Markets | NGI All News Access | NGI Data

NatGas Cash Drops as Harvey Pummels Pipelines; October Futures Drop 4 Cents

Physical natural gas for Thursday delivery weakened in Wednesday’s trading; weakness in California along with soft pricing in Louisiana, the Midcontinent and Midwest offset gains in the Northeast. Pipelines reported Harvey-driven damage, and the NGI National Spot Gas Average fell 3 cents to $2.67.

Futures trading was uninspired, and the spot October contract was confined to less than a 6-cent range. At the close October had fallen 4.4 cents to $2.939 and November was off 3.9 cents to $3.014. October crude oil fell 48 cents to $45.96/bbl.

Not only has Harvey had a destructive impact on production, but pipelines have been compromised in a number of instances. Texas Eastern Transmission announced a Harvey-caused force majeure which affects all meters on its Cameron Lateral, according to industry consultant Genscape. The company said it would not allow any flow on the lateral until it was sure that it had not sustained damage from Hurricane Harvey. Flows on the lateral had averaged 9 MMcf/d from July 30 to Aug. 27 but dropped to just above zero since then. Genscape noted that TETCO plans to conduct an inspection of the lateral as soon as weather permits.

In addition Golden Triangle Storage near Beaumont, TX, declared a force majeure and said they will halt injections and withdrawals due to conditions imposed by Hurricane Harvey, Genscape said.

“The two most active interconnects on the line — interconnects with Kinder Morgan Texas and TETCO — have dropped to zero as a result. Recent receipts onto Golden Triangle from TETCO were about 50 MMcf/d; deliveries onto Kinder Morgan Texas were about 40 MMcf/d,” Genscape said.

Since deliveries and receipts were closely matched, “this event is affecting what would otherwise be an expected 10 MMcf/d of injections into storage at the Golden Triangle facility. Total max impact to gas flows on the Golden Triangle system is estimated at 90,000 MMBtu/d.”

These outages are on top of other prominent curtailments between Enterprise TX and TGP interconnects at Delmita, Santa Elena, Gilmore, and San Salvador. NGPL declared a Force Majeure on Segment 22 Southbound on August 24, and on the Louisiana Line on August 27, according to Genscape.

In its 4 p.m. CDT report the National Hurricane Center (NHC) reported that Harvey was located 50 miles north of Lake Charles, LA, and was still packing winds of 40 mph. Harvey is moving erratically toward the north-northeast near 8 mph and this general motion is expected to continue through Thursday. A turn toward the northeast is expected Thursday night and Friday. On the forecast track, the center of Harvey should move through southwestern and central Louisiana Wednesday and Wednesday night, then move through northeastern Louisiana and northwestern Mississippi Thursday and Thursday night, NHC said.

If Harvey weren’t enough NHC is also following Tropical Storm Irma, located in the far eastern Atlantic about 420 miles west of the Cabo Verde Islands. It’s up to 50 mph and is heading west at 13 mph. Some strengthening is anticipated during the next 48 hours, and Irma could become a hurricane on Friday, NHC said.

In physical market trading prices were mostly lower across the board. Gas at the Algonquin Citygate shed 4 cents to $2.10 and deliveries to New York City via Transco Zone 6 was flat at $1.88. Gas on Tetco M-3 Delivery was quoted 3 cents lower at $1.67 and packages priced at Dominion South fell 10 cents to $1.60.

At the Chicago Citygate gas for Thursday delivery gave up 2 cents to $2.79 and deliveries at the Henry Hub changed hands 2 cents lower at $2.86. Gas on El Paso Permian fell 2 cents to $2.65 and parcels on Northern Natural Demarcation eased 4 cents to $2.71.

Next day gas at California points fell as power loads, still forecast at near-record levels, were expected to moderate slightly. Gas at Malin fell a nickel to $2.76, and gas at the PG&E Citygate retreated 3 cents to $3.36. Gas at the SoCal Citygate tumbled 19 cents to $4.60 and gas priced at the SoCal Border Average slipped 8 cents to $4.05.

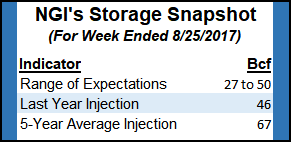

The 10:30 a.m. EDT report on inventories by the Energy Information Administration (EIA) may divert trader attention from the ravages of Harvey as estimates are coming in well below both short- and long-term averages. Last year 46 Bcf were injected and the five-year pace is for a 67 Bcf build. This week estimates are coming in around 30 Bcf or less.

Ritterbusch and Associates calculates a 29 Bcf build and Citi Futures is expecting an increase of 35 Bcf. A Reuters poll of 19 traders and analysts showed an average 32 Bcf with a range of plus 27 Bcf to plus 50 Bcf.

The bullish argument for diminished productive capacity is not fully in place just yet, and market technicians see conditions where prices could still work lower. “Despite the slow progress bulls are still in a position to grind out a seasonal bottom,” said Brian LaRose, analyst with United ICAP in closing comments. LaRose said he wants to see several things happen before he is willing to call $2.753 a market low. “Top on my list are one, a move well above $3.10 by the October contract, two a breach of $.380-.403 in the March/April spread, and three, a breach of the $2.991/3.010 highs in the April contract. Have no reason to seriously entertain a recovery otherwise.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |