Strong Natgas Cash Outdoes Flat Futures; September Drops Less Than A Penny

Physical natural gas for next-day delivery gained ground Wednesday led primarily by surging East Coast quotes. Gains in Texas, Louisiana and the Northeast were able to lift flat pricing in the Rocky Mountains and Appalachia, and the NGI National Spot Gas Average rose 4 cents to $2.68. A combination of warmth and humidity in major East Coast markets along with a healthy next-day power market helped buoy prices.

Futures languished. At the close September had eased eight-tenths of a cent to $2.811 and October had drifted lower by four-tenths to $2.851. September crude oil added 43 cents to $49.59/bbl.

Sultry conditions up and down the East Coast lifted cooling and power loads. AccuWeather.com forecast Boston’s Wednesday high of 83 was seen making it to 85 Thursday with a humidity adjusted reading of 90. Friday was forecast to reach 84, 3 degrees above normal.

New York City’s 86 high reading Wednesday was predicted to hold Thursday, but on a humidity adjusted basis Thursday’s high is forecast to reach an uncomfortable 96. Friday’s high was seen at 84, the seasonal norm. Philadelphia’s 90 degree max Thursday was anticipated to reach 89, or 94 adjusted for humidity, and Friday’s peak was also seen at 89, 2 degrees above normal.

Gas at the Algonquin Citygate soared 53 cents to $3.22 and deliveries to Iroquois Waddington gained 7 cents to $2.89. Gas on Tennessee Zone 6 200 L jumped 61 cents to $3.23.

Deliveries to Tetco M-3 shed 6 cents to $1.99, and gas headed for New York City on Transco Zone 6 fell 12 cents to $2.58.

Other market points were solidly in the black. Gas at the Chicago Citygate was quoted at $2.77, 5 cents higher, and packages at the Henry Hub rose 2 cents to $2.77. Deliveries to El Paso Permian rose 3 cents to $2.62, and gas priced at Northern Natural Demarcation added 3 cents to $2.69.

Out West gas at Opal was up a cent at $2.59, and gas on El Paso S Mainline rose 10 cents to $3.28. At the PG&E Citygate next-day gas fetched $3.25, up a nickel and gas priced at the SoCal Border Average changed hands 4 cents higher at $3.08.

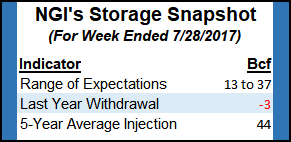

As for the futures screen, the market’s inability to follow through on Monday’s plunge may be due to short covering, according to one analyst. “The market may be attracting a modest flow of short covering ahead of Thursday’s DOE storage report, with early estimates suggesting a consensus developing at 22 Bcf in net injections for the week ended July 28, a modest step up from the 17 Bcf refill in the prior week but still supportive to the 44 Bcf five-year average gain,” said Tim Evans of Citi Futures Perspective.

“While arguably less supportive than last week’s scenario, we note that a declining surplus still confirms the market is becoming at least somewhat tighter physically on a seasonally adjusted basis.”

The five-year average storage build for the week ending July 28 stands at 44 Bcf, but if estimates by traders are any indication, storage builds will fall well short of that. Last year 3 Bcf were withdrawn. JP Morgan estimates an 18 Bcf injection, and Stephen Smith Energy is looking for a build of 23 Bcf. A Reuters survey of 24 traders and analysts revealed an average 21 Bcf build with a range of +13 Bcf to +37 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |