Regulatory | Infrastructure | NGI The Weekly Gas Market Report

Dominion South Boosted as Rover Phase 1A Now Flowing 600 MMcf/d-Plus

Energy Transfer Partners LP’s Rover Pipeline was flowing just above 600 MMcf/d out of eastern Ohio Wednesday after ramping up over the holiday weekend, helping to lift Appalachian Basin prices amid recent weakness at regional hubs.

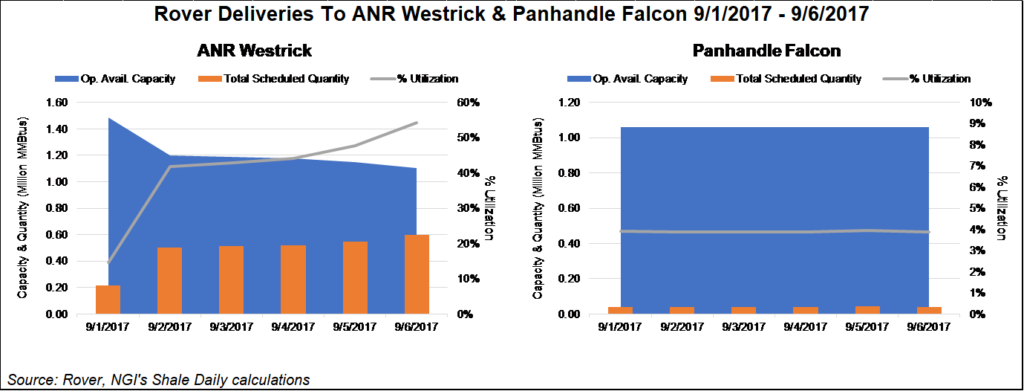

After receiving its in-service authorization from FERC last week, Rover began flowing last Friday, delivering 258 MMcf/d from the Ohio River System (ORS) in Cadiz, OH, to interconnects with Panhandle Eastern and ANR in northwest Ohio, according to data from PointLogic Energy.

As of Wednesday, Rover had ramped up to more than 600 MMcf/d, delivering volumes received from the Ohio River System and from MarkWest’s Cadiz processing plant to ANR and Panhandle, PointLogic data show.

Genscape Inc. reported similar volumes and said in a recent note to clients that it has observed “continuing growth in ORS deliveries to Rover, while ORS deliveries to REX and Tetco have flattened/declined, suggesting that incremental growth of the system will continue to be seen via Rover volumes. The vast amount of Rover volumes are rerouted from REX and Tetco, though there is a small amount of incremental production growth evident in the ORS based on overall aggregate volumes being delivered.”

Appalachian producers are no doubt cheering the arrival of the additional takeaway on Rover, especially as regional prices have languished heading into the fall shoulder season. Coming off a steep drop heading into the holiday weekend, the Rover volumes appeared to put some upward pressure on Dominion South pricing to start the week.

In Tuesday trading Dominion South averaged $1.38/MMBtu, up 33 cents on the day, according to Daily GPI prices. In Friday trading gas at Dominion South went for $1.05/MMBtu, down almost 40 cents on the day.

PointLogic analyst Luke Larsen described this as the “typical rude Labor Day weekend treatment” for regional prices. Larsen said gas for weekend delivery at Dominion South traded at levels not seen since last October, when a storage glut had Appalachian prices swooning below $1/MMBtu.

On Tuesday, “Dominion reported nonproprietary working gas inventory levels at 233 Bcf as of the end of August 2017, which was a one-week increase of 11 Bcf,” Larsen said. “Last year for the same week the increase was only 5 Bcf. This narrowed the year-on-year shortfall from 20 Bcf down to only 14 Bcf as the pipeline headed into the holiday.”

BTU Analytics LLC analyst Jake Fells said the initial volumes on Rover appear to be “coming at the expense, at least in part, of other pipes.

“Our view is that production will grow through the end of the year as projects come online over the next couple of months…including Rover Phase 1B at some point later this year.”

The highly anticipated $4.2 billion Rover, designed to transport Marcellus and Utica shale gas to markets in the Midwest, Gulf Coast and Canada, was scheduled to begin service earlier this year but has been delayed following multiple hang-ups with FERC and state regulators.

Rover has been waiting for FERC to lift a moratorium on horizontal directional drilling (HDD) for the project, which the Commission issued in May in response to a roughly 2 million gallon drilling fluids spill that occurred during project construction. Rover filed a number of documents to the FERC project docket Wednesday [CP15-93] related to its plans for the remaining HDDs as it seeks to address the Commission’s concerns.

Energy Transfer management said during a 2Q2017 conference call that it would take about 40 days to complete HDD work for Phase 1B once FERC lifts the moratorium. Rover’s Phase 2, which would bring the project up to its full 3.25 Bcf/d designed capacity, is projected to come online by early December.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 1532-1266 |