Infrastructure | E&P | NGI All News Access | NGI The Weekly Gas Market Report

NOV Chief Says ‘Scarcity’ Returning to Oilfields as Excess Equipment Depleted

Oil and natural gas customers are steadily exhausting the backlog of excess oilfield equipment, as a strong recovery in North America’s onshore takes hold, according to drilling technology expert National Oilwell Varco Inc. (NOV).

Despite still navigating a “challenging market,” NOV is seeing efficiency gains from investments made over the last two years and rising demand, CEO Clay Williams said during a conference call to discuss second quarter performance.

“Scarcity is returning to the oilfield, and, around the world, customers are steadily exhausting excess stocks of the critical products, equipment and technologies we supply, laying the groundwork for future demand,” he said. “The strong recovery we’ve seen thus far in North America, combined with many international markets stabilizing and offshore markets nearing bottom, makes us optimistic in our outlook.”

It’s not all blue skies, but NOV reversed some of its year-ago losses. Net losses totaled $75 million (minus 20 cents/share) in 2Q2017, up from a loss of $217 million (minus 58 cents) in 2Q2016. Revenues were $1.76 billion, an increase of 1% sequentially and 2% year/year. Operating losses totaled $62 million, or 3.5% of sales, versus a loss of $270 million in 2Q2016. Operational cash flow was $168 million.

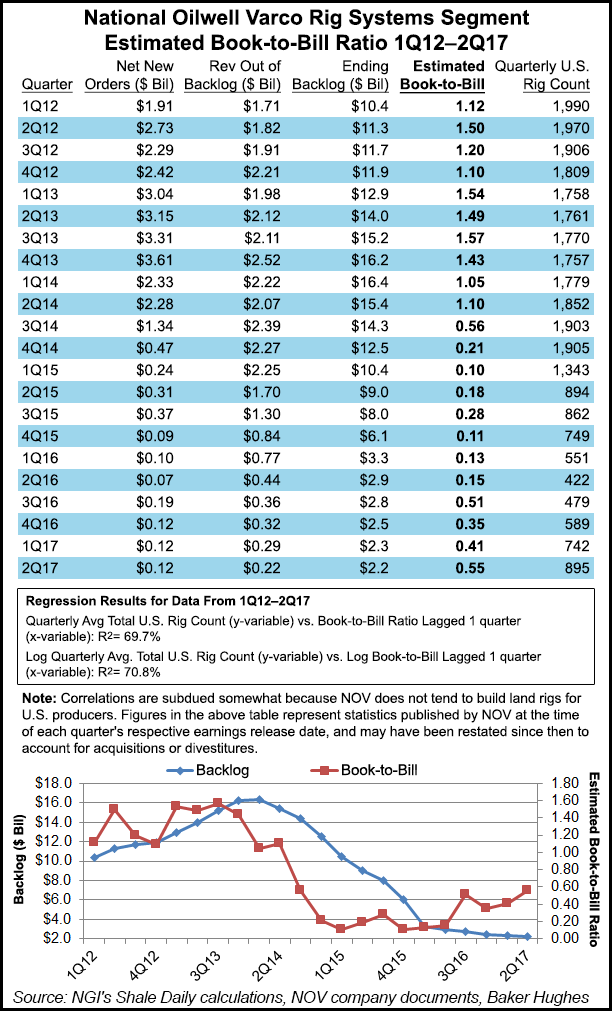

In the rig systems segment, revenue fell 12% sequentially and 39% year/year to $346 million, with an operating loss of $7 million, or 2% of sales. Revenue from backlog declined to $224 million as backlog waned and some capital equipment deliveries were deferred to the third quarter.

Backlog for capital equipment orders at the end of June was $2.22 billion. New orders during the quarter were $124 million, representing a book-to-bill of 55%. Land-related orders represented 60% of the order book and included one 1,500-hp alternating current Ideal Rig and a complete land rig equipment package that included the NOVOS process automation platform.

In the rig aftermarket segment, revenue totaled $341 million, up 6% sequentially but down 6% from a year ago. Operating profit was $76 million, or 22.3% of sales. NOV is seeing “rising demand for spare parts, service and repair.

Wellbore technologies generated revenue of $614 million, an increase of 11% sequentially and 20% year/year. The operating loss totaled $24 million, 3.9% of sales.

“Robust U.S. activity growth and modest improvements in many international markets, partially offset by Canadian spring break-up, increased customer demand for the segment’s products and services,” management said.

Within the completion/production solutions business, revenue increased 1% sequentially and 21% from 2Q2016 to $652 million. Operating profit was $27 million, or 4.1%. Land-oriented operational revenue gains were offset by declines in the offshore business.

Backlog for capital equipment orders for completion/production solutions at the end of June was $881 million. New orders during the quarter totaled $501 million, representing a book-to-bill of 127% when compared to the $393 million of orders shipped from backlog.

“Nearly all of the segment’s business units secured orders well in excess of 100% book-to-bill,” NOV noted. “Included in the order book was a total of 107,500 hp of pressure pumping equipment, orders for seven new coiled tubing units, and a subsea soft yoke system for a floating storage regasification unit.”

During the quarter, NOV won a thru-tubing tools order in North America from an independent service company, booking 60 TerraMax milling systems, totaling over 260 tools. The TerraMax milling system is a bottomhole assembly (BHA) for coiled tubing mill-out. The first 20 BHAs have been delivered, and the customer is using them in the Eagle Ford Shale and Permian Basin for extended-reach operations, NOV said.

NOV also in the last quarter introduced a higher-torque top drive to enable drilling contractors to drill longer laterals faster and more efficiently, the 1,200-hp TDS-11HD. In addition, NOV introduced the latest version of its MD Totco autodriller, e-Wildcat 2.0, which combines high-resolution sensors with rig-specific algorithms to allow conventional rigs to maintain a constant rate of penetration. Drilling times are improved by up to 30%, according to NOV.

During the quarter, NOV also signed a 10-year service and support agreement with Transocean Ltd. to maximize uptime and reduce total cost of ownership for the drill-floor equipment on 15 offshore drilling rigs. The collaborative arrangement leverages the operational expertise of both organizations and incorporate NOV’s drilling technologies, global aftermarket service and repair capabilities, and data-driven solutions, including its Rigsentry condition-monitoring system.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |