NatGas Forward Prices Sink Further on Unsupportive Storage, Weather Fundamentals

Natural gas forward prices couldn’t catch a break last week as forecasts for cooler weather and an unimpressive storage report sent September prices down by an average 11.5 cents between July 28 and Aug. 3, according to NGI’s Forward Look.

Not every market bled red, however, as some localized demand and the possibility of another heat wave in the next couple of weeks lifted some markets in the Southeast and Northeast.

Nymex futures set the tone for the week, plunging nearly 15 cents last Monday as cooler risks in the weather forecasts led to some panic for traders with long positions, who rushed to liquidate positions. “This is the lowest settle we’ve seen for prompt natural gas going back to May of 2016,” Houston-based Mobius Risk Group said last Monday.

Prices didn’t fare too well last Tuesday either, as weakening cash prices brought the Nymex September contract down to a new low in intraday trading before rebounding to close the day up 2.5 cents to $2.82. Prices shifted less than 2 cents the next couple of days, ultimately settling Thursday at $2.80.

The lack of movement following Monday’s dramatic slide came as record heat continued over the West, with temperatures again reaching the 90s-115 degrees F, especially over California and the Pacific Northwest.

Despite an increase in renewable generation in those regions, Pacific Northwest markets saw somewhat smaller declines at the front of the curve compared to other markets across the United States. Northwest Pipeline-Sumas September forward prices fell 9.1 cents from July 28 to Aug. 3 to reach $2.343, according to Forward Look. This compares with a 13.6-cent decline in the Nymex September futures contract and the national average decline of 11.5 cents.

The Sumas October and winter 2017-2018 package also posted slightly smaller losses, while packages further out the forward curve fell more in line with the rest of the country.

Beyond the western part of the country, a new weather system was strengthening over the Midwest, with temperatures behind the cool front dropping below normal and into the comfortable 70s to lower 80s, forecasters with NatGasWeather said. Showers and cooling associated with the system spread south and east throughout the weekend, and was expected to drop national demand to below normal through early this week.

Heat was expected to return to the South late this week, and the pattern for the second half of August was trending slightly hotter in recent days, with expectations of very warm to hot conditions over the southern half of the country and warm to very warm conditions in the northern tier, the forecaster said.

“We continue to see ways the second half of August plays out quite hot as the upper ridge expands and strengthens, while potentially also including the East,” NatGasWeather said.

The weather team at Bespoke Weather Services agreed there appears to be an increase in bullish risk in the 11-15-day forecast that could put a bottom in for natural gas prices by early next week, if the risk is able to translate into the medium range.

Global weather models have shown temperatures warming in that timeframe as a stronger Bermuda High looks likely to set up, Bespoke said. Taking into account other factors, forecasters expect a warmer flow to gradually erode the cold sitting across the middle of the country over the next 10 days.

“A short-term bottom for natural gas may be near,” Bespoke said last Friday.

“Near” appears to be the key word, as the Nymex September futures contract was trading more than 2 cents lower mid-day Friday and ultimately settled at $2.774, down 2.6 cents on the day.

Thursday’s storage report from the U.S. Energy Information Administration (EIA) did little to swing the market. The EIA reported a 20 Bcf injection into storage inventories for the week ending July 28, lifting inventories to 3,010 Bcf, 279 Bcf less than last year at this time and 87 Bcf above the five-year average of 2,923 Bcf.

In spite of the weak market response, analysts saw the report as supportive. “The build for last week was in line with consensus expectations, slightly more than the 17 Bcf build in the prior week, and well below the 44 Bcf five-year average for the date,” said Tim Evans of Citi Futures Perspective. “So the report was bullish on a seasonally adjusted basis, as expected.”

NatGasWeather said surpluses would continue to gradually decline through the rest of the month, eventually flipping to deficits early in September. “The markets have yet to show concerns about carrying deficits into the winter season, evidenced by prices near lows of the summer,” the forecaster said.

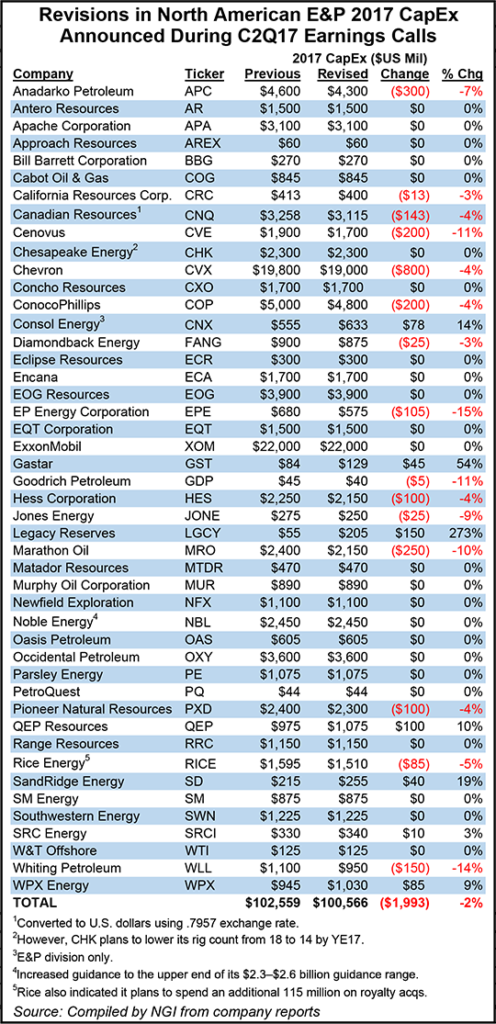

However, given the surge in drilling rigs to date this year, production could continue to climb in the months ahead. Through the first two weeks of the 2Q2017 earnings season, some North American exploration and production (E&P) companies indicated their planned activity for the second half of the year remains intact.

“By our count, North American E&P companies have taken down their collective spend by about 2% for all of 2017, but most of that seems to be either a delay in exploration spending, deferred midstream projects or cost savings from drilling efficiencies,” said NGI’s Patrick Rau, director of strategy & research. “None of that is really impacting planned drilling and completions activity. If anything, producers as a whole have increased their 2017 production guidance.”

Weather could, as usual, be a key component of the overall storage picture in the weeks ahead and could help determine whether or not near-term prices climb back out of this week’s hole, Houston-based Mobius said. If August injections were to average less than 45 Bcf per week, the company said it would expect prices to once again find support above $3.

“At present, the first half of the month is forecast to be significantly cooler than normal across the eastern two-thirds of the country, and thus power burn is being notably impacted. However, at current price levels, it would take only a modest change in the cooler-than-normal pattern to see eye-popping power consumption once again,” Mobius said.

Diving deeper into the markets, the general downturn in the markets was reflective of the cooler weather forecasts for the near term and the on-point storage report. But some markets in the Southeast and Northeast, where above-average temperatures and increasing humidity lifted demand, posted rather substantial increases for the week.

The most notable was Transco zone 5 South, where September forward prices shot up 24.8 cents from July 28 to Aug. 3 to reach $2.833, according to Forward Look. Most of the week’s gains came early in the week when temperatures rose to the upper 80s after spending the weekend in the upper 70s to low 80s.

“This is strictly weather and demand going back to Dalton,” a Northeast trader said of the Georgia city. “The heat was pretty confined, and you had a lot of plants running.” At prices this low, the region is also seeing more coal plants being displaced, the trader said.

The strength at Transco zone 5 South extended into October as well, with forward prices rising 11 cents during that time to $2.873. The gains in October correspond with news from AccuWeather that the Northeast and MidAtlantic can expect summer warmth to linger into fall. Transco zone 5 South’s winter 2017-2018 strip, meanwhile, dropped 18 cents to $4.52, and the summer 2018 strip rose 4 cents to $2.98, Forward Look data shows.

Meanwhile, Northeast points also landed in the black last week amid the intense heat that saw temperatures in New York City reach 92 on Tuesday, 8 degrees above normal. Transco zone 6-New York September forward prices climbed about 4 cents to $2.344, and October inched up 1 cent to $2.481. The winter 2017-2018 package was down 14 cents to $5.60, while the following winter (2018-2019) was down a nickel to $5.30.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 |