Bullish Storage Build Puts Pressure on $3 Natural Gas

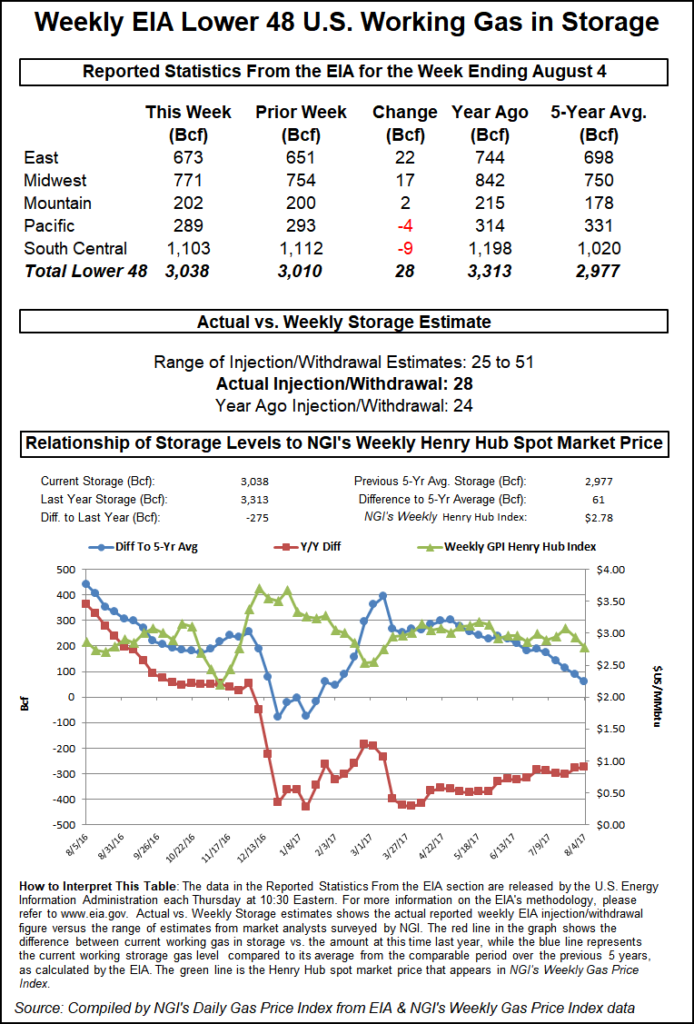

Natural gas futures bulls received a dose of supportive fundamentals Thursday morning as the Energy Information Administration reported that a less-than-expected 28 Bcf was injected into underground storage for the week ended Aug. 4.

Heading into Thursday’s 10:30 a.m. EDT report, September natural gas futures were hovering around $2.895, but in the half hour after the number was revealed, the prompt month contract sprung to a high of $2.989, up 10.6 cents from Wednesday’s regular session close. As of 11:30 a.m. EDT, the September contract was still threatening the psychological $3 price level as it traded at $2.985.

Citi Futures’ Analyst Tim Evans called the storage number “bullish,” noting that it could be a sign of things to come.

“The 28 Bcf net injection was bullish relative to both expectations for a more robust 36 Bcf build and the 53 Bcf five-year average refill,” he said. “The smaller build implies a somewhat tighter balance for the weeks ahead.”

In the days leading up to the storage report, Wells Fargo Securities LLC had been expecting a 35 Bcf injection, while Tradition Energy was looking at a 40 Bcf build, and a Reuters survey of 24 traders revealed an average 36 Bcf increase with a range of injections from 25 Bcf to 49 Bcf. Last year 24 Bcf was injected for the week.

As of Aug. 4, working gas in storage stood at 3,038 Bcf, according to EIA estimates. Stocks are now 275 Bcf less than last year at this time, but still 61 Bcf above the five-year average of 2,977 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |