Global NatGas Fastest Growing Fossil Fuel to 2040 as Supply, Trade Soars, Says EIA

Worldwide natural gas consumption is projected to increase to 177 Tcf in 2040 from 124 Tcf in 2015 and account for the largest increase in fossil fuel consumption, but renewable energy resources are picking up the pace, the U.S. Energy Information Administration (EIA) said Thursday.

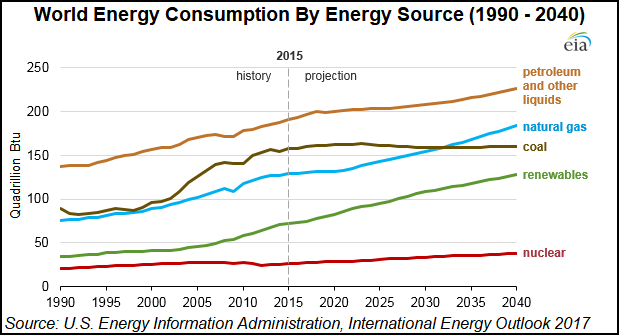

In the latest International Energy Outlook 2017 (IEO2017), EIA researchers are projecting world energy consumption will grow by 28% from 2015 to 2040. The long-term forecast includes projections of energy demand by region and primary energy source; electricity generation by energy source; and energy-related carbon dioxide emissions.

By every measure, the outlook for natural gas is “very favorable,” said EIA’s Ian Mead, assistant administrator of the Office of Energy Analysis. He presented the forecast at the Center for Strategic & International Studies.

“We expect natural gas supply to be good and prices to be low,” Mead said. The growth rates were “toned down” slightly on the rise of renewables, but overall, it’s a “very favorable outlook to supply the world’s needs.”

Abundant gas resources and rising production contribute to its strong competitive position among other resources, and gas “remains a key fuel in the electric power sector and the industrial sector,” according to the IEO2017.

“In the power sector, natural gas is an attractive choice for new generating plants because of its relative fuel efficiency. Natural gas also burns more cleanly than coal or petroleum products, and as more governments begin implementing national or regional plans to reduce carbon dioxide (emissions, they may encourage the use of natural gas to displace more carbon-intensive coal and liquid fuels.”

LNG, Gas Pipeline Trade Soaring

To meet the growth in gas demand projected in the IEO2017 reference case, the world’s gas producers are expected to increase supplies by 42% to 2040. The largest increases occur in the Middle East (11.8 Tcf), China (9.5 Tcf), the United States (10.7 Tcf), and Russia (4.8 Tcf).

“In Russia, production growth is supported primarily by increasing development of resources in the country’s Arctic and eastern regions,”researchers said. “U.S. production growth comes mainly from shale resources. In China, most growth in the long-term comes from the country’s development of its shale resources, which are projected to account for more than half of its total natural gas production in 2040.”

The global gas trade, both by pipeline and liquefied natural gas (LNG) is poised to increase as well, according to the forecast. World LNG trade is expected to nearly triple by 2040 to around 31 Tcf from about 12 Tcf in 2015.

“Most of the near-term increase in liquefaction occurs in Australia and North America, where a number of new liquefaction projects are planned or under construction, many of which will become operational within the next decade,” researchers said.

“U.S. LNG exports are projected to increase significantly over the projection period and to account for more than 60% of total U.S. natural gas exports in 2040.”

Along with strong growth in the LNG trade, gas trade by pipeline also increases in the IEO2017 reference case, as several long-distance pipelines are completed and existing infrastructure expands through 2040.

Today, most gas volumes traded internationally by pipeline are in Europe and in the Americas, between Canada and the United States, with U.S. pipeline exports to Mexico also becoming a more important component of trade in the Americas.

“Mexican pipeline imports from the United States have more than quadrupled since 2009, and they are expected to continue to increase over the next several years,” according to the report. “By 2018, the United States becomes a net exporter of natural gas on an average annual basis, as pipeline exports to Mexico and LNG export volumes grow.”

The LNG and trade forecast mirrors recent long-term energy forecasts by BP plc, ExxonMobil Corp., Statoil ASA and others mirror many EIA findings and expect North America to become the leading LNG exporter. The International Energy Agency, in its five-year-forecast, also said the role of gas in the global energy mix is sharply evolving with LNG export growth.

Renewables Gain, But Fossil Fuels Rule

Although renewables fuels are seen growing at a faster clip than fossil fuels, fossil fuels still account for 77% of energy use in 2040, led by natural gas.

Global natural gas consumption is seen increasing by 1.4%/year over the forecast period. “Abundant natural gas resources and rising production — including supplies of tight gas, shale gas, and coalbed methane — contribute to the strong competitive position of natural gas,” researchers said.

Liquid fuels, mostly petroleum-based, remain the largest source of world energy consumption. “However, the liquids share of world marketed energy consumption falls from 33% in 2015 to 31% in 2040, as oil prices rise steadily, leading many energy users to adopt more energy-efficient technologies and to switch away from liquid fuels when feasible.”

Meanwhile, coal is expected to be increasingly replaced by gas, renewables and nuclear power for electric power generation, and coal demand also is expected to weaken for industrial processes.

Renewables are expected to be the world’s fastest-growing energy source to 2040, with consumption increasing by an average 2.3%/year. The w second fastest growing source is nuclear power, with consumption increasing by 1.5%/year over the period.

Most of the growth in consumption is expected from non-OECD countries, in countries driven by strong economic growth, particularly in Asia. Non-OECD Asia, which includes China and India, is seen accounting for more than 60% of the total increase in energy consumption through 2040.

The IEO2017 includes long-term projections of world energy demand by region and primary energy source; electricity generation by energy source; and energy-related carbon dioxide emissions.

EIA is projecting world net electricity generation increases by 45% to 34 trillion kWh in 2040, remaining the world’s fastest growing form of end-use energy consumption.

“Power systems continue to evolve from isolated, noncompetitive grids to integrated national and international markets,” researchers said.

Global prospects continue to improve for generation from renewable energy sources and natural gas, according to the IEO2017. Renewables are the fastest growing source of energy for electricity generation, with average increases of 2.8%/year to 2040. After renewable energy sources, natural gas and nuclear power are the next fastest growing sources of energy used to generate electricity.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9966 |