NatGas Forwards Nearly Flat on Cooler Weather Forecasts, Bullish Storage Report

In a week that saw the Nymex August natural gas futures contract swing in a tight 16-cent range between July 21 and 27, the front-month futures ended the period essentially where it started as cooler weather forecasts bumped up against a bullish storage report, according to NGI’s Forward Look.

The same was true for most other gas markets across the United States, with the exception of Northeast markets, which have all but written off the summer demand season.

“This market is terrible. There’s no volatility. So boring,” a Northeast trader said.

Nymex futures got off to a dismal start last week, with the August contract shedding around 7 cents on Monday as changes in weather forecasts showed cooler temperatures in key energy markets in the near term. Much of the change in the forecast was related to an active storm pattern in the Pacific, with the result being cooler weather across the Eastern half of the country, MDA Weather Services said last Monday.

Houston-based Mobius Risk Group said while the cooler forecast revisions suggest demand from July 24-Aug. 7 will be roughly 15 Bcf lower than earlier anticipated, storage data from the past several days indicates balances remain tight enough to cause sub-40 Bcf injections over the next several weeks.

“This threshold, if met, will be higher than the comparable weeks last year, but low enough to provide renewed support following the August contract expiry,” Mobius said.

Tuesday’s trading action brought about a moderate rebound that made up most of Monday’s decline, but Mobius said behavior along the Nymex futures curve suggested speculative participants were largely responsible for the day’s gains.

“In addition, limited liquidity during the first day of bid-week helped to propel the prompt contract higher, and the ramifications of such a price change are typically felt in at least the front three months. Fundamentally, there was little change day-over-day, and if anything, the news was bearish in nature,” Mobius said last Tuesday.

The rest of the week saw continued swings, with the Nymex August futures contract ultimately expiring 4.5 cents higher at $2.969 Thursday on bullish storage news.

The United States Energy Information Administration (EIA) reported a 17 Bcf injection into storage inventories for the week ending July 21, about 7 Bcf less than consensus estimates. Last year, 20 Bcf was injected and the five-year average stands at 47 Bcf. Inventories now stand at 2,990 Bcf, 302 Bcf less than last year at this time and 111 Bcf above the five-year average of 2,879 Bcf.

Tim Evans of Citi Futures Perspective said, “This was a second consecutive bullish miss relative to consensus expectations and supportive relative to the 47 Bcf five-year average for the week ended July 21. While the report doesn’t provide background fundamental data on supply or demand factors, our guess is that this represents a higher rate of power sector consumption than anticipated.”

That is a logical assessment of the reason for the bullish miss, as the EIA on Thursday also reported that U.S. natural gas power burn set a high for 2017, surpassing 41 Bcf/d on July 20. Other analysts agreed, with Mobius saying that even though the EIA storage report summarizes the results of a market survey obtained from storage operators of their activity for the week concluding each Friday at 9 a.m., in reality, the cutoff time of 9 a.m. is most likely not precise in terms of the data storage operators provide in their survey responses.

“If so, then July 21 could have had a larger-than-usual impact on the storage report when compared to other days in the past,” Mobius said.

This is because storage demand was very strong on July 21, relative to most days surrounding it. In fact, by all indications, Mobius said that natural gas was net withdrawn from storage on that day and on July 20, which is the day the EIA said recorded the highest power burn of 2017 so far.

“Therefore, if some storage operators included a greater portion of Friday in their survey response, it would have affected the weekly storage report to a greater extent than most other Fridays would have … and to the lower end. If the storage report next week comes out over expectations (currently anticipated to be around 22 Bcf) by about 5 Bcf, then the dynamic above might be an explanation as to why,” Mobius said.

Indeed, data and analytics company Genscape said analysis of the stack shows that gas burn was up about 12 Bcf week over week, which was more than was suggested by scheduled nominations and may help explain the lower-than-expected injection. Compared to degree days and normal seasonality, a 17 Bcf injection appears tight versus the prior five years by approximately 3.9 Bcf/d, the company said.

Taking a closer look at the markets, the lack of volatility and competing market movers left the Nymex and other gas markets basically treading water. The Nymex August futures contract ended the July 21-27 period down about half a penny at $2.967. The September futures contract barely budged at $2.967, while the balance of summer (September-October) rose a penny to come in just shy of the $3 mark at $2.99. Calendar year 2018 slipped 2 cents during that time to $2.99, the calendar year 2019 dropped 2 cents to $2.81 and calendar year 2020 fell 4 cents to $2.76.

On Friday morning, the Nymex September futures contract had dipped into the red, trading less than a penny lower at around $2.96. It ultimately settled 2.6 cents lower at $2.941.

“Three bullish storage numbers in a row, and we are off,” the trader said. “There’s too much fast money in here, and they only care about the next forecast.”

To be sure, the latest weather outlooks aren’t offering much hope that any summer heat will be prolonged. In fact, forecasters at NatGasWeather continue to expect a seasonal overall pattern for the next 10 days as very warm to hot conditions cover the southern half to two-thirds of the country, while remaining mostly comfortable across the northern tier. The West will be the hottest region, where highs of mainly 90s and 100s will continue into the foreseeable future.

Indeed, California markets posted some of the only gains for the week as Genscape projects demand in the state growing from the recent seven-day average of 5.63 Bcf/d to 6.34 Bcf/d for the July 31-Aug. 4 period.

At the Southern California Border, August forward prices rose 4 cents from July 21 to July 27 to reach $2.886, while September tacked on 2 cents to reach $2.816. The balance of summer (September-October) was up 3 cents to $2.79 and the prompt winter was up 2 cents to $3.10, according to Forward Look.

Pacific Gas & Electric Citygates August forward prices moved up 2.7 cents during that time to reach $3.307, while September edged up 2 cents to $3.287. The balance of summer (September-October) rose 3 cents to $3.29, and the winter 2017-2018 climbed 2 cents to $3.36, Forward Look data shows.

With seasonal weather on tap for the next week or so for the majority of the country, NatGasWeather expects the pace of storage surplus declines to slow, although next week’s build (for the week ending July 28) is expected to come in well under the five-year average and drop surpluses to around +85 Bcf.

“Our most recent calculations show November [end-of-season] at 3,744 Bcf, -130 Bcf under the five-year average and around -25 Bcf less than ICE [Intercontinental Exchange],” NatGasWeather said Friday morning. “$3 is still the level bears need to hold and bulls want to gain.”

What will be of increasing importance is where weather trends after Aug. 8-9, as the latest data has shown hotter risks for this period, especially over the northern and eastern U.S. as high pressure tries to expand to include these areas.

Mobius said while it’s true end-of-summer expectations for storage have declined quite a bit during July — down from around 3.85 Tcf to start the month to 3.75 Tcf on Thursday — a lot of the diminishing of expectations occurred early in the month as mid-July heat solidified across the U.S.

“But more recently, we’ve seen another dip in expectations possibly in front of the aforementioned heat in the back part of the weather forecast,” Mobius said.

Meanwhile, production remains a key focal point of market watchers as Lower 48 production hit 73.1 Bcf/d on July 13, cresting the 73 Bcf/d mark for the first time since Feb. 2016, according to Genscape. Since then, however, Genscape has estimated volumes have averaged 72.67 Bcf/d, including falling as low as 72.26 Bcf/d on the 14th.

“That said, the failure to bust through the 73 Bcf/d level is not totally surprising, and production is coming in pretty close to Spring Rock forecasted levels,” Genscape said.

On the month, production has averaged 72,597 MMcf/d versus Genscape’s Spring Rock forecast of 72,698 MMcf/d. Texas and Gulf Coast volumes are coming in about 300 MMcf/d and 180 MMcf/d, respectively, below expectations, while offshore Gulf of Mexico volumes are coming in about 300 MMcf/d higher than forecast, the Louisville, KY-based company said.

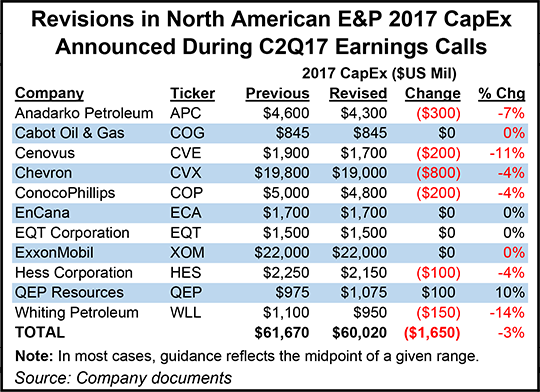

As for whether the production gains expected for the remainder of the year and into 2018 come to fruition, that remains unclear. The majority of exploration and production companies that have held their quarterly earnings calls had indicated they plan to cut capital expenditures (capex) for the rest of 2017.

Super independent Anadarko Petroleum Corp., on its July 25 earnings call, said capex for 2017 have been cut by $300 million, which includes a reduction of around $250 million in upstream spend and $50 million for midstream. Combined with asset sales, the lower capex should reduce volumes.

“We sincerely believe the volatility of the current operating environment requires financial discipline, and as I have said many times, pursuing growth without adequate returns is something we will avoid,” Anadarko’s CEO Al Walker said last Tuesday.

Meanwhile, the delay of Energy Transfer Partners LP’s (ETP) Rover Pipeline is creating even more uncertainty about future production growth as the 710-mile greenfield project will transport 3.25 Bcf/d of Marcellus and Utica shale natural gas to markets in the Midwest, Gulf Coast and Canada — once it comes into service, that is.

Rover received a certificate from the Federal Energy Regulatory Commission in February, a few months later than ETP had planned. Since then, ETP has moved forward with an accelerated construction schedule, accumulating various run-ins with regulators.

In May, the Ohio Environmental Protection Agency cited Rover for violating environmental laws, most notably a roughly 2 million gallon spill of horizontal directional drilling (HDD) fluids near the Tuscarawas River in Stark County, OH. The spill later prompted FERC to suspend HDD activities for the project pending a third party review. FERC’s Office of Enforcement launched an investigation of the Tuscarawas HDD incident after test results indicated the presence of diesel fuel in the drilling mud.

Meanwhile, Ohio EPA asked the state’s attorney general to pursue hundreds of thousands in civil penalties over the alleged violations occurring during Rover’s construction. And in an order filed Monday with the Federal Energy Regulatory Commission, the West Virginia Department of Environmental Protection (WVDEP) ordered Rover to cease and desist development activities because of violations under the project’s state-issued water pollution control permit.

The WVDEP said Rover must suspend “land development activity until such time when compliance with the terms and conditions of its permit and all pertinent laws and rules is achieved.”

WVDEP conducted site inspections of Rover construction in progress on April 26 and July 12 and said it observed several violations related to improper sediment and erosion controls. The alleged violations occurred as Rover constructed its Sherwood Lateral and Sherwood Compressor Station in West Virginia’s Doddridge and Tyler counties.

Rover was originally scheduled to come online in two phases this year. Phase 1, connecting production from Ohio, West Virginia and Pennsylvania to the Midwest Hub in Defiance, OH, was scheduled to come online this month. But after FERC said it would withhold in-service authorization pending additional clean-up and mitigation for the Tuscarawas spill, ETP pushed back start-up for Phase 1 to “late summer.”

Unrelated to Rover but still creating uncertainty regarding future production gains, the Nexus Gas Transmission pipeline, originally planned for service in late 2017, won’t start up until sometime in 2018 due to the ongoing wait for a certificate decision from the currently quorum-less FERC, executives for backer DTE Energy Co. said Wednesday.

During a conference call to discuss the Detroit-based utility’s 2Q2017 results, CEO Gerard Anderson acknowledged that developers have been forced to revise the schedule for the 255-mile, 1.5 Bcf/d greenfield natural gas pipeline as the project application languishes in the FERC’s mounting backlog.

FERC’s lack of a quorum also puts the in-service of NextEra Energy Inc.’s Mountain Valley Pipeline (MVP) natural gas project at risk, company management said Wednesday.

The Juno Beach, FL-based company has been reaching out to the Senate to stress the importance of restoring the FERC’s quorum as soon as possible, management said during a conference call to discuss 2Q2017 results.

NextEra plans to invest about $1.1 billion in MVP through a joint venture with EQT Midstream Partners LP, Con Edison Transmission Inc., WGL Midstream and RGC Midstream LLC. The Appalachian Basin-to-Southeast pipeline is scheduled to start construction later this year and be in service by December 2018.

“As far as Mountain Valley timing is concerned, it’s pretty important that we get that FERC certificate by the end of September in order to continue on the timeline that we have, and so we’re watching” the situation in the Senate closely, NextEra CEO Jim Robo said.

With production trapped in Appalachia, forward prices at Dominion continued to weaken. Dominion August forward prices tumbled about 10 cents from July 21 to 27 to reach $1.691, while September slid 10 cents to $1.60. The balance of summer (September-October) dropped 10 cents to $1.67, while the winter 2017-2018 held steady at $2.65, according to Forward Look.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 |