Traders Re-Think Demand Destruction; Weekly NatGas Up Nearly A Dime

During the previous week traders were all abuzz about lost demand and its impact on prices as the NGI Weekly Spot Gas Average for the week ended Sept. 8 fell a nickel to $2.55. By the time this week’s trading got underway, however, traders realized that demand destruction might have been a little overblown, at least from a market perspective. That and forecasts of warmer weather prompted a turnaround, and for the week ended Sept. 15, the NGI Weekly Spot Gas Average rose 8 cents to $2.63.

The week’s greatest gainer turned out to be NOVA/AECO C with a rise of $C0.69 to $C1.32/Gj and the weakest point was gas at the SoCal Citygate falling 14 cents to $3.07. Outside the Northeast and California gains of a few pennies to a dime or more were common.

Regionally the Northeast proved to be the week’s most improved with a rise of 31 cents to average $2.19, and California was the only region in the red with a loss of 3 cents to $2.94.

The Southeast rose 13 cents to average $2.97, and both South Louisiana and the Midwest rose 9 cents to $2.90 and $2.87, respectively.

All other regions were up by a penny to as much as a nickel. East Texas and the Midcontinent were both 5 cents higher at $2.88 and $2.72, respectively.

October futures rose 13.4 cents week on week to $3.024.

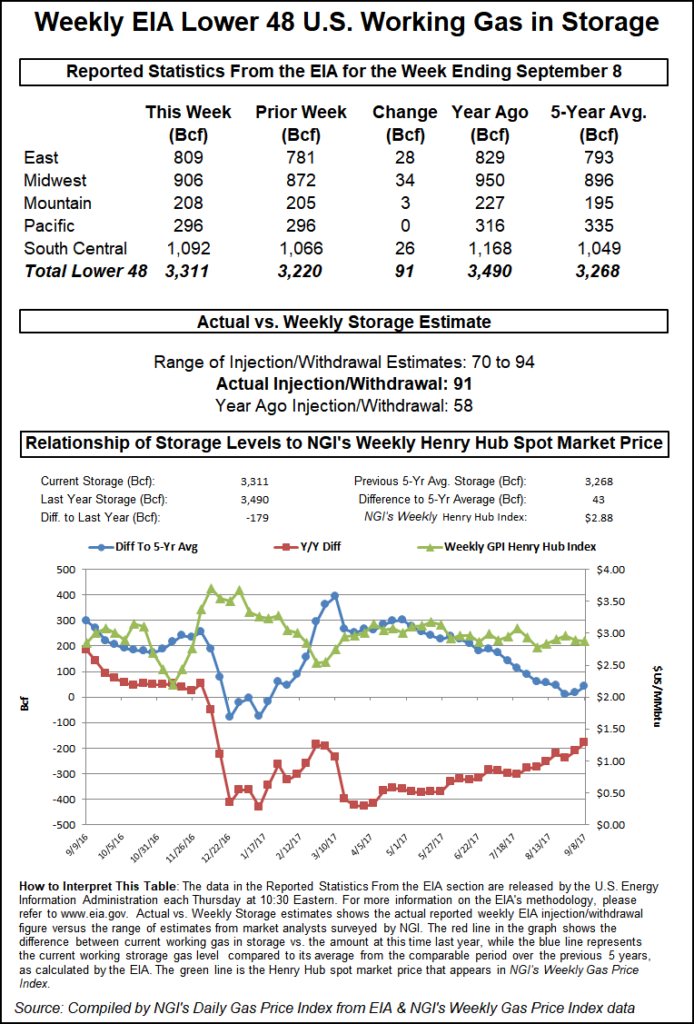

Thursday’s trading saw the EIA report a storage build of a hefty 91 Bcf for the week ended Sept. 8, about 6 Bcf greater than expectations. Futures prices made a counterintuitive advance anyway. At the close Thursday October had added 1.2 cents to $3.07 and November had improved nine-tenths of a cent to $3.127.

Analysts were all geared up for a big number, but came up a little short. Last year 58 Bcf was injected and the five-year average stands at 63 Bcf. Kyle Cooper of ION Energy calculated a 90 Bcf injection and Ritterbusch and Associates was looking for a 77 Bcf build. A Reuters survey of 23 traders and analysts showed an average 85 Bcf with a range of +70 Bcf to +94 Bcf.

At the time the EIA figures were issued Thursday, the market was hovering around $3.052. Following the release, October futures jumped to $3.093, and by 10:45 a.m. EDT October was trading at $3.081, up 2.3 cents from Wednesday’s settlement.

The market’s reaction to the number caught traders by surprise.

“The number should have been bearish, right?” a New York floor trader told NGI. “It took a brief downturn and then made new highs. The session’s low of $3.036 was not made after the number came out.

“I had heard 83 Bcf-85 Bcf and coming in at 91 Bcf, you would have thought it would have made a downturn. It seems to happen all the time. Within 15 minutes of the number coming out, we are trading at or above where it was or at or below where it was depending on the significance of the number. You’ve got to make your moves real quick and get out because you are going to lose money within the 15-minute time frame.

“It doesn’t make a lot of sense, but sometimes this market doesn’t. You can say that natural gas got a psychological boost from crude oil, which is trading over $50/bbl and made a new high at $50.50/bbl as well.”

The trader said, “Above $3.10 should be a little bit of a resistance level, but the main one is going to be $3.25; $3 will be a little bit of support underneath and below that you will get something at the $2.85 to $2.90 level, but primarily $2.75. Right now I am not looking to see either one of those, $2.75 or $3.25.”

Inventories now stand at 3,311 Bcf and are 179 Bcf lower than last year and 43 Bcf above the five-year average. In the East Region 28 Bcf was injected, and the Midwest Region saw inventories rise by 34 Bcf. Stocks in the Mountain Region were 3 Bcf higher, and the Pacific Region was unchanged. The South Central Region added 26 Bcf.

The positive market response to an otherwise bearish storage report has some traders putting on their bull suit. A survey by Bloomberg News of 12 traders and analysts found seven bullish, two bearish, and the rest think the market will trade steady.

Buy the rumor sell the fact anyone?

“I’m sitting here watching the natural gas, and storms have always been demand killers and always will be,” said a California trader. “Gasoline demand fell apart and it’s the same with natural gas, and I plan to sell these rallies although I don’t know how much further natural gas can go. It tried its rally and couldn’t get through $3.50, and it tested $2.75 and held in there.

“There’s no campaign to get on, so I don’t know what the bulls are thinking.”

In Friday’s trading physical natural gas traders just couldn’t see getting stuck with a three-day commitment in a well-supplied market, and prices fell across a broad front. Gains in Appalachia couldn’t offset double digit losses in the Northeast, Midcontinent, Midwest, Rockies and California, and the NGI National Spot Gas Average skidded 9 cents to $2.58.

Futures bulls failed to provide any follow-through to Thursday’s counterintuitive gain following a bearish storage report, and October managed to hold $3, but at settlement had lost 4.6 cents to $3.024. November fell 4.2 cents to $3.085.

Although temperatures were forecast above-normal in major eastern markets, traders only had to look at forecast energy demand to realize there was little incentive to make incremental purchases for power generation. AccuWeather.com forecast that the high of 80 both Friday and Saturday in New York City wasn’t expected to drop until Monday when it was expected to reach 74, only a degree below normal. Philadelphia’s Friday high of 83 was seen rising to 84 by Saturday and dropping to 78 by Monday, the seasonal norm.

The bigger picture was told by expected energy demand as major power grids predicted Monday load to be less than that of Friday. The New York ISO forecast that peak load of 22,231 MW Friday would take its normal weekend hit Saturday to 20,706 MW, but by Monday peak load was only expected to recover to 21,856 MW. The PJM Interconnection estimated Friday peak load of 39,865 MW would slide Saturday to 37,394 MW but only make it back to 37,821 MW by Monday.

Gas at the Algonquin Citygate skidded 30 cents to $1.53 and deliveries to New York City via Transco Zone 6 shed 28 cents to $2.28. Gas priced at the Tetco M-3 Delivery point rose three cents to $1.26 and packages on Dominion South rose 3 cents as well to $1.19.

Gas at the Chicago Citygate fell a dime to $2.84 and deliveries to the Henry Hub were quoted at $2.99, down 5 cents. Packages on El Paso Permian tumbled 18 cents to $2.47 and gas on Northern Natural Demarcation fell 11 cents to $2.70.

Western quotes fared no better. Kern Receipts were seen at $2.57, down 15 cents, and Kern Delivery came in at $2.64, 17 cents lower. Gas at the PG&E Citygate shed 13 cents to $3.25, and gas priced at the SoCal Citygate fell 20 cents to $2.87.

Analysts see forecast warm weather tempering recent stout storage injections. “This week’s injection was 29 Bcf above last year’s reported figure of 62 Bcf and 27 Bcf above the five-year average of 64 Bcf, but the miss was largely due to the storm-related shortfall in demand in the southeastern U.S.,” said the analytical team at Wells Fargo.

“We believe power-burn demand will be relatively strong due to warmer than normal weather forecasts for much of the U.S. over the next two weeks. Our cumulative injection forecast for the next two weeks is 145 Bcf, 44 Bcf above last year’s cumulative injection of 101 Bcf but 9 Bcf below the five-year average of 154 Bcf.”

In spite of the day’s slide in October futures, market observers see “shorts likely to be more on the defensive than the longs with broad-based hot temperature forecasts beginning to stretch toward month’s end,” said Jim Ritterbusch of Ritterbusch and Associates Friday. “The nation’s Midcontinent is expected to see large enough temperature deviations to crank up air conditioners in the process of limiting seasonal injections.

“Although another larger than normal supply build would appear likely in next week’s Energy Information Administration (EIA) report, subsequent releases will be showing some impact from what is apt to be one final dose of cooling degree day (CDD) accumulation prior to next month when more seasonal trends will likely be developing. So, although the supply surplus has been expanding this month, the market appears to be taking into consideration the fact that the storage overhang is modest especially in comparison with the huge excess of almost 400 Bcf seen earlier this year.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |