U.S. Onshore Drilling Declines Focused in Texas; Rig Counts Steady Elsewhere

Driven by a sharp drop in natural gas drilling, five U.S. rigs packed up for the week ended Friday (Aug. 11), according to data released Friday by Baker Hughes Inc. (BHI).

The domestic rig count finished the week at 949, down from 954 the week before but well above 481 rigs running a year ago. Eight natural gas-directed rigs left the patch in the United States, canceling out a weekly gain of three oil-directed rigs. After posting heavy losses the previous week, the Gulf of Mexico added a rig to finish at 17, in line with year-ago totals.

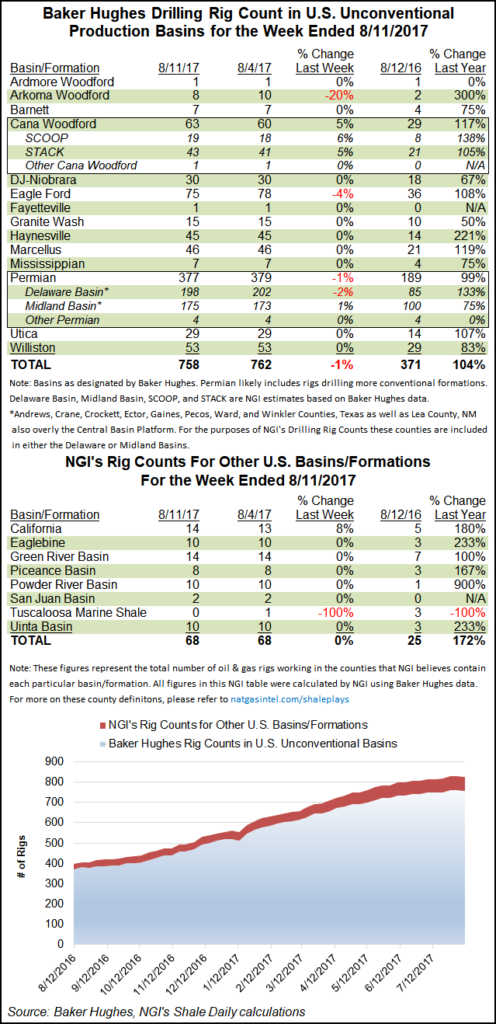

The onshore declines were focused in Texas, which lost seven rigs for the week to finish at 459, according to BHI’s state-by-state breakdown. Among Texas plays, the Eagle Ford Shale in South Texas lost three rigs to end at 75 (up from 36 in the year-ago period), while the Permian Basin dropped two rigs to wrap up the week at 377 (up from 189 a year ago).

Canada finished at 220 rigs for the week, adding three oil-directed rigs while natural gas rigs held flat at 93, according to BHI.

The total North American rig count ended at 1,169, down two week/week and up from 607 rigs running a year ago.

Outside of Texas, most of the U.S. onshore held steady for the week. In Oklahoma, the Arkoma Basin’s Woodford play dropped two rigs to end at eight for the week, but that was offset by a gain of three rigs in the Cana Woodford, which finished at 63 rigs (up from 29 a year ago). The last rig running in the Tuscaloosa Marine Shale packed up and went home during the week, according to NGI’s Shale Daily calculations based on BHI data.

The 4% week/week drop in the U.S. gas rig count comes amid a disappointing cooling season and sustained sub-$3 prices in the day-ahead and futures markets. The September Henry Hub contract had been languishing in the $2.80s/MMBtu before the Energy Information Administration reported yet another lean storage build that spurred a 10-cent climb in futures Thursday.

“It seems like the fallback in gas prices in recent weeks may be starting to translate to a lower gas-focused rig count,” said NGI’s Patrick Rau, director of strategy & research. “Of course, the majority of those released rigs were in Texas. It will be interesting to see whether the further delay in the Rover Pipeline will lead to any kind of rig reductions in Ohio and Pennsylvania.”

Rau said the gas-directed rigs that left the patch may have been lower horsepower rigs, as exploration and production (E&P) companies continue to prize the higher-spec rigs capable of drilling longer laterals.

“In fact, demand for those will likely continue to grow, even if the absolute U.S. rig count falls over the coming weeks,” Rau said. “In the face of lower commodity prices, producers will seek to lower their costs and improve their efficiencies all the more, everything else being equal. More and more these super specification (spec) rigs are becoming the vehicle to drill those more efficient, longer-lateral wells, and once they get their hands on a super spec rig, operators are loathe to let go.”

In a recent note, Evercore ISI analyst James West said he doesn’t see the U.S. rig count declining as much in 2018 as some have forecast, as long as oil prices remain at around current levels. “What’s the probability that the rig count sees a 25% decline,” from around 950 rigs in 2018, “as many expect?” he asked. That probability is “very low, in our view, in a roughly $50/bbl West Texas Intermediate environment.”

The Big Oil majors are running “around 90 rigs, and that number seems pretty solid considering the deals they have done and the fact they are down from 185 in 2014,” West said. “If every public E&P ran 20% fewer rigs — and that would imply complete capitulation on multi-year growth plans (probably a $40-45/bbl scenario) — that would be 105 horizontal rigs from current levels.

“The question will be the privates, two-thirds of whom are running under three rigs,” West said. Operators “need to believe in sub-$50/bbl” or it could be “a complete end to the acquisition and development cycle for those sponsor-backed entities to retrench by 150 (50%).”

According to running tally calculated by NGI’s Shale Daily based on 2Q2017 reports, North American E&Ps are planning to pare back 2017 capital expenditures by about 2% cumulatively from spending levels announced earlier in the year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |