Bears Back In The Saddle Following Stout EIA Stats

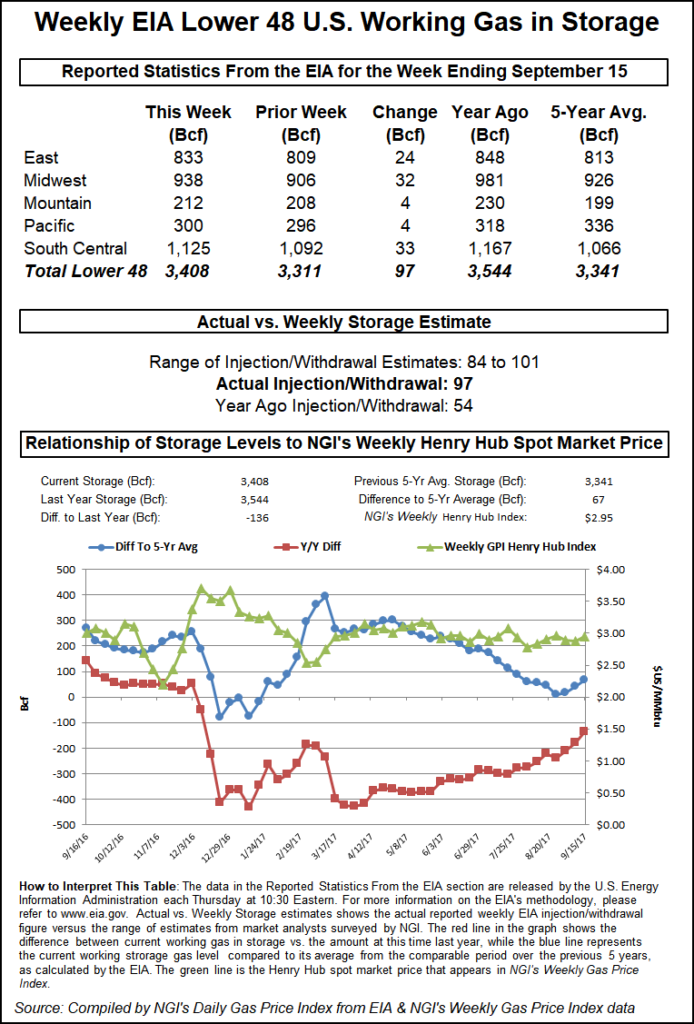

October natural gas futures plunged Thursday following a report by the Energy Information Administration (EIA) showing a storage injection that was greater than what traders were expecting. The EIA reported an injection of 97 Bcf, about 6 Bcf greater than consensus estimates.

Just before report time the market was hovering around $3.032. Following the release of the number October futures dropped to $2.982. And by 10:45 a.m. October was trading at $2.979, down 11.5 cents from Wednesday’s settlement.

Prior to the report traders were looking for a lesser storage build, but nonetheless well above historical norms. Last year 54 Bcf was injected and the five-year average stands at 73 Bcf. Citi Futures Perspective calculated an 84 Bcf injection and Stephen Smith Energy was looking for an 88 Bcf build. A Reuters survey of 25 traders and analysts showed an average 91 Bcf with a range of plus 84 Bcf to plus 100 Bcf.

“I had heard 91 Bcf, so it was a little bit of a bearish number, and we sold off on it,” said a New York floor trader.

“To call this a buying opportunity is a little bit of a scary assumption, but you know we will get over $3 again. This market has been see-sawing back and forth at $3 for months, but I would wait a little bit, a couple of days.

“The initial influx is going to be everyone wants to sell it, sell it, sell it and you may have hit some stops to bring it to this level. If you do buy it at these levels I would put a stop in at $2.75,” the trader told NGI.

Inventories now stand at 3,408 Bcf and are 136 Bcf less than last year and 67 Bcf greater than the five-year average. In the East Region 24 Bcf was injected, and the Midwest Region saw inventories rise by 32 Bcf. Stocks in the Mountain Region were 4 Bcf greater, and the Pacific Region grew by 4 Bcf as well. The South Central Region added 33 Bcf.

Salt storage rose by 19 Bcf to 304 Bcf and non-salt storage increased 14 Bcf to 821 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |