EIA’s Bullish Storage Revision Overshadows Plump Weekly Injection; September Moves Higher

September natural gas saw a six-cent turnaround Thursday in the minutes following the 10:30 a.m. EDT release of the Energy Information Administration’s (EIA) weekly storage inventory report, which included a bullish 9 Bcf downward revision to working gas stocks for the week ended Aug. 4.

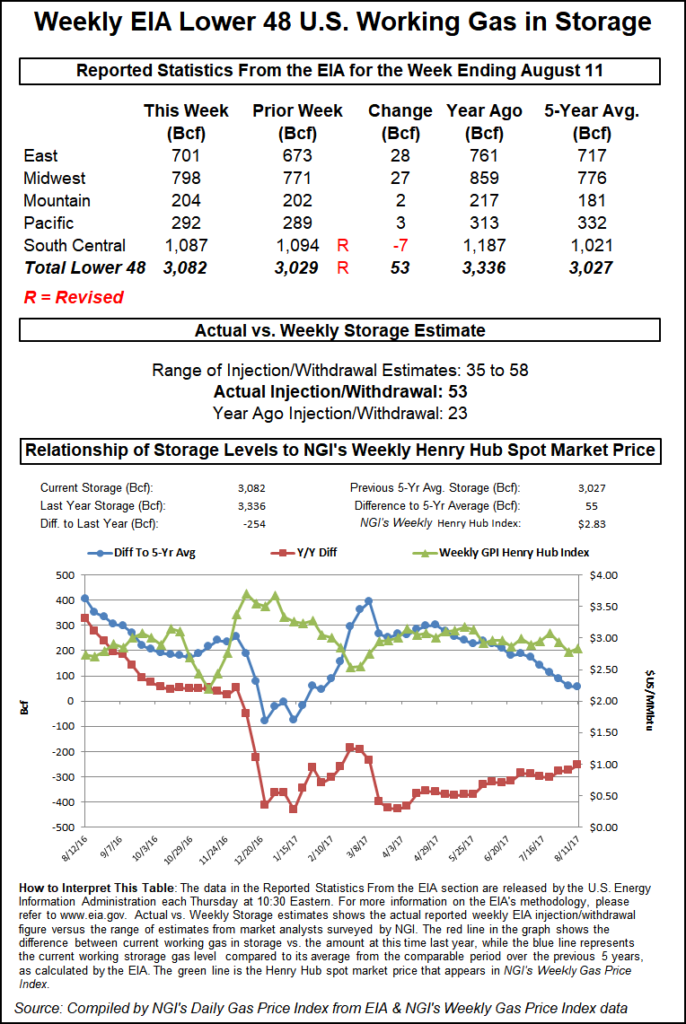

The market initially seemed unsure of what to do with EIA’s figures. EIA reported an implied 53 Bcf build for the week ended Aug. 11, higher than most estimates and 3 Bcf above the five-year average build of 50 Bcf. The minute the weekly injection figure went live, the September contract traded as low as $2.856, about 3 cents down from Wednesday’s settle of $2.890.

But then traders digested EIA’s revisions, which resulted in an average 10 Bcf reduction for the weeks between June 30 and Aug. 4 based on reclassifying working gas to base gas. As a result, EIA reduced the 3,038 Bcf of total working gas stocks in last week’s report down to 3,029 Bcf.

By 10:40 a.m. EDT, the September contract traded as high as $2.921, up 3 cents from Wednesday. By 11 a.m. EDT, the market had settled into a range of around 1-2 cents higher than the previous day’s close.

“The natural gas market is sorting out the mixed messages from this morning’s storage report,” Citi Futures’ Tim Evans said. “The 53 Bcf injection for the week ended Aug. 11 was somewhat more than the 48-50 Bcf consensus expectation and above the 50 Bcf five-year average for the date, and so incrementally bearish on that account.

“However, there was also a material…downward revision to prior data since June 30 as working gas was reclassified as base gas. In our view, the reclassification is a clear bullish surprise, with less working gas available to supply the market than the market had assumed.”

Prior to the release of the storage figures, most estimates called for an injection slightly below the five-year average but higher than the 28 Bcf (revised up to 30 Bcf) build reported last week. A Bloomberg survey produced an injection range spanning from 35 Bcf to 58 Bcf with a median expectation of a 49 Bcf build.

The revisions affected the South Central region, which saw total stocks end the report week at 1,087 Bcf (283 Bcf salt, 804 Bcf nonsalt), an implied weekly withdrawal of 7 Bcf. The East saw a weekly injection of 28 Bcf to end at 701 Bcf. The Midwest finished at 798 Bcf, up 27 Bcf week/week. The Mountain and Pacific regions ended the week at 204 Bcf (plus 2 Bcf) and 292 Bcf (plus 3 Bcf) respectively.

Total working gas in storage for the week ended Aug. 11 stands at 3,082 Bcf, higher than the five-year average 3,027 Bcf but well below inventories of 3,336 Bcf in the year-ago period.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |