E&P | NGI All News Access | NGI The Weekly Gas Market Report

ExxonMobil Earnings Jump 97%, While Capex Falls 24%

North America’s top oil and gas company ExxonMobil Corp. on Friday reported a strong comeback earnings-wise for the second quarter, as oil and gas realizations increased and refining margins improved.

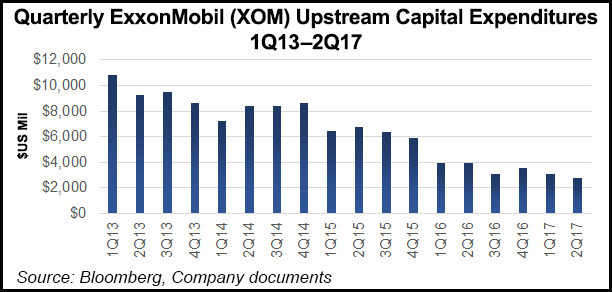

Net profits climbed year/year in 2Q2017 to $3.35 billion (78 cents/share) from $1.7 billion (41 cents). Cash flow from operations and asset sales was $7.1 billion, including proceeds from asset sales of $154 million. Capital expenditures, meanwhile, fell by almost one-quarter to $3.9 billion from $5.2 billion.

“These solid results across our businesses were driven by higher commodity prices and a continued focus on operations and business fundamentals,” said CEO Darren W. Woods. “Our job is to grow long-term value by investing in our integrated portfolio of opportunities that succeed regardless of market conditions.”

Upstream earnings overall climbed to $1.2 billion, $890 million higher year/year on higher liquids and natural gas realizations. Lower liquids volume and mix effects decreased earnings by $260 million.

There’s still work to do in the United States, as the domestic upstream unit lost $183 million in the quarter, versus a year-ago loss of $514 million. Outside the United States, upstream earnings were $1.4 billion, $559 million higher year/year.

Natural gas production rose 158 MMcf/d year/year to 9.9 Bcf/d, primarily on a gain from an Australian liquefied natural gas project ramp-up. The increase in gas output was partly offset by field decline and lower demand.

On an oil-equivalent basis, total production worldwide decreased 1% from 2Q2016. Liquids production was down 61,000 b/d to 2.3 million b/d.

Among the operational highlights between April and June, ExxonMobil spud its first Permian Basin well in newly acquired Delaware sub-basin acreage, a 12,500-foot lateral section. ExxonMobil also is expanding its midstream capabilities in the basin through partnerships, including its recently signed agreement with Summit Midstream Partners LP.

Investor relations chief Jeff Woodbury during a conference call on Friday said the Permian Basin is one of the company’s top-tier investments. The Permian was the only U.S. onshore play that he singled out during the prepared remarks. Activity in the twin sub-basins, the Midland and Delaware, is heating up.

“Strong drilling and completion execution in the Midland Basin has to date yielded unit development costs of about $7/bbl oil,” Woodbury said. “We’ve been steadily increasing our Permian drilling activity through 2017.”

Current net production from the Midland is more than 165,000 boe/d, an increase of 20% from 2Q2016.

“Despite growing industry activity in the Permian, we have successfully offset inflationary pressure through increased efficiencies and higher recoveries per well,” he said. “And this includes, amongst other factors, a continuing reduction in drilling days and cost per foot, as well as further improvement in completion designs.”

ExxonMobil today has 16 operated rigs in the Delaware and Midland sub-basins combined, and expects to reach 19 total rigs by the end of August.

Delaware development has begun ramping up in New Mexico, and as it progresses, “we anticipate extending lateral lengths, including leveraging our learnings from our recent completion of Bakken horizontal wells of over three miles,” Woodbury said.

Estimated unit development costs for the full northern Delaware acreage today are around $5-7/boe.

On the operational front in Canada, the company moved a platform from the Bull Arm construction site in Newfoundland and Labrador to the Hebron field in the Jeanne d’Arc Basin, about 220 miles (350 kilometers) offshore. The ExxonMobil-led Hebron field development, sanctioned in 2013, is expected to produce 150,000 b/d of oil from a recoverable resource of 700 million bbl. Commissioning work is underway, with first oil anticipated before the end of the year.

Within its petrochemicals business, ExxonMobil and Saudi Basic Industries Corp., aka SABIC, during 2Q2017 selected a site near Corpus Christi, TX to potentially develop a world-scale ethane steam cracker capable of producing 1.8 million metric tons of ethylene/year. The timing of a final investment decision has not been announced. ExxonMobil also completed two 650,000 metric tons/year high performance polyethylene lines at its plastics plant in Mont Belvieu, TX, with production to begin during the third quarter.

ExxonMobil also announced plans during 2Q2017 to enter the Mexican fuels market in 2017 with Mobil-branded stations and a line of advanced Synergy gasoline and diesel fuels. The company plans to invest about $300 million in fuels logistics, product inventories and marketing over the next 10 years.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |