Bakken Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

North Dakota’s Bakken Production, Prices Inch Upward in July

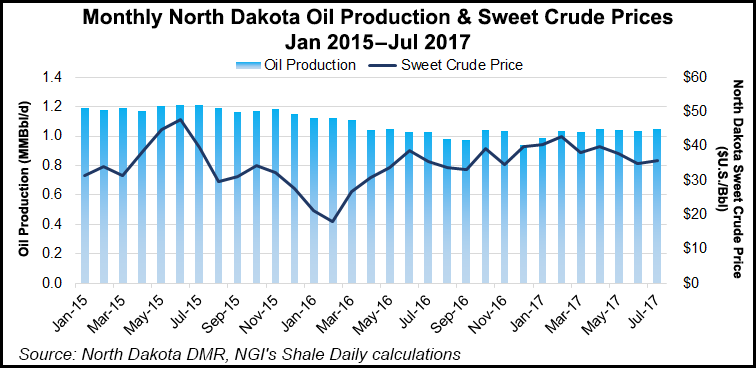

North Dakota’s Bakken Shale oil and natural gas production edged up slightly in July, despite price-related pressures that have kept operators treading water, Department of Mineral Resources (DMR) officials said Friday.

The number of producing wells hit an all-time high at 13,981. Prices and rig counts also increased month/month, but DMR Director Lynn Helms said prices are expected to remain lower for the rest of this year.

“The drilling rig count increased three from June to July, then decreased two from July to August, and is currently unchanged from August to today,” Helms said on a webinar. “Operators have shifted from running the minimum number of rigs to incremental increases and decreases,” as West Texas Intermediate (WTI) oil prices wobbled between $40 and $50/bbl. “If the WTI price drops below$45/bbl for more than 30 days, the rig count is expected to drop.”

Helms called $50/bbl oil prices the “magic number” for future growth from the Bakken.

“We’re running somewhere near 5% above state projections for oil and gas revenues, and that will help,” Helms said in offsetting lower prices.

The state’s analysis envisions a “soft landing” for oil prices next year with sustainable levels above $50/bbl. An excessive spike in prices is seen as counterproductive.

“Around the world and in the United States, we’re back into the normal storage envelope” for crude oil, Helms said. “Storage levels are all headed for average or below-average levels by the end of this year,” even with the impacts from hurricanes Harvey and Irma.

“There is now the anticipation we are going to see some significant but not ”spikey’ price increases in the fourth quarter and first quarter 2018,” he said. “We already see the West Texas Intermediate prices very close to that $50 number, which is a magic number for us.”

July oil production was 32.4 million bbl (1.047 million b/d), compared to 30.9 million bbl (1.032 million b/d) in June. Natural gas production climbed month/month to 58.1 Bcf, a new all-time daily average of1.87 Bcf/d, from 55.4 Bcf (1.85 Bcf/d).

State officials expect “oil price weakness” will continue through 2017, Helms said. Given the prospects for continued reductions beyond next March by the Organization of the Petroleum Exporting Countries (OPEC), the role of U.S. shale production will be watched more closely, he said.

“The markets are watching to see if U.S. shale production offsets OPEC cuts, and as U.S. crude oil inventories continue to drop, international energy projections have raised estimates for 2017-18 global crude demand.”

North Dakota sweet crude prices averaged $34.72/bbl in June, $35.83/bbl in July and $37.93/bbl in August.

The number of well completions has become highly variable from 88 in June to a preliminary tally of 67 in July. Estimated wells waiting on completion were up 34 to 889 from the end of June to the end of July. Estimated inactive well count was 1,478, up 20 from the end of June to the end of July.

The number of drilled-but-uncompleted (DUC) wells remains high with prices below the $50/bbl level.

“Part of that is due to the prices, and the other part is that it was difficult to hire more hydraulic fracturing crews, but we’ve seen that change, too,” he said. During July and August the state had 24-25 fracturing crews running, which he said should reduce the amount of DUCs.

For wellhead gas capture, 88% were captured in July, down from June. Except for the Fort Berthold Reservation, where the capture rate was 82%, the statewide total was 90%.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |