Near-Term Temps Pull Plug On Physical NatGas, Futures Resilient; October Gives Up 2 Cents

It almost seemed as though all physical natural gas market points were anticipating the load-diminishing effects of Hurricane Irma, but it was below-normal temperature forecasts in major eastern markets that sent prices for next-day deliveries tumbling Thursday.

A few points in the Rockies managed to cross the line into positive territory but hefty losses were incurred in the Northeast and Appalachia, with more moderate setbacks in the Southeast, Midcontinent, Louisiana, and Texas. The NGI National Spot Gas Average dropped 8 cents to $2.55.

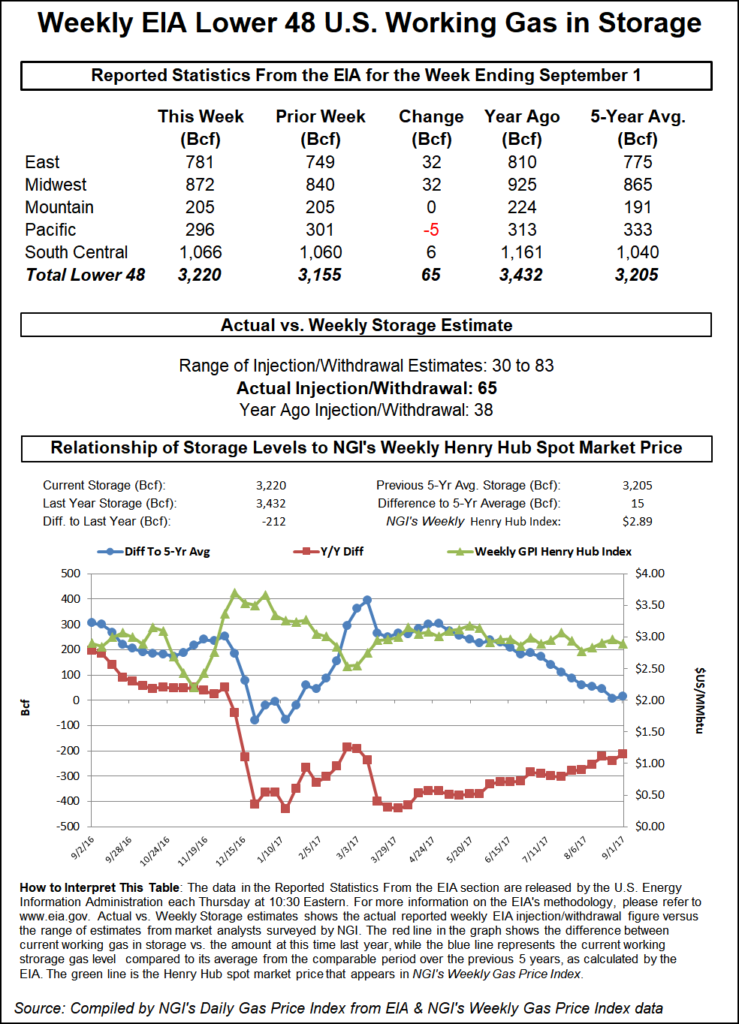

The Energy Information Administration (EIA) reported a storage build of 65 Bcf Thursday, in line with expectations, and futures were held to a lean 6 cent range. At the close October had eased 1.9 cents to $2.981, and November had fallen 1.6 cents to $3.053. October crude oil rose 50 cents to $49.16/bbl.

The October contract inched lower following EIA’s report, which showed a week/week storage injection about 1 Bcf greater than consensus estimates.

Just prior to the 10:30 a.m. EDT report for the week ending Sept. 1, the market was drifting within a 6-cent range, but when the number was released, October futures posted the early-session low of $2.977 and by 10:45 a.m. the contract was trading at $2.988, down 1.2 cents from Wednesday’s settlement.

Prior to the report traders were looking for a storage build about equal to the actual figures. Last year, however, 38 Bcf was injected and the five-year average build stood at 58 Bcf for the week. Kyle Cooper of ION Energy calculated a 64 Bcf injection and Stephen Smith Energy Associates estimated a 67 Bcf build. A Reuters survey of 22 traders and analysts showed an average 64 Bcf increase with a wide range of plus 30 Bcf to plus 83 Bcf.

“The market is within a 6-cent range so how badly can you get hurt with that,” a New York floor trader told NGI. “We’ve been trading right around the $3 level for how long now? It’s just kind of stuck in this range.”

The trader said that for the price action to indicate something meaningful it would have to break above $3.10. “Even if we trade above $3 for a couple of days it doesn’t seem to matter. You have to break above $3.10 for a few days and then you might see some momentum to the upside.

“Under $2.90 on the downside, then maybe you would see $2.75. We have just been drifting back and forth now for a long period of time.”

As for the market impact of looming Hurricane Irma “that is already in the market. We know where it is going.”

Inventories now stand at 3,220 Bcf and are 212 Bcf less than last year and 15 Bcf greater than the five-year average. In the East Region 32 Bcf was injected, and the Midwest Region saw inventories rise by 32 Bcf as well. Stocks in the Mountain Region were unchanged and the Pacific Region was down 5 Bcf. The South Central Region added 6 Bcf.

Analysts see a change in the Gulf tropical storm trading dynamic as the reason for the market’s recent failure to respond to Harvey and now Irma. “How quickly we forget the power of a hurricane to get the natural gas bulls going. These storms come through and we get a ho-hum out of it,” said Elaine Levin, president of Powerhouse LLC, a Washington DC-based trading and risk management firm.

As they might say in New York City… “fuhgedditaboutit.”

It was back in 2005 that the Gulf endured a double whammy of Katrina and Rita and “12 years later you see the massive structural changes shale gas has brought to the market. The fact that you had this massive Category 4 Hurricane go right into the Gulf and you had no response is the telling story,” Levin said.

Physical gas traders at eastern points weren’t forgetting anything as weather forecasters expected below normal temperatures in Boston and New York. Wunderground.com predicted Boston’s Thursday high of 72 would reach a pleasant 75 Friday before slipping to 67 on Saturday, 9 degrees off the seasonal norm. New York City was expected to see a high of 70 Thursday followed by a high of 73 Friday and a high of 69 Saturday, 8 degrees below normal.

Gas at the Algonquin Citygate shed 23 cents to $1.46, and deliveries to New York City via Transco Zone 6 tumbled 66 cents to $1.76. Gas on Tetco M-3 Delivery gave up 22 cents to $1.23 and packages on Dominion South retreated 21 cents to $1.20.

Spot prices at other points were less volatile. Gas at the Chicago Citygate dropped 3 cents to $2.83 and gas priced at the Henry Hub fell a nickel to $2.88. On Transco Zone 4 gas was quoted at $2.84, down 6 cents and gas at the NGPL Midcontinent Pool fell 4 cents to $2.73.

Kern Receipts changed hands a penny higher at $2.71 and Transwestern San Juan was quoted at $2.69, down 2 cents. Gas at the SoCal Citygate shed 7 cents to $3.18 and gas priced at the SoCal Border Average shed 2 cents to $2.83.

Longer term weather forecasts are expected slightly warmer, according to forecaster WSI Corp. in its morning 11- to 15-day outlook. “[Thursday’s] forecast is somewhat warmer than yesterday’s outlook over much of the Midwest and East, except perhaps along the northern tier, and slightly cooler over the interior west-central U.S.”

Risks to the forecast include temperatures running “still warmer over much of the eastern third of the U.S. if a trough does not redevelop across this region. However, models show significant inconsistency with each other and previous runs. Furthermore, any tropical activity approaching the East Coast could support the development of another deep trough in its wake.”

WSI also said that the course of deadly Hurricane Irma has not been fully determined, but its load killing properties are highly dependent on what direction it takes. For now, “Irma will track to the west-northwest between the Bahamas and northern coast of Cuba by Saturday and will begin to threaten southern Florida with gusty winds and squalls. Then during Saturday night and Sunday, the center of Major Hurricane Irma will turn northward toward southern and eastern Florida.

“The center of the system will remain on a northerly track that will bring Irma near eastern Georgia into the Carolinas by Monday and Tuesday. The exact track still needs to be fine-tuned and is critical to the severity of the impacts. Any small shift with the track has major implications. Nonetheless, damaging winds, flooding rain, surge, high waves, coastal erosion, etc, are major concerns. As a result, power outages are likely across Florida into the eastern Georgia and the Carolinas, including FPL, Progresses Energy Florida and Carolinas, Southern Company, SCE&G and Santee Cooper (SCPSA).”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |