected Denver-Julesburg (DJ) Basin volumes, following strong new well performance in Wells Ranch and East Pony, and an increasing oil contribution.

Combined Wells Ranch and East Pony volumes are expected to climb more than 10% from the second quarter. Higher natural gas volumes in the DJ more than offset lower expected NGLs. Better than anticipated pipeline pressures throughout the DJ are also benefitting overall production.

In Texas, where Noble Energy works the Permian Basin and Eagle Ford Shale, sales volumes for the third quarter “are consistent with expectations, reflecting the planned number of wells drilled, completed, and turned into production.” An impact to production and operations, as a result of Hurricane Harvey, “was limited and primarily related to third-party downstream issues,” said management.

Strong sequential volume increases in the Eagle Ford in the third quarter reflected “continued robust well performance from South Gates Ranch activity.” And in the Permian’s Delaware sub-basin, “volumes are growing as expected.”

The company’s first central gathering facility in the Delaware, capturing produced oil, natural gas and water, ramped up in late July and recently was connected to the Advantage Pipeline LLC system, which takes crude volumes to Crane County, TX.

Gulf of Mexico sales volumes are expected at the high end of original guidance, reflecting field and facility performance and limited hurricane impacts. Offshore West Africa, oil and NGL liftings are occurring as planned, while natural gas volumes are above expectation at the Alba field.

Third quarter volumes in gas-rich fields of Israel are trending within the expected original range. Tamar field production during the months of July and August averaged more than 1 Bcf/d gross.

Fourth quarter guidance is unchanged from prior expectations, management said.

“The increase in third quarter expected volumes raises full-year 2017 sales volumes to range between 342,000 and 352,000 boe/d, pro forma for asset divestments executed earlier in the year. “ The company reaffirmed its prior outlook of 40% U.S. onshore oil growth from the first quarter to the fourth quarter.

Majority owned Noble Midstream Partners LP also increased its third quarter guidance. The partnership, spun off of Noble Energy last fall, increased net income guidance to $42-43 million. Oil and gas gathering volumes are expected to be 92,000-97,000 boe/d, about 15% higher than prior guidance. Produced water gathering volumes were raised 30% above mid-point prior guidance while fresh water delivery volumes were lifted 52%.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |