Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report | Regulatory

NEB Ratifies 46% Toll Discount for TransCanada’s NatGas Mainline

A 1.4-Bcf/d wave of Western Canadian natural gas will start reaching Ontario, Quebec and northeastern U.S. markets on schedule Nov. 1, thanks to swift approval Thursday of a deep cross-country pipeline toll discount.

Only nine days after hearings on the plan, the National Energy Board (NEB) ratified a 46% cut, to C77 cents/gigajoule (GJ) (65 cents/MMBtu), by TransCanada Corp.’s gas Mainline for a 23-company who’s-who of western producers.

As gas resource and royalty owners, the Alberta and British Columbia (BC) governments also backed the 10-year deal, known as the Dawn Long Term Fixed Price or Dawn LTFP after the southern Ontario storage and trading hub that is the discount service’s destination. The NEB, using a streamlined procedure, postponed issuing reasons for the decision.

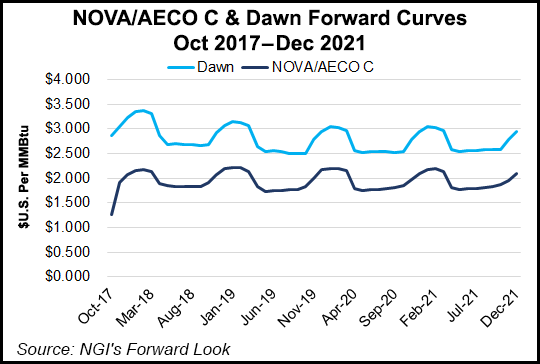

Forthcoming competition with U.S. shale gas will erode eastern prices, but the toll cut is deep enough to let BC and Alberta producers keep net gains, predicted a report by Fairfax, VA-based ICF for the Dawn hub’s owner, Union Gas.

On the cross-country Mainline’s eastern side, the study foresees an average Dawn price drop of C13 cents/GJ (11 cents/MMBtu). On the western end, TransCanada’s Nova Gas Transmission Ltd. supply collection grid in Alberta and BC, an average producer gain of C11 cents/GJ (9 cents/MMBtu) was projected.

The ICF markets review challenged western optimism that Dawn LTFP would enable Western Canadian producers to recover significant shares of sales lost in Ontario, Quebec and the U.S. Northeast to swelling American shale gas output.

As much as 45% of the Dawn LTFP discount-tolled flows would be “cannibalized” away from deliveries via other TransCanada services that continue to charge the old full rate of C$1.42/GJ ($1.19/MMBtu), the forecast estimated.

The Union-ICF review also projected western producer revenue gains would be too low to drive much drilling, so that Dawn LTFP would drain flows from other conduits out of BC and Alberta too such as Alliance Pipeline and Gas Transmission Northwest.

As Ontario gas distribution affiliates, Union and Enbridge Gas urged the NEB only to approve Dawn LTFP for three years at most in order to perform a complete review of TransCanada services and costs scheduled for 2020. The eastern firms hold old, full-priced Mainline shipping contracts, did not participate in the Dawn LTFP negotiations, and called the discount service “cross-subsidization” of the pipeline’s western clients.

But the new deal’s supporters remained optimistic. The BC government said Dawn LTFP fulfills a “clear need for a competitive tolling offering” enabling Western Canada Sedimentary Basin producers “to preserve and reclaim eastern market share.”

In a statement to the NEB’s Sept. 11-12 hearings on the toll deal, the Alberta government agreed. “The service,” said government officials, “provides a competitive opportunity for Canadian supply to retain economic access to traditional markets that have become a key challenge facing Alberta’s natural gas industry.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |