Markets | NGI All News Access | NGI Data

NatGas Cash, Futures Hold Their Ground As Irma Approaches; October Adds 3 Cents

Stout declines at Northeast points were almost able to offset broad regional gains in physical natural gas trading Wednesday for Thursday delivery. The NGI National Spot Gas Average rose a penny to $2.63, and gains were posted in the Rockies, Appalachia, Louisiana, the Midcontinent and Midwest. Most locations in the Northeast, however, fell from a nickel to a dime.

Futures traders were engaged in another round of trying to assess load loss expected when a dangerous Hurricane Irma makes landfall in Florida, and although demand destruction is expected to be formidable, no one wants to be short the market this time of year. At the close October had risen 2.8 cents to $3.000 and November had gained 2.5 cents to $3.069. October crude oil added 50 cents to $49.16/bbl.

“I’m impressed with the market’s ability not to fall too far below $3,” said Tom Saal, vice president at FCStone Latin America in Miami as he was preparing for what looked like an onslaught from Hurricane Irma.

“Even with the low demand summer we have had, I think it shows underlying fundamental support from exports. Going forward the fundamental story of the year is exports.

“[Demand loss from Irma] could bring the market down to test support levels we have been seeing in the low $2.80s if that were the case. Power could be knocked out for a lot of people in the States.

“The funds are still pretty long natural gas, and I think storage levels will not be where they were a year ago going into winter, and that’s another underlying support in the market. Now is not the time to be short the market. You could get caught in a technical rally.”

Another element of demand loss is reflected in the inability to export liquefied natural gas (LNG) via Cheniere Energy Inc.’s Sabine Pass export terminal. “Port Arthur reopened late last week but with draft restrictions that still prevent LNG vessels from entering,” said Eric Fell, analyst with Genscape. Prior to Hurricane Harvey LNG exports from Sabine were running 2 Bcf/d, but “as a result of the lack of vessels and Sabine’s storage nearing capacity, nominations to Sabine remain well below 0.5 Bcf/d.”

Getting those exports back up to prior levels “is all dependent upon conditions at Port Arthur,” said Fell. “The hurricane and flooding caused the Port to be closed for a while due to debris and silt in the channel. It’s now opened to vessels but there are draft restrictions which are keeping boats like crude oil tankers and LNG carriers out.

“They haven’t been able to get a boat in in two weeks, and as they continued to liquify they came close to storage capacity and had to ramp down volumes really hard. It’s all a matter of when Port Arthur can get the big boats in.”

Futures traders see the market injecting storm premium in spite of the fact demand destruction is what seems to be in play. “The market was able to advance by about 1% [Wednesday] on what appeared to be insertion of storm premium related to hurricane Irma,” said Jim Ritterbusch of Ritterbusch and Associates in closing comments. “Although Irma is unlikely to impede much Gulf of Mexico gas production, the magnitude of this storm would appear to support several cents worth of risk premium. However, demand deterioration and the cooling effects of both Harvey and Irma appear to be outweighing any loss of production.

“This is keeping the gas market trapped at about the middle of a three week, 20 cent trading range but with upside still exceeding downside possibilities. We continue to cite a minuscule supply surplus as a bullish consideration that will keep the market sensitive to even minor supply disruptions. While this surplus against five year averages could increase by around 7 Bcf with tomorrow’s Energy Information Administration (EIA) data, little cushion will exist for any abnormal weather patterns as the shoulder period arrives in a couple of weeks.

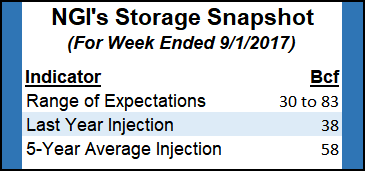

“We will be looking for seasonal injection of about 55 Bcf that would compare with the five year average build of 58 Bcf and last year’s 38 Bcf increase. We are maintaining a bullish stance for now and suggest holding long October positions with stop protection still suggested below $2.92.”

In physical trading prices were widely mixed. Gas at the Algonquin Citygate fell a dime to $1.69, and packages on Transco Zone 6 New York shed 8 cents to $2.42. Deliveries to Tetco M-3 rose a penny to $1.45, and gas on Dominion South rose 3 cents to $1.41.

Gas at the Chicago Citygate added 3 cents to $2.86, and parcels at the Henry Hub were quoted 7 cents higher at $2.93. Gas on El Paso Permian changed hands a penny higher at $2.69 and gas on Panhandle Eastern rose a dime to $2.70.

At Opal next day deliveries came in at $2.70, up 6 cents and at Malin deliveries rose 4 cents to $2.73. Gas at the SoCal Citygate skidded 12 cents to $3.25, and packages priced at the SoCal Border Average fell a nickel to $2.85.

The Thursday EIA storage report is likely to give traders some clues as to the demand/production losses associated with Hurricane Harvey. Last year 38 Bcf were injected and the five-year pace stands at 58 Bcf. Kyle Cooper if ION Energy predicts a build of 64 Bcf, and Stephen Smith and Associates calculates a 67 Bcf increase. A Reuters survey of 22 traders and analysts revealed a 64 Bcf average with a range of plus 30 Bcf to plus 83 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |