Infrastructure | E&P | Marcellus | NGI All News Access | Utica Shale

Rover Cleared to Resume HDDs as FERC Lifts Moratorium

Rover Pipeline LLC is wasting no time restarting horizontal directional drilling (HDD) at key sites now that it has the go-ahead from FERC, but the pipeline’s full in-service date could slip to late 1Q2018, Energy Transfer Partners LP (ETP) said Tuesday.

After months of pleading from Rover, FERC on Monday lifted a moratorium on horizontal directional drilling (HDD) that had delayed portions of the 710-mile, 3.25 Bcf/d natural gas mega-project.

In a letter order issued late Monday, the Federal Energy Regulatory Commission authorized Rover to resume HDD activities at nine sites where work had been suspended following a roughly 2 million gallon drilling fluids spill near the Tuscarawas River in Stark County, OH, earlier this year.

“Rover has demonstrated sufficient progress on the required rehabilitation and restoration of the areas affected by the inadvertent release and drilling mud contamination,” FERC wrote. “Rover has also developed and filed specific measures to address the recommendations” made by J.D. Hair & Associates Inc. following an independent review “as well as staff’s site-specific recommendations for the referenced nine crossings.”

The list of sites includes the Captina Creek HDD, identified as a key crossing point for the Clarington Lateral in eastern Ohio, part of Rover’s Phase 1B.

“Drilling operations” at the nine FERC-approved locations “are expected to begin within the week with an emphasis on the Captina Creek HDD in Belmont County, OH,” ETP said Tuesday. “The completion of the Captina Creek HDD will allow the full Phase 1 portion of Rover from Seneca, OH, to Defiance, OH, to be placed in service by the end of the year.”

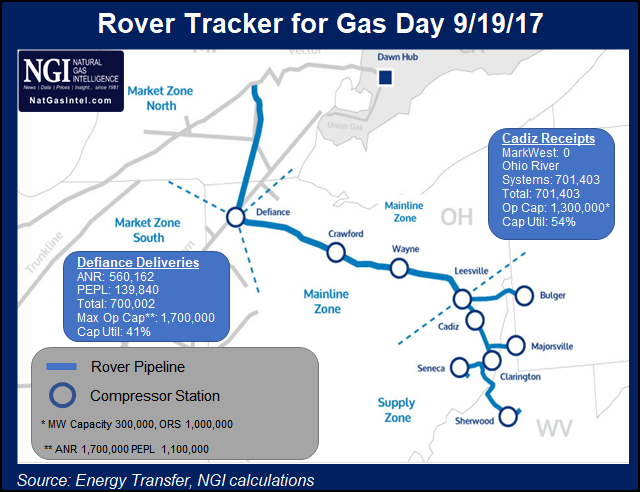

Rover’s Phase 1A began service at the start of the month. Phase 1A has since ramped up to around 700 MMcf/d flowing from Cadiz, OH, to interconnects with Panhandle Eastern and ANR, according to NGI‘s daily Rover Tracker.

“The Rover Pipeline Project will continue to work with the FERC to adhere to the requirements outlined in its approval and look forward to successfully placing the full project into service in the end of the first quarter of 2018,” ETP said.

During a 2Q2017 conference call in August, ETP management had said Phase 2 was on track for service by early December “with full commercial service in January.”

The other sites where HDD work can resume include:

In the months following FERC’s order halting new HDD work, Rover sent multiple requests to reauthorize HDDs. The company also hired an independent HDD specialist to provide analysis and recommendations.

FERC said Monday that it’s still investigating the Tuscarawas spill over the presence of diesel fuel in the drilling mud.

“This authorization for Rover to re-commence certain HDD activities does not bear on or impact” the Office of Enforcement’s “ongoing investigation into the circumstances of the drilling fluid contamination at the Tuscarawas River HDD site, and the causes thereof,” FERC wrote. FERC said any deviation from approved plans developed in response to the spill could result in a stop-work order for Rover or additional referrals to the Office of Enforcement.

Lifting Rover’s HDD moratorium counts as a significant win for the producers that have staked claims on the pipeline’s substantial transportation capacity out of the Appalachian Basin. Rover is designed to deliver Marcellus and Utica shale gas to markets in the Midwest, Gulf Coast and Canada, including via interconnects with the Midwest Hub in Defiance, OH, and the Vector Pipeline in Michigan.

Genscape Inc. analyst Colette Breshears told NGI that “our analysis agrees” with ETP’s schedule for a 4Q2017 start-up for Phase 1B, but she said there’s still risk that Phase 2 could slip beyond the first quarter depending on what happens with FERC.

“We are generally on board with a 1Q2018 date for Phase 2 but note that there is a high risk for slippage past March if permission to drill the other two-thirds of the HDDs isn’t received in the next couple of weeks,” she said.

In the meantime, the Captina Creek HDD is a critical drill that should allow new receipt points south of Cadiz to connect to Rover, Breshears noted.

“Captina Creek is the only HDD preventing flow from the Berne, Seneca and Clarington receipt points,” Breshears said. “Volumes on the pipe will be determined primarily by whether compression becomes available. Without compression, we expect it will be extremely hard to raise volumes above 700 MMcf/d.”

With 700 MMcf/d already hitting the market, how much has Rover impacted production so far?

“To date, we have seen about 150 MMcf/d of new production directly attributable to Rover,” with the rest “coming at the expense of other pipes,” mainly Texas Eastern Transmission, or Tetco, BTU Analytics LLC’s Matthew Hoza said in a note Tuesday.

The new volumes flowing on Rover have had other ripple effects, Hoza said.

“Where is that 700 MMcf/d of gas actually going? Currently, almost all of Rover’s volumes are being delivered to ANR, but again, a good amount of Rover volumes are displacing volumes from other pipes,” he said. “Rover deliveries are displacing Rockies Express Pipeline (REX) deliveries to ANR. Because of this displacement, REX deliveries to ANR are moving southbound and more gas is moving further west on REX.”

While REX parent Tallgrass Energy Partners LP recently announced its Cheyenne Connector project to transport more Rockies-produced gas west-to-east, “with the start-up of Rover and the displacement of REX gas, an increasing amount of Appalachian gas is making its way farther west,” Hoza said.

Winter heating demand could “mask some of the changes taking place. However, assuming a normal winter this year, by spring 2018, when Rover’s full volume is online and seasonal demand ebbs, we will most likely see two things occur: more Appalachian gas displacing Rockies volumes out of the Midwest and weak supply basin basis as prices come down to force producers to curb volumes.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |