Infrastructure | E&P | Marcellus | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

Marcellus, Utica NatGas Growth Paced by Processing, Fractionation Capacity, EIA Says

A dramatic increase in processing and fractionation capacity in Appalachia since 2010 has helped set the pace for the region’s natural gas production growth, with more expansion on the horizon, the Energy Information Administration (EIA) said in a note Tuesday.

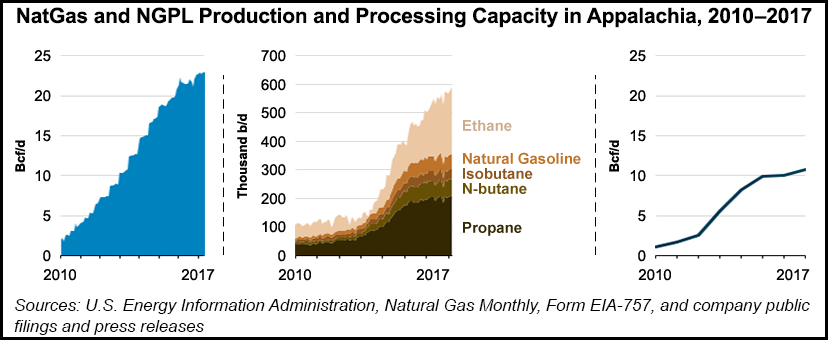

EIA said it estimates natural gas processing capacity in Kentucky, Ohio, Pennsylvania and West Virginia has increased nearly tenfold since the early years of shale development in Appalachia, going from 1.1 Bcf/d in 2010 to 10 Bcf/d in 2016.

“The additional capacity to process natural gas has supported growth in production of both natural gas and natural gas plant liquids (NGPL), with natural gas production in those states increasing from 2 Bcf/d in January 2010 to 22.9 Bcf/d in May 2017,” EIA said, noting that NGPL production grew from 106,000 b/d to 621,000 b/d over the same period.

EIA’s Drilling Productivity Report estimates that Marcellus and Utica shale production has continued to grow over the past few months. EIA’s Short-Term Energy Outlook expects that growth to continue through the remainder of 2017.

EIA said it expects natural gas processing capacity in Appalachia to increase by 2.5 Bcf/d over the next two years.

The new processing plants being added in Appalachia “can recover more propane than plants using older processing technologies and can more easily adjust their equipment to extract more or less ethane from the natural gas stream” depending on market conditions, EIA said.

Meanwhile, in Appalachia, “unlike in other producing regions, all liquids extracted are fractionated locally. As a result, the natural gas processing capacity buildout in the Appalachian region has been accompanied by significant additions to regional fractionation capacity.”

EIA said Appalachian fractionation capacity has increased from an estimated 41,000 b/d in 2010 to nearly 850,000 b/d in 2016, and that capacity could climb to 1.1 million b/d by 2019.

“Because natural gas produced in the Appalachian region tends to contain higher amounts of ethane than in other U.S. production, natural gas processing plants in the region extract most ethane separately from the remaining NGPL stream to manage pipeline natural gas heat content,” EIA said. “De-ethanization capacity in the region has grown from none in 2010 to more than 200,000 b/d in 2016, and it may reach 350,000 b/d by 2019.

“In addition to helping gas quality meet requirements on natural gas pipelines, de-ethanization capacity also helps provide supplies to meet increasing domestic and global demand for ethane as a petrochemical feedstock.”

As production has increased, natural gas prices in the Marcellus and Utica have shown signs of infrastructure constraints this summer, trading at large negative basis differentials after seeing some improvement earlier in the year.

But more Appalachian takeaway capacity is on the way to support the continued expansion of regional production, processing and fractionation.

Energy Transfer Partners LP’s Rover Pipeline is under construction and looking to start up the first of the 3.25 Bcf/d, $4.2 billion project’s facilities by the end of the month.

The Nexus Gas Transmission pipeline, a 1.5 million Dth/d east-to-west takeaway project targeting markets in the Midwest and Canada, received a certificate from FERC.

Meanwhile, the southbound Atlantic Sunrise expansion, designed to carry more gas out of the northeastern Marcellus via the Transcontinental Gas Pipe Line (Transco), received authorization this week to start-up about 400,000 Dth/d of incremental capacity on the project.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |