Marcellus | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

Consol Hits Snags in Utica; Production Declines

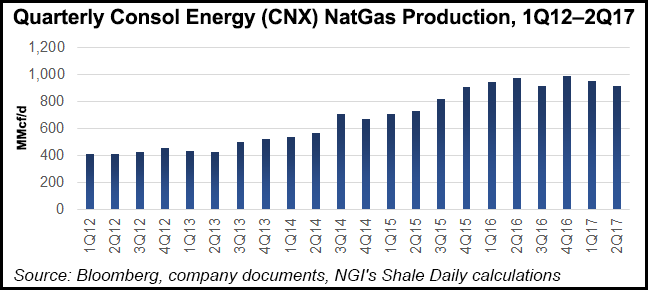

Consol Energy Inc. had problems at two Utica Shale pads in southeast Ohio during the second quarter that led to significant turn-in-line (TIL) delays and only six wells coming online, which reduced year/year production by 7%.

The company had expected to TIL three well pads during the quarter, but only one came on in the Marcellus Shale. COO Tim Dugan said pre-fracturing (frack) well preparation issues and problems with drilling out a frack plug at the Utica pads in Monroe County, OH, led to a combined 92 days of delays.

“Those are really one-time events and if you look back at the last couple of years we have had very, very few events like this,” Dugan told financial analysts during a call on Tuesday to discuss second quarter results. “But when you look at the rate we’ve changed at and the operational improvements we’ve made — we’re constantly pushing, we’re trying new things — occasionally we will have issues. But we were able to figure out how to overcome those issues and get past them. Actually, every time something goes wrong, you learn something that makes you better.”

Consol produced 92.2 Bcfe during the second quarter, down from the 99.3 Bcfe it produced in the year-ago period and from 95 Bcfe in 1Q2017. The company also attributed the decline to a 3 Bcfe production decrease that came with a post-closing adjustment on a West Virginia asset sale.

The company now expects to TIL five pads in the third quarter. Consol also raised its budget by $78 million for the year to $620-645 million. CEO Nicholas Deluliis said most of the extra money would go to drill another nine wells and to cover service cost increases related to pressure pumping. Some of the capital would also go to covering expenses related to the operational issues in Ohio.

Delullis stressed that despite those problems, Consol is still on track to meet its full-year production guidance of 420-440 Bcfe. He said significant improvements to drilling efficiencies, completion designs and type curves helped offset the quarter’s production snags and continue to reduce spending. Given those gains, the company increased its 2018 production forecast by 30 Bcfe to 520-550 Bcfe.

Consol continued with its plans to divest $400-600 million of noncore assets by year’s end. The company received $326 million in proceeds during the second quarter, which included the sale of 22,500 Marcellus Shale acres and some associated Utica assets in Pennsylvania. Consol has sold $345 million of assets year-to-date, and is on track to separate its coal and gas businesses by year’s end, Deluliis said.

Average prices were down slightly to $2.47/Mcfe from $2.50/Mcfe in the year-ago quarter. “Prices were down due to the commodity pulling back while basis further widened,” Dugan said of natural gas. “That decrease was partially offset by additional cost improvements.” Revenue was up significantly to $866 million from $285.9 million in 2Q2016.

Net income was $169.5 million (73 cents/share) in 2Q2017, compared with a net loss of $469.8 million (minus $2.05) in the year-ago period.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |