Infrastructure | E&P | NGI All News Access

Haynesville Rigs Surpass Marcellus for First Time Since 2011; U.S. Count Down Six

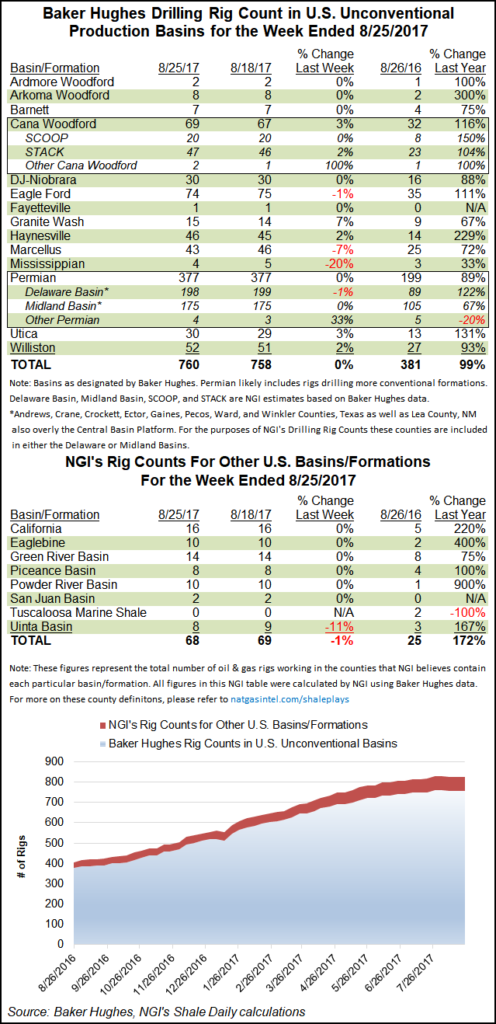

Led by declines in the Marcellus Shale, the U.S. rig count fell by six for the week ending Friday, as two natural gas-directed and four oil-directed units left the patch, according to data from Baker Hughes Inc. (BHI).

The United States ended the week at 940 rigs versus 489 running a year ago. The weekly losses included three horizontal rigs, one directional rig and two vertical rigs. Canada added three rigs for the week, with a gain of nine gas-directed rigs offsetting six oil-directed rigs packing up, according to BHI.

The total North American rig count finished the week down three at 1,157, up from 635 in the year-ago period.

The biggest week/week decline occurred in the Marcellus, which dropped three rigs to end at 43 versus 25 rigs a year ago. The declines appeared to come from Pennsylvania, which dropped three rigs for the week to end at 31.

The decline represents the first week/week drop in the Marcellus since June. It also means that the Haynesville Shale, after adding one rig for the week to finish at 46, surpassed the mighty Marcellus for the first time in six years, cementing the once-forgotten East Texas/North Louisiana play’s resurgence after years of Appalachian natural gas dominance.

The last time the Haynesville had more rigs than the Marcellus was in 2011, when both plays were flying high at north of 100 rigs, according to an analysis of BHI data. The Haynesville began to fall off in 2012 and had as few as 12 rigs running during the depths of the downturn in 2016. Both plays have seen steady growth in drilling activity since, though the Haynesville has now added more rigs year/year at 32 versus 18 added year/year in the Marcellus.

The Haynesville, advantageously positioned near Gulf Coast demand pull from liquefied natural gas and pipeline exports to Mexico, has seen its rig count triple from 14 rigs running a year-ago.

Meanwhile, the drilling increases in the Marcellus have contributed to widening basis differentials as producers wait on new takeaway projects like the 3.25 Bcf/d Rover Pipeline to hit the market.

Among other plays, the Utica Shale added a rig for the week to end at 30, from 13 rigs running a year ago, according to BHI. The Cana Woodford climbed two rigs to end at 69 for the week, while the Granite Wash added one.

North Dakota’s Williston Basin added a rig for the week to end at 52, nearly double its year-ago tally of 27.

The Eagle Ford Shale in Texas dropped a rig during the week, finishing at 74. The Mississippian Lime also saw one rig depart, leaving its tally at four.

Among states, Texas dropped three rigs during the week, while Oklahoma, Utah and Alaska each dropped one.

Amid the slowdown in the rig count, producers are adding to their hedge positions to meet output targets, according to a recent analysis conducted by ESAI Energy LLC. The firm reviewed 35 prominent exploration and production companies and found that more than 65% of their expected production is hedged for the remainder of 2017.

“Total 2017 shale output will average 5.2 million b/d, 580,000 b/d higher than last year,” ESAI said. “Producers will seek to increase their hedges for 2018, but will need to cover their full-cycle costs for sustainable growth. Even with a slowdown in rig count, shale production, led by the Permian Basin, will rise roughly 450,000 b/d to average 5.6 million b/d in 2018. Hedging will increase and support further growth if the forward curve for West Texas Intermediate moves over $50/bbl.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |