E&P | NGI All News Access | Permian Basin

Permian Pure-Play E&Ps Report Increased Production, Lower Operating Costs

Four pure-play exploration operators in the Permian Basin reported increasing production in the second quarter, especially for oil, while successfully batting down lease operating expenses (LOE).

Producers Callon Petroleum Co., Diamondback Energy Inc., Laredo Petroleum Inc. and RSP Permian Inc. took divergent positions during quarterly conference calls about their production guidance and capital expenditures (capex) for the remainder of the year. Executives also touched on a hot topic: increasing natural gas-to-oil ratios (GOR) in the massive basin.

Callon Output Jumps 68%

Natchez, MS-based Callon reported a 68% increase in oil production, to about 1.6 million bbl in 2Q2017 from 948,000 bbl in 2Q2016. Natural gas production also rose year/year to 2.5 Bcf from 1.65 Bcf, a 54% increase. Total production increased 65%, to 2.02 million boe (22,209 boe/d) from 1.22 million boe (13,451 boe/d).

LOEs declined by almost 15% sequentially, from $7.01/boe to $6.01/boe in 2Q2017. The company attributed the decrease to the increase in production volumes, as well as early-day benefits from infrastructure projects materializing throughout the three-month period.

In the Midland sub-basin, Callon during the quarter placed a combined 14 gross (9.7 net) wells into production in three operating areas — Monarch, Ranger and WildHorse — and is on pace to complete about 42 net wells in 2017. Last month, the company deployed a fourth rig in the Delaware sub-basin to drill its Spur prospect, and it still plans to deploy a fifth rig in the play in early 2018.

Second-half 2017 activity “will be well-balanced across our four operating areas, as an ongoing development of Monarch and Wildhorse are supplemented by our first operated wells at Ranger since 2015, and we take off on our development in the Delaware basin,” Callon COO Gary Newberry said during the quarterly earnings call. “Our Spur program will start with two single well pads in the lower Wolfcamp A, as we get our feet wet before transitioning to our typical multi-well pad development during the fourth quarter.”

Newberry also touched on higher GORs in the Permian. He said while the company had seen increased GOR in its legacy assets — such as the East Bloxom Field, in Upton County, TX — it would not impact the drilling for oil. Pioneer Natural Resources Co., during its quarterly conference call earlier this month, caused some consternation about rising GORs in the Permian.

“Over time you may well see an upward mobility or movement toward gas,” Newberry said, adding that all of the new well activity “is really highly oil concentrated. And it will stay that way for several years, before it really gets to steady-state flow and you start to have more and more gas break out in the formation.

“We are very confident about the oil type curve itself. But we are not surprised by a slow increase in GOR. It just does not impact the oil rig.”

Callon is keeping its production guidance for the full-year 2017 unchanged at 22,500-25,500 boe/d. It also affirmed spending $350 million on capital expenditures (capex) for operations during the year.

Callon reported net income of $31.6 million (16 cents/share) in 2Q2017, compared with a year-ago net loss of $71.9 million (minus 61 cents).

Diamondback LOEs Down 25%

Production more than doubled for Midland, TX-based Diamondback during the second quarter, to 7 million boe (76,977 boe/d) from 3.4 million boe (36,841 boe/d) in 2Q2016. Oil accounted for 75% of total production (5.2 million bbl), up slightly from 72% (2.4 million bbl) in the year-ago quarter.

LOEs declined by more than 25% from a year ago, from $5.57/boe to $4.14/boe in 2Q2017. The company lowered its LOE guidance for the full year to $3.75-4.75/boe, down from a previous forecast of $4.75-5.75/boe.

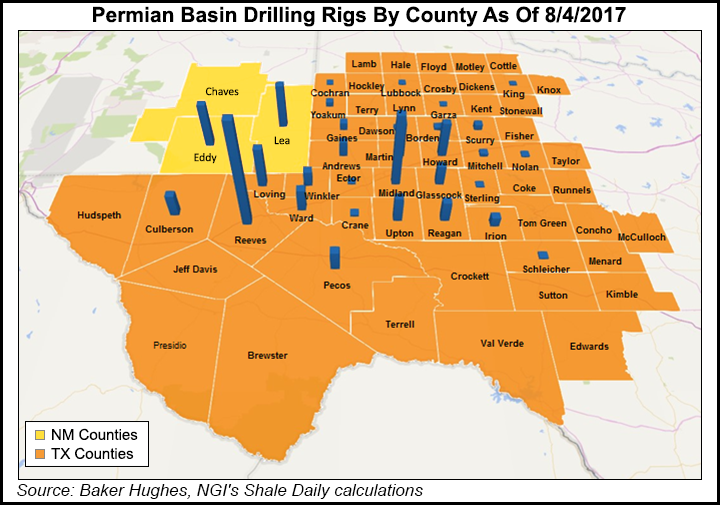

Diamondback averaged eight operated rigs — three in the southern Delaware, five in the Midland — during the quarter, drilling 34 gross horizontal wells and turning 35 wells into production. It deployed a ninth operated rig in the Midland last May. CEO Travis Stice said the company plans to operate eight or nine rigs for the rest of the year.

“We’re still trying to understand exactly what the return profile is going to look like for the southern Delaware wells,” Stice said during a conference call to discuss results. “As we underwrote acquisitions, we demonstrated, based on the data we had at hand, that the Wolfcamp A competed for capital from some of our better investment opportunities on the Midland Basin side. If that holds true, and we expect it will, then you’ll see us migrate more toward an equal allocation of activity on the Midland Basin side and the Delaware Basin side.

“We’re going to continue to monitor the returns we are getting, and we are going to allocate capital to the highest rate of return projects that are going to ensure that we generate the greatest corporate return. But as we understand it right now, we’re going to continue to allocate pretty equally on both sides of the basin, recognizing that we’re still early in the game on the Delaware and it’s going to take us a while to ramp up rig activity to equal what we have on the Midland Basin side.”

Diamondback increased its full-year production guidance to 74,000-78,000 boe/d from 69,000-76,000 boe/d. However, it lowered the high end of capex guidance for the year, from $1 billion to $950 million. Capex now is expected to be $800-950 million.

Diamondback’s net income in 2Q2017 was $158.4 million ($1.61/share), versus a net loss in the year-ago period of $155.5 million (minus $2.17).

Laredo At Record Output

Laredo, which is focused on the Wolfcamp, produced a company record 58,632 boe/d in the second quarter, with 47% from oil (2.5 million bbl). That output marked a 23% increase in production from the year-ago quarter (47,667 boe/d), which saw oil at 46% (2 million bbl) of the total. The Tulsa-based company also broke its record for oil production, averaging 27,275 b/d.

The company also produced 8.5 Bcf of natural gas in 2Q2017, a 21% increase from the year-ago quarter (7 Bcf). It also produced 1.4 million bbl of natural gas liquids in the most recent quarter, up 24% from 2Q2016 (1.2 million bbl).

LOEs declined nearly 15%, from $4.43/boe in 2Q2016 to $3.77/boe in 2Q2017. For the fourth consecutive quarter, LOEs were below $4.00/boe. The company issued LOE guidance of $3.60-4.00/boe for the third quarter.

“A key driver of our success in reducing operating expenses is our prior investments in field infrastructure and our production corridors, with water-handling infrastructure providing significant benefits,” operations chief Dan Schooley said in an earnings call Tuesday.

Using four horizontal rigs, Laredo completed 16 horizontal wells, with an average completed lateral length of 9,100 feet, during the second quarter. The company plans to complete 60-65 horizontal wells in 2017, with laterals expected to average 10,000 feet.

During Tuesday’s call, CEO Randy Foutch declined to comment further on the potential sale of Medallion Gathering & Processing LLC (MGP), the sole owner of the Medallion-Midland Basin Pipeline. The company announced it had initiated a process to sell MGP last month. Subsidiary Laredo Midstream Services LLC owns a 49% stake in MGP.

“Maintaining a four-rig program going forward, we would expect to be a little bit better match between the capital and the cash flow,” Foutch said. However, “we’re not going to speculate on any type of transaction, the proceeds from that or the use of that.”

Regarding GORs, Foutch said Laredo hasn’t “always drilled for the best productivity. What we’ve done is really try to drill and make sure we could understand the value creation” by drilling for the best net asset value.

“If the reservoir fluids [are] the same up and down the section, or basically the same or a lot alike, then anywhere you penetrate that and successfully complete any kind of a stimulation, you’re going to have about the same fluid content.”

Laredo increased its expected year/year production growth to 16-19% from 15%. The company expects 3Q2017 output of 59,000-62,000 boe/d and in 4Q2017, production should average 61,000-64,000 boe/d. Oil is expected to account for 45-47% of production for both quarters, with NGLs and natural gas expected to make up 26-27% and 27-28% of 3Q2017 production, respectively.

Laredo’s capex for the full year is unchanged at $530 million, which includes $450 million for drilling and completions.

Laredo reported net income of $61.1 million (25 cents/share) in 2Q2017, compared with a net loss of $71.4 million (minus 33 cents) in 2Q2016.

RSP Output Doubles Up

Like Diamondback, production more than doubled for RSP during the second quarter. The Dallas-based company reported 4.9 million boe (54,341 boe/d) of production in 2Q2017, up from 2.4 million boe (26,407 boe/d) in the year-ago quarter. Oil accounted for 72% of output.

LOEs dropped more than 12%, from $5.37/boe in 2Q2016 to $4.72/boe in 2Q2017. The expenses averaged $5.03/boe during the first half of 2017, within RSP’s issued guidance of $4.50-5.50/boe for the full year.

RSP deployed six operated horizontal rigs — four in the Midland, two in the Delaware — during the second quarter, and added a third rig to the Delaware in May. The company drilled 22 wells and completed 18 wells during the quarter. Broken down by play, 10 of the 18 completed wells were in the Midland sub-basin — with five wells targeting the Wolfcamp A, three wells in the Wolfcamp B and two wells in the Lower Spraberry. The remaining eight wells were in the Delaware sub-basin, of which six targeted Wolfcamp A, one was drilled into the emerging Wolfcamp XY horizon, and one targeted the Second Bone Spring formation.

Last March, RSP completed the second part of its $2.4 billion cash-and-stock deal to acquire Silver Hill Energy Partners LLC and Silver Hill E&P II LLC. In the transaction, RSP acquired about 41,000 net acres in West Texas in Loving and Winkler counties, with net production of 15,000 boe/d (69% oil) from 58 wells, including 49 horizontals, targeting seven zones.

“As we consider our operating strategy and plans going into next year, we will look to closely balance our capital spending with our cash flow generation while remaining flexible to adjust our activity levels to market conditions,” CEO Steve Gray said. “Because of our strong well performance and operating efficiency, we have the capability to continue to grow our annual production volumes on a double-digit basis within cash flow at oil prices below $50/bbl.”

RSP reported net income of $31.1 million (20 cents/share) in 2Q2017, compared with a net loss in 2Q2016 of $9.8 million (minus 10 cents).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |