NatGas Cash Trails EIA Data-Driven Futures; September Adds a Dime

All attention was focused on the futures arena Thursday as physical natural gas traders for the most part hunkered down and got their deals done ahead of the Energy Information Administration (EIA) inventory report. Physical traders may have been a little clairvoyant, as gains in the cash market preceded a double-digit advance by the futures.

Only three cash points followed by NGI failed to make it to positive territory, and double-digit rises were posted by Northeast, Appalachia and Midcontinent locations. The NGI National Spot Gas Average rose 2 cents to $2.64.

The EIA reported a lean 28 Bcf storage injection Thursday morning, and September futures followed with an immediate 10 cent surge. By the time the dust had settled September had registered a stout 10.2 cent advance to $2.985, and October had tacked on 9.7 cents to $3.017. September crude oil dropped 97 cents to $48.59/bbl.

Natural gas futures bulls welcomed the dose of supportive fundamentals from the less-than-expected underground storage build for the week ended Aug. 4.

Heading into Thursday’s 10:30 a.m. EDT report, September natural gas futures were hovering around $2.895, but in the half hour after the number was revealed, the prompt month contract sprung to a high of $2.989, up 10.6 cents from Wednesday’s regular session close. As of 11:30 a.m. EDT, the September contract was still threatening the psychological $3 price level as it traded at $2.985.

Citi Futures’ Analyst Tim Evans called the storage number “bullish,” noting that it could be a sign of things to come.

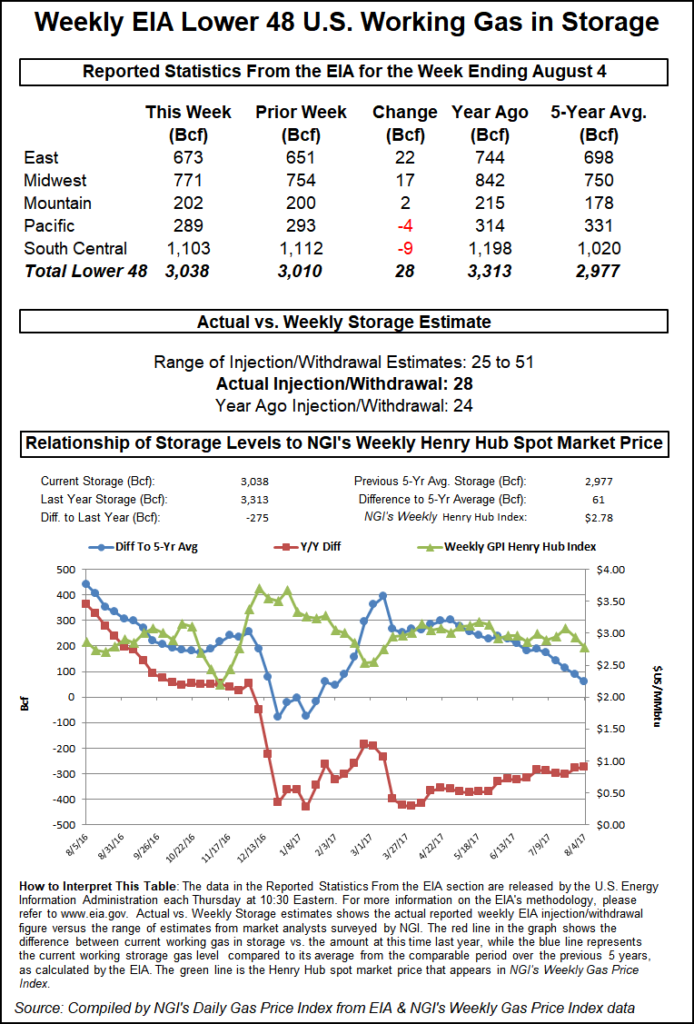

“The 28 Bcf net injection was bullish relative to both expectations for a more robust 36 Bcf build and the 53 Bcf five-year average refill,” he said. “The smaller build implies a somewhat tighter balance for the weeks ahead.”

The report may be an indicator of things to come, but traders note that the market has visited the $3 level numerous times in the last several weeks only to come away disappointed. “A real test will come Friday if traders show they are in for a longer-term bullish move or if they just take quick profits off this move and send the market back down to the $2.80s,” a New York floor trader told NGI.

In the days leading up to the storage report, Wells Fargo Securities LLC had been expecting a 35 Bcf injection, while Tradition Energy was looking at a 40 Bcf build, and a Reuters survey of 24 traders revealed an average 36 Bcf increase with a range of injections from 25 Bcf to 49 Bcf. Last year 24 Bcf was injected for the week.

As of Aug. 4, working gas in storage stood at 3,038 Bcf, according to EIA estimates. Stocks are now 275 Bcf less than last year at this time, but still 61 Bcf above the five-year average of 2,977 Bcf.

From a storage/supply perspective bullish clouds are gathering, but if government estimates are correct the case for higher prices will be facing strong headwinds in the form of increased production.

Dry natural gas production from U.S. onshore basins is expected to increase 1.2 Bcf/d this year from 2016, averaging 73.5 Bcf/d, according to the EIA.

However, domestic exports to overseas markets also should continue to strengthen, government researchers said Tuesday in the August Short-Term Energy Outlook (STEO).

The forecast for total U.S. 2018 gas production is an increase of 3.9 Bcf/d from 2017 to 77.34 Bcf/d, up from a previous estimate of 76.42 Bcf/d.

The United States should become a net gas exporter in 2018, a shift already underway this year as gas exports exceeded imports in three of the first five months of 2017.

Bulls also got a boost from near term weather forecasts calling for warmer temperatures. MDA Weather Services in its morning six- to 10-day outlook said the nation could expect “a more zonal flow stemming from less amplification in the omega block over Canada and a diminishing influence from a fading risk for development with tropical Invest 99 in the Atlantic.” MDA said these events have the forecast trending warmer in this period, with these changes focused in the Plains, Midwest and East.

“Despite this, near normal temperatures remain the favored solution for most areas across the Lower 48, with the exceptions being early period belows in the mid-South and late period aboves in parts of the West. Aboves are also seen in western Texas, with most of Texas carrying hotter risks in a drier regime.”

Expectations of muggy, uncomfortable weather Friday in major eastern markets were enough to send next-day physical prices bounding higher. AccuWeather.com forecast that New York City’s high Thursday of 83 would slip to 82 Friday but when adjusted for humidity the high was 92. Saturday’s high is forecast at 78, 5 degrees below normal. Philadelphia’s Thursday high of 87 was anticipated to ease to 84 (90 adjusted for humidity) Friday, and slide to 83 Saturday, 3 degrees below normal.

Gas at the Algonquin Citygate was flat at $2.08 and packages bound for New York City on Transco Zone 6 soared 21 cents to $1.98. Tetco M-3 Delivery added 10 cents to $1.73 and gas delivered to Dominion South was quoted 9 cents higher at $1.68.

Deliveries to the Chicago Citygate fetched $2.83, up 3 cents and gas at the Henry Hub changed hands 2 cents higher at $2.87. Gas on El Paso Permian rose 5 cents to $2.66 and gas priced on Panhandle Eastern came in a dime higher at $2.56.

At the Cheyenne Hub Friday gas added 3 cents to $2.59, and gas on Transwestern San Juan rose 7 cents to $2.66. Parcels at the PG&E Citygate rose 2 cents to $3.28 and gas priced at the SoCal Border Average added 3 cents to $2.82.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |