Markets | NGI All News Access | NGI Data

NatGas Cash, Futures Swoon As EIA Reports Healthy Injection

Typically physical natural gas traders will try to get their deals done ahead of the release of Energy Information Administration (EIA) storage data, and early weakness in futures Thursday morning ahead of the weekly report’s release may have tipped off physical traders.

Not one point followed by NGI made it to the win column and less weak quotes in the Rockies and California partially offset steeper declines in the Northeast and Appalachia. The NGI National Spot Gas Average skidded 13 cents to $2.70.

Thursday’s trading began Wednesday evening with October futures at around $3.08, but by 10:00 a.m. EDT October had already slid to $3.02. Just before report time the market was hovering around $3.032.

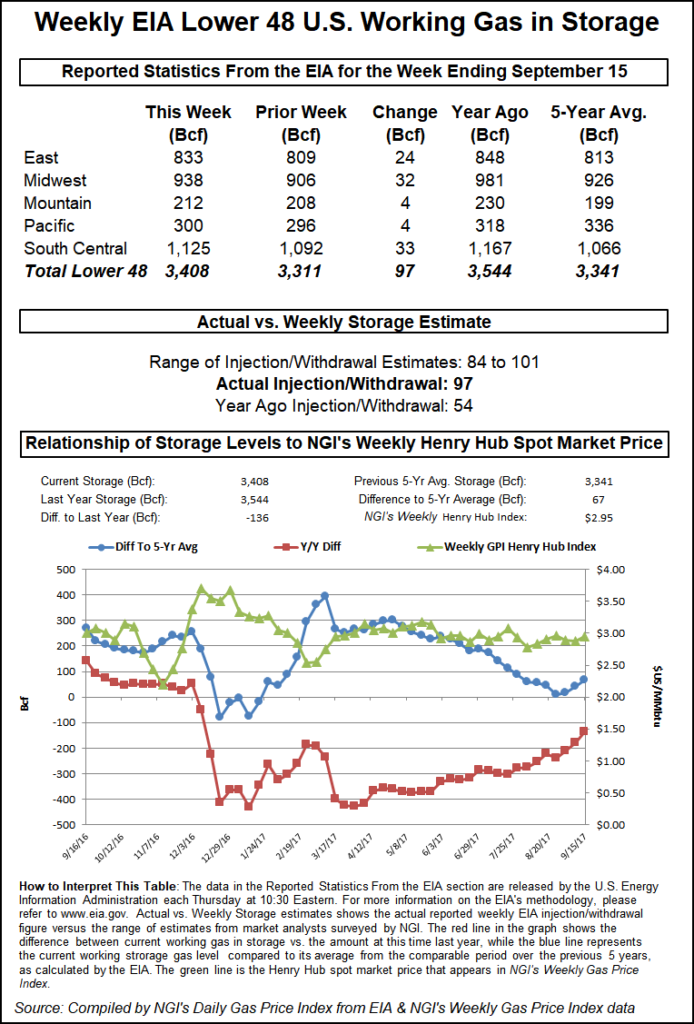

The EIA reported a storage build of 97 Bcf at 10:30 a.m. EDT, about 6 Bcf greater than expected, and the bears were off to the races. October futures promptly dropped to $2.982, and by 10:45 a.m. October was trading at $2.979, down 11.5 cents from Wednesday’s settlement. At the close, October had dropped 14.8 cents to $2.946, and November fell 14.2 cents to $3.007. November crude oil eased 14 cents to $50.55/bbl.

Prior to the report traders were looking for a lesser storage build, but nonetheless well above historical norms. Last year 54 Bcf was injected and the five-year average stands at 73 Bcf. Citi Futures Perspective calculated an 84 Bcf injection and Stephen Smith Energy was looking for an 88 Bcf build. A Reuters survey of 25 traders and analysts showed an average 91 Bcf with a range of plus 84 Bcf to plus 100 Bcf.

“I had heard 91 Bcf, so it was a little bit of a bearish number, and we sold off on it,” said a New York floor trader.

“To call this a buying opportunity is a little bit of a scary assumption, but you know we will get over $3 again. This market has been see-sawing back and forth at $3 for months, but I would wait a little bit, a couple of days.

“The initial influx is going to be everyone wants to sell it, sell it, sell it and you may have hit some stops to bring it to this level. If you do buy it at these levels I would put a stop in at $2.75,” the trader told NGI.

One school of thought has the market setting up for more volatility. “After a pretty constructive week, the market took NG1 down by nearly 15 cents in a matter of hours, settling back below the $3/MMBtu level,” noted Breanne Dougherty, analyst with Societe Generale in New York.

“We definitely were more in line with the momentum of earlier this week, and do not see support for today’s aggressive downward move. We remain bullish to the Nymex as a whole through 2018, we see the curve as particularly undervalued through 1H 2018; the closer winter gets, the more volatile things are likely to become.”

Inventories now stand at 3,408 Bcf and are 136 Bcf less than last year and 67 Bcf greater than the five-year average. In the East Region 24 Bcf was injected, and the Midwest Region saw inventories rise by 32 Bcf. Stocks in the Mountain Region were 4 Bcf greater, and the Pacific Region grew by 4 Bcf as well. The South Central Region added 33 Bcf.

In physical trading a one-day forecast plunge in New England temperatures was enough to send quotes scurrying lower. AccuWeather.com forecast Boston’s high Thursday of 72 would drop to 63 on Friday before recovering to 73 on Saturday. The normal high in Boston this time of year is 70.

Gas at the Algonquin Citygate dropped 62 cents to $2.13 and packages on Iroquois Waddington fell 41 cents to $2.75. Gas on Tennessee Zone 6 200 L was quoted 74 cents lower at $1.96.

In the Mid-Atlantic temperatures were forecast above normal and the drop in prices was not quite so steep. New York City’s high Thursday of 80 was expected to hold Friday before rising to 86 Saturday, 13 degrees above normal.

Gas bound for New York City on Transco Zone 6 shed 17 cents to $2.99, and deliveries to Tetco M-3 came in 34 cents lower at $1.53. Gas on Dominion South dropped 29 cents to $1.49.

Deliveries to the Chicago Citygate skidded 9 cents to $2.96 and packages at the Henry Hub dropped 3 cents to $3.11. Gas on El Paso Permian came in a dime lower at $2.48, and gas priced at the NGPL Midcontinent Pool retreated 13 cents to $2.68.

Kern River receipts changed hands a nickel lower at $2.61 and gas at Malin fell 3 cents to $2.66. Gas at the PG&E Citygate fell 9 cents to $3.22 and gas at the SoCal Citygate dropped a nickel to $2.99.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |