E&P | NGI All News Access | NGI The Weekly Gas Market Report

Canadian Drilling Getting Boost From Improved Commodity Prices, Shifting Investments

Improved commodity prices and a shift in investment emphasis are fueling a partial recovery by Canadian natural gas and oil drilling this year, according to the voice of the industry’s service, supply and manufacturing companies.

The Petroleum Services Association of Canada (PSAC) predicted the 2017 national well count will hit 7,200, about double the 2016 total, but still nearly 40% less than the annual average of 11,670 during the first half of this decade.

PSAC raised its previous forecast by 8% to reflect strengthening first-half 2017 field activity and rising confidence that prices will hold firm at annual averages of C$2.75 ($2.20/Mcf) natural gas and US$49/bbl oil.

PSAC president Mark Salkeld said the Canadian industry is becoming more like its counterpart in the United States. The switch goes “toward liquid-rich natural gas and light tight oil which ultimately provide a faster return on investment dollars than the longer-term investment in oilsands projects.”

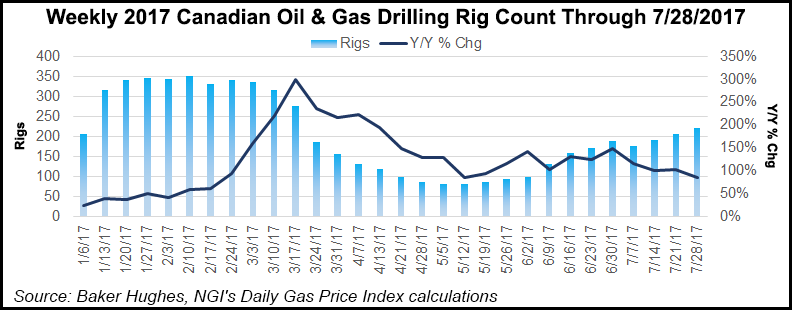

Said Salkeld, “This investment shift played an important role in taking a rig count from what we thought would be closer to 200 active rigs to well over 300 in first quarter 2017.”

The partial field activity recovery also relies on cost cutting that has potential to backfire on the Canadian industry in the long run, he added.

“Cost reductions from the services sector demanded by their customers are playing a significant role in helping with activity levels, enabling exploration and development companies to drill more wells at less cost. The downside to this is that slim service sector margins mean less funds available for new research and development and innovation.”

The new PSAC forecast of gas, liquid byproducts and oil drilling anticipates 2017 well counts of 3,604 in Alberta, 580 in British Columbia (BC), 2,794 in Saskatchewan and 206 in Manitoba. Horizontal drilling and hydraulic fracturing continue to play a growing role.

However, the trade association described the recovery as modest by previous Canadian industry standards and doubted that the booming activity experienced before the 2014-2015 drop in energy prices would return anytime soon.

Cancellation of Pacific NorthWest’s liquefied natural gas export terminal project on BC’s Pacific coast last week was a discouraging sign, Salkeld said.

“Canada continues to struggle with its place in the world of energy supply given our lack of access to tidewater and public support for infrastructure, suggesting the lofty levels of activity seen in 2014 are likely a thing of the past.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |