Markets | NGI All News Access | NGI Data

NatGas Cash Flat Off Storage Report, Expired August Futures End on Firm Note

Most physical natural gas traders hunkered down Thursday and got their deals done ahead of the often volatility-inducing Energy Information Administration (EIA) inventory report.

Physical prices moved little as modest gains in the Northeast, Appalachia, and the Midwest offset weakness in California and flat pricing in the Midcontinent. TheNGI National Spot Gas Average gained was flat at $2.64.

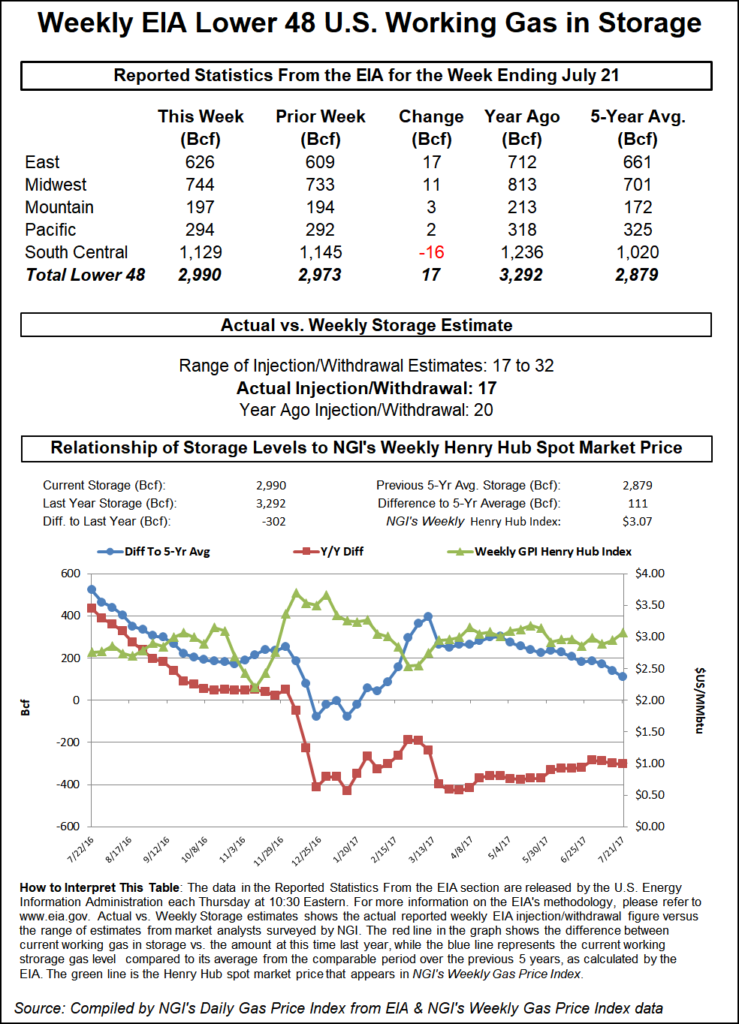

The EIA reported a storage build far below expectations at just 17 Bcf, about 7 Bcf less than what traders were looking for. At the close the expired August contract added 4.5 cents to $2.969 and September had risen 5.3 cents to $2.967. September crude oil gained 29 cents to $49.04/bbl, its fourth straight gain for the week.

August futures got a quick shot of adrenaline following a report Thursday by the EIA showing a storage injection that was significantly less than the market was expecting. The 17 Bcf was about 7 Bcf less than consensus estimates. When the number rattled across trading desks, the expiring August futures rose to $2.998, but at 10:45 a.m. August was trading at $2.970, up 4.6 cents from Wednesday’s settlement. The soon-to-be-spot September contract had risen 6.3 cents from Wednesday to $2.977.

Before the report was released, traders were looking for a storage build far higher than the actual figures. Last year 20 Bcf was injected and the five-year average stands at 47 Bcf.

ION Energy calculated a 21 Bcf injection, and Raymond James and Associates estimated a 32 Bcf build. A Reuters survey of 24 traders and analysts showed an average 24 Bcf with a range of +17 Bcf to +32 Bcf.

“All of a sudden the market popped it up,” said a New York floor trader. “I think you had some shorts in the market against recent lows that were hanging on because there was [only] sideways movement that were spooked out because of the number. If the market can’t make new highs it will slip back, and if it gets under $2.97, traders will push it back to the lows.”

Tim Evans of Citi Futures Perspective said, “This was a second consecutive bullish miss relative to consensus expectations and supportive relative to the 47 Bcf five-year average for the week ended July 21. While the report doesn’t provide background fundamental data on supply or demand factors, our guess is that this represents a higher rate of power sector consumption than anticipated.”

Wells Fargo Securities LLC analysts said the report was bullish.

“Based on current weather forecasts as well as elevated power burn levels thus far in July (35.8 Bcf/d month to date), our model projects a 48 Bcf cumulative storage build over the next two weeks. This would be substantially below the five-year average of 100 Bcf and would reduce the storage surplus to just 66 Bcf by the first week of August.”

Inventories now stand at 2,990 Bcf and are 302 Bcf less than last year and 111 Bcf above the five-year average.

In the East Region 17 Bcf was injected, and the Midwest Region saw inventories rise by 11 Bcf. Stocks in the Mountain Region were greater by 3 Bcf and the Pacific Region was up by 2 Bcf. The South Central Region fell by 16 Bcf.

Uninspired physical trading got some of its direction from uninspired next-day power markets. The Intercontinental Exchange reported only small movements in next-day peak power prices across major power grids. On-peak Friday power at the ISO New England’s Massachusetts Hub rose $1.04 to $27.23/MWh and peak Friday deliveries at the PJM West terminal eased 94 cents to $30.00. At the Indiana Hub on-peak Friday power slipped $1.16 to $31.50/MWh.

Near term temperature forecasts called for below normal readings in major markets. Wunderground.com forecast that New York City’s Thursday high of 77 would reach 81 Friday and settle back to 73 on Saturday, 11 degrees below normal. Chicago’s Friday peak of 83 was predicted to recede to 80 Friday and 79 Saturday, 5 degrees less than its seasonal norm.

The National Weather Service in Chicago said, “One more afternoon of muggy conditions will come to an end as a large area of high pressure builds southeast into the Midwest tonight.

“Behind the front a seasonally cool and much drier airmass will take up residence across Northeast Illinois and northwest in Friday and through the weekend. The surface high will be north of the area, and this will maintain a Northeast and cooler wind, along with continued higher waves along the shore, despite generally sunnier skies. Comfortable highs will top in the 70s to near 80.”

[Subscriber Notice Regarding NGI’s Market-Leading Natural Gas Price Indexes]

Gas at the Algonquin Citygate was flat at $2.04, and deliveries to Transco Zone 6 in New York rose 15 cents to $1.89. Packages priced on Tetco M-3 Delivery were quoted 3 cents higher at $1.72, and gas on Dominion South came in 3 cents higher at $1.67.

Gas at the Chicago Citygate changed hands a penny higher at $2.79 and deliveries to the Henry Hub were unchanged at $2.92. Gas on El Paso Permian was flat at $2.65 and packages priced on Northern Natural Demarcation shed a penny to $2.73.

At Opal gas was seen at $2.70, up 2 cents and Kern Delivery came in at $2.92, up 6 cents. The SoCal Border Average rose a penny to $2.86, and deliveries to PG&E Citygate were up a cent at $3.29.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |