Domestic NatGas Supply Forecast to Increase in 2017, 2018, Says EIA

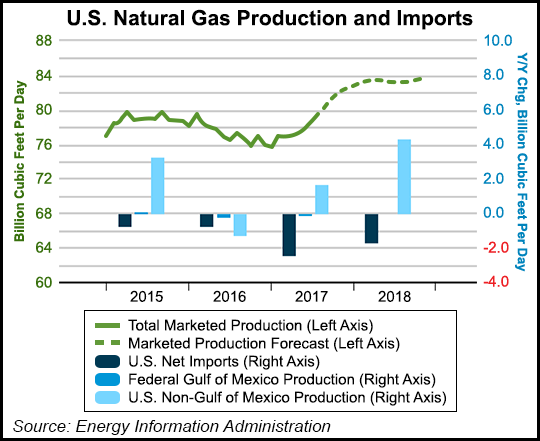

Dry natural gas production from U.S. onshore basins is expected to increase 1.2 Bcf/d this year from 2016, averaging 73.5 Bcf/d, according to the Energy Information Administration (EIA).

Domestic exports to overseas markets also should continue to strengthen, government researchers said Tuesday in the August Short-Term Energy Outlook (STEO).

The forecast for total U.S. 2018 gas production is an increase of 3.9 Bcf/d from 2017 to 77.34 Bcf/d, up from a previous estimate of 76.42 Bcf/d.

The United States should become a net gas exporter in 2018, a shift already underway this year as gas exports exceeded imports in three of the first five months of 2017.

EIA also is forecasting gas prices to move higher.

“In July, the average Henry Hub natural gas spot price was $2.98/MMBtu, about the same as in June,” EIA noted. “Higher natural gas exports and growing domestic natural gas consumption in 2018 contribute to the forecast Henry Hub natural gas spot price rising from an annual average of $3.06/MMBtu in 2017 to $3.29/MMBtu in 2018.”

Last month EIA’s researchers estimated gas prices would average $3.10/MMBtu this year and $3.40 in 2018. The June STEO estimated gas prices would average $3.16 in 2017 and $3.41 in 2018.

New York Mercantile Exchange contract values for December 2017 delivery, in the five-day period ending last Friday (Aug. 3), “suggest that a range of $2.17/MMBtu to $4.48/MMBtu encompasses the market expectation for December Henry Hub gas prices at a 95% confidence level,” the STEO said. The Aug. 3 Henry price settled down 15 cents from July 3. Henry spot prices averaged $2.98/MMBtu in July, nearly unchanged from the June average.

Gas production in the Marcellus and Utica shales has risen substantially in recent years, often outpacing gas pipeline capacity growth, which in turn has pressured regional prices lower relative to the benchmark Henry price.

The front-month basis swap for Dominion South in southwestern Pennsylvania was minus $1.20/MMBtu as of last Friday, down from the average basis of minus 50 cents/MMBtu from January through May, EIA noted.

“This price decrease reflects constrained pipeline takeaway capacity, which drives producers to lower their natural gas prices. Prior increases in takeaway capacity in the region have narrowed the basis.”

Last November the Algonquin Incremental Market expansion began service, likely contributing to the basis swap narrowing by more than $1.00/MMBtu, according to EIA.

“The Dominion South basis swap could remain near minus $1.00/MMBtu without new takeaway capacity,” researchers said. However, the Federal Energy Regulatory Commission certified several gas pipeline projects for the region earlier this year.

“Once new capacity comes on line, especially from the Atlantic Sunrise and the Rover pipeline projects, the basis swap with Henry Hub could narrow.”

EIA also sees U.S. electricity generation declining this year by 1.2% from 2016, mostly reflecting forecasts of milder temperatures in 3Q2017 versus a year ago. Forecast generation is seen up by 1.8% in 2018 mostly on expectations of an upcoming colder winter.

“EIA expects the share of U.S. total utility-scale electricity generation from natural gas to fall from an average of 34% in 2016 to about 31% in 2017 as a result of higher natural gas prices, increased generation from renewables and coal, and lower electricity demand,” researchers said.

Meanwhile, coal’s forecast generation share now is expected to match natural gas in 2018, averaging 31-32%.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2158-8023 |